File Name: Normaliz.efs

Description:

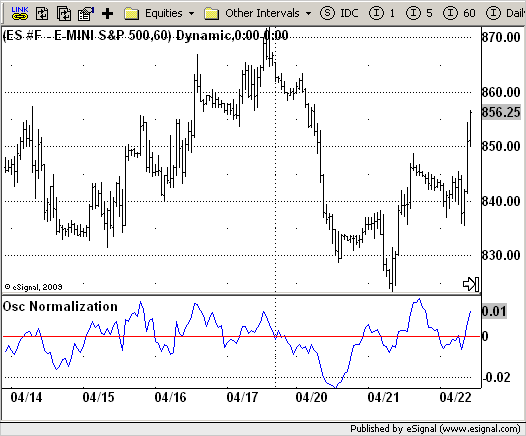

Osc Normalization

Formula Parameters:

NormType : 1

OscLength : 10

NormLength : 10

Source of Normalizing : Close

Source of Oscillator : Close

Notes:

This indicator is created for normalizing any other indicators using its functions.

The first function to be created is one based on Bell's technique for

normalizing to average price. This function has three input values. OscValue

represents the value of the oscillator to be normalized. This input is included

in each of the four functions. The NormPrice and NormLength inputs represent the

price and length values used to calculate the average that is used in the normalization.

The second function is for Bell's technique for normalizing to standard deviation

of prices. This function also has three input values. I already described the OscValue

input. The NormPrice and NormLength inputs represent the price and length values used

to calculate the standard deviation that is used in the normalization.

The third function is for Bell's techniques for normalizing to average range of prices.

Unlike the two previous functions, this function only has two inputs: the OscValue input,

and the NormLength input, which represents the number of bars to use in the calculation of

the average true range that is used in the normalization.

The fourth function is for Bell's technique for normalizing to range. This function also

has only two inputs: the OscValue input, and a NormLength input, which represents the number

of bars to use for the historical range that is used in the normalization.

Download File:

Normaliz.efs

EFS Code:

Description:

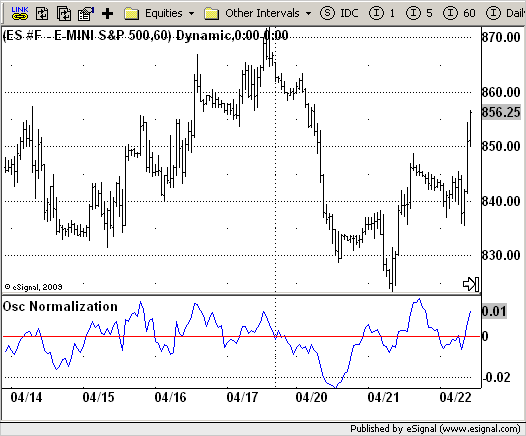

Osc Normalization

Formula Parameters:

NormType : 1

OscLength : 10

NormLength : 10

Source of Normalizing : Close

Source of Oscillator : Close

Notes:

This indicator is created for normalizing any other indicators using its functions.

The first function to be created is one based on Bell's technique for

normalizing to average price. This function has three input values. OscValue

represents the value of the oscillator to be normalized. This input is included

in each of the four functions. The NormPrice and NormLength inputs represent the

price and length values used to calculate the average that is used in the normalization.

The second function is for Bell's technique for normalizing to standard deviation

of prices. This function also has three input values. I already described the OscValue

input. The NormPrice and NormLength inputs represent the price and length values used

to calculate the standard deviation that is used in the normalization.

The third function is for Bell's techniques for normalizing to average range of prices.

Unlike the two previous functions, this function only has two inputs: the OscValue input,

and the NormLength input, which represents the number of bars to use in the calculation of

the average true range that is used in the normalization.

The fourth function is for Bell's technique for normalizing to range. This function also

has only two inputs: the OscValue input, and a NormLength input, which represents the number

of bars to use for the historical range that is used in the normalization.

Download File:

Normaliz.efs

EFS Code:

PHP Code:

/*********************************

Provided By:

eSignal (Copyright c eSignal), a division of Interactive Data

Corporation. 2009. All rights reserved. This sample eSignal

Formula Script (EFS) is for educational purposes only and may be

modified and saved under a new file name. eSignal is not responsible

for the functionality once modified. eSignal reserves the right

to modify and overwrite this EFS file with each new release.

Description:

Osc Normalization

Version: 1.0 04/22/2009

Formula Parameters: Default:

NormType 1

OscLength 10

NormLength 10

Source of Normalizing Close

Source of Oscillator Close

Notes:

This indicator is created for normalizing any other indicators using its functions.

The first function to be created is one based on Bell's technique for

normalizing to average price. This function has three input values. OscValue

represents the value of the oscillator to be normalized. This input is included

in each of the four functions. The NormPrice and NormLength inputs represent the

price and length values used to calculate the average that is used in the normalization.

The second function is for Bell's technique for normalizing to standard deviation

of prices. This function also has three input values. I already described the OscValue

input. The NormPrice and NormLength inputs represent the price and length values used

to calculate the standard deviation that is used in the normalization.

