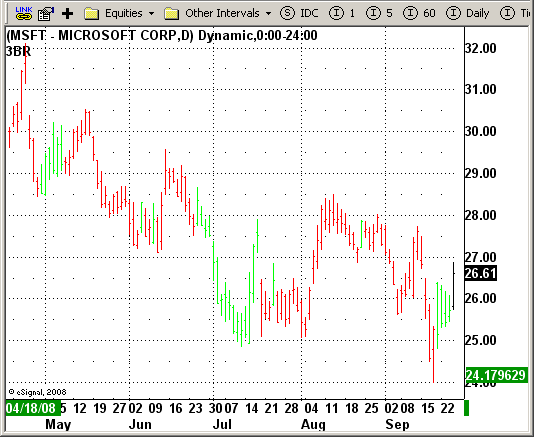

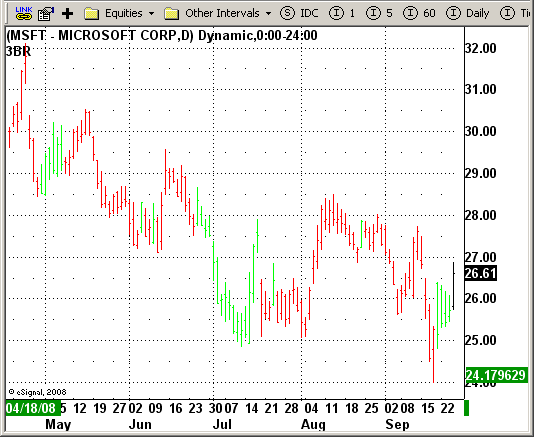

File Name: 3BarReversal.efs

Description:

3-Bar-Reversal-Pattern Strategy

Formula Parameters:

Notes:

This startegy based on 3-day pattern reversal described in "Are Three-Bar

Patterns Reliable For Stocks?" article by Thomas Bulkowski, presented in

January,2000 issue of Stocks&Commodities magazine.

That pattern conforms to the following rules:

- It uses daily prices, not intraday or weekly prices;

- The middle day of the three-day pattern has the lowest low of the three days, with no ties allowed;

- The last day must have a close above the prior day's high, with no ties allowed;

- Each day must have a nonzero trading range.

Download File:

3BarReversal.efs

EFS Code:

Description:

3-Bar-Reversal-Pattern Strategy

Formula Parameters:

Notes:

This startegy based on 3-day pattern reversal described in "Are Three-Bar

Patterns Reliable For Stocks?" article by Thomas Bulkowski, presented in

January,2000 issue of Stocks&Commodities magazine.

That pattern conforms to the following rules:

- It uses daily prices, not intraday or weekly prices;

- The middle day of the three-day pattern has the lowest low of the three days, with no ties allowed;

- The last day must have a close above the prior day's high, with no ties allowed;

- Each day must have a nonzero trading range.

Download File:

3BarReversal.efs

EFS Code:

PHP Code:

/*********************************

Provided By:

eSignal (Copyright c eSignal), a division of Interactive Data

Corporation. 2008. All rights reserved. This sample eSignal

Formula Script (EFS) is for educational purposes only and may be

modified and saved under a new file name. eSignal is not responsible

for the functionality once modified. eSignal reserves the right

to modify and overwrite this EFS file with each new release.

Description:

3-Bar-Reversal-Pattern Strategy

Version: 1.0 09/25/2008

Notes:

This startegy based on 3-day pattern reversal described in "Are Three-Bar

Patterns Reliable For Stocks?" article by Thomas Bulkowski, presented in

January,2000 issue of Stocks&Commodities magazine.

That pattern conforms to the following rules:

- It uses daily prices, not intraday or weekly prices;

- The middle day of the three-day pattern has the lowest low of the three days, with no ties allowed;

- The last day must have a close above the prior day's high, with no ties allowed;

- Each day must have a nonzero trading range.

Formula Parameters: Default:

**********************************/

function preMain() {

setPriceStudy(true);

setStudyTitle("3BR");

setCursorLabelName("3BR");

setColorPriceBars(true);

setDefaultPriceBarColor(Color.black);

}

function main() {

if(getCurrentBarIndex() == 0) return;

if (!Strategy.isLong()) {

if(open(-2) > close(-2) && high(-1) < high(-2) && low(-1) < low(-2) && low(0) > low(-1) && high(0) > high(-1) + 0.25) {

Strategy.doLong("Long", Strategy.CLOSE, Strategy.THISBAR);

}

}

if (!Strategy.isShort()) {

if(open(-2) < close(-2) && high(-1) > high(-2) && low(-1) > low(-2) && high(0) < high(-1) && low(0) < low(-1) + 0.25) {

Strategy.doShort("Short", Strategy.CLOSE, Strategy.THISBAR);

}

}

if(Strategy.isLong())

setPriceBarColor(Color.lime);

if(Strategy.isShort())

setPriceBarColor(Color.red);

return;

}