The third function is for Bell's techniques for normalizing to average range of prices.

Unlike the two previous functions, this function only has two inputs: the OscValue input,

and the NormLength input, which represents the number of bars to use in the calculation of

the average true range that is used in the normalization.

The fourth function is for Bell's technique for normalizing to range. This function also

has only two inputs: the OscValue input, and a NormLength input, which represents the number

of bars to use for the historical range that is used in the normalization.

**********************************/

var fpArray = new Array();

var bInit = false;

function preMain() {

setStudyTitle("Osc Normalization");

setCursorLabelName("Norm Osc", 0);

setCursorLabelName("Balance", 1);

setDefaultBarFgColor(Color.blue, 0);

setDefaultBarFgColor(Color.red, 1);

var x = 0;

fpArray[x] = new FunctionParameter("NormType", FunctionParameter.STRING);

with(fpArray[x++]) {

setName("Type of Normalization");

addOption("Average");

addOption("StdDev");

addOption("ATR");

addOption("Range");

setDefault("Average");

}

fpArray[x] = new FunctionParameter("OscLength", FunctionParameter.NUMBER);

with(fpArray[x++]) {

setName("Length of Oscillator");

setLowerLimit(1);

setDefault(10);

}

fpArray[x] = new FunctionParameter("NormLength", FunctionParameter.NUMBER);

with(fpArray[x++]) {

setName("Length of Normalization");

setLowerLimit(1);

setDefault(8);

}

fpArray[x] = new FunctionParameter("sNormPrice", FunctionParameter.STRING);

with(fpArray[x++]){

setName("Source of Normalization");

addOption("open");

addOption("high");

addOption("low");

addOption("close");

addOption("hl2");

addOption("hlc3");

addOption("ohlc4");

setDefault("close");

}

fpArray[x] = new FunctionParameter("sOscPrice", FunctionParameter.STRING);

with(fpArray[x++]){

setName("Source of Oscillator");

addOption("open");

addOption("high");

addOption("low");

addOption("close");

addOption("hl2");

addOption("hlc3");

addOption("ohlc4");

setDefault("close");

}

}

var xMOM = null;

var xHHMOM = null;

var xLLMOM = null;

var xMA = null;

var xPriceOsc = null;

var xPriceNorm = null;

var xNormStdDev = null;

function main(NormType, sOscPrice, OscLength, sNormPrice, NormLength) {

var nBarState = getBarState();

if (nBarState == BARSTATE_ALLBARS) {

if (NormType == null) NormType = "Average";

if (sOscPrice == null) sOscPrice = "close";

if (OscLength == null) OscLength = 10;

if (sNormPrice == null) sNormPrice = "close";

if (NormLength == null) NormLength = 8;

}

if (bInit == false) {

xPriceOsc = eval(sOscPrice)();

xPriceNorm = eval(sNormPrice)();

xMOM = mom(OscLength, xPriceOsc);

xHHMOM = upperDonchian(NormLength, xMOM);

xLLMOM = lowerDonchian(NormLength, xMOM);

xMA = sma(NormLength, xPriceNorm);

xNormStdDev = efsInternal("Calc_StdDev", NormLength, xPriceNorm, xMA)

xATR = atr(NormLength);

setCursorLabelName(NormType, 0);

if (NormType != "Range") {

addBand(0, PS_SOLID, 1, Color.red, "Line");

} else {

addBand(50, PS_SOLID, 1, Color.red, "Line");

}

bInit = true;

}

var OscValue = xMOM.getValue(0);

var AvgValue = xMA.getValue(0);

var NormAvg = 0;

if (AvgValue != 0) NormAvg = OscValue / AvgValue;

var StdDev = xNormStdDev.getValue(0);

var NormStdDev = 0;

if (StdDev != 0) NormStdDev = OscValue / StdDev;

var ATR = xATR.getValue(0);

var NormATR = 0;

if (ATR != 0) NormATR = OscValue / ATR;

var HiHi = xHHMOM.getValue(0);

var LoLo = xLLMOM.getValue(0);

if (HiHi == null) return;

var HighLowDiff = HiHi - LoLo;

var NormRange = 0;

if (HighLowDiff != 0) NormRange = (((OscValue - LoLo) / HighLowDiff) * 100);

var nRes = 0;

if (NormType == "Average") {

nRes = (NormAvg);

}

else if (NormType == "StdDev") {

nRes = (NormStdDev);

}

else if (NormType == "ATR") {

nRes = (NormATR);

}

else if (NormType == "Range") {

nRes = (NormRange);

}

return nRes;

}

function Calc_StdDev(Period, xSeries1, xSeries2) {

var nRes = 0;

var sum = 0;

var barsBack = 0;

var nSeries1 = xSeries1.getValue(0);

if (nSeries1 == null) return;

for (barsBack = 0; barsBack < Period; barsBack++) {

sum += (xSeries1.getValue( - barsBack) - xSeries2.getValue(0)) * (xSeries1.getValue( - barsBack) - xSeries2.getValue(0));

}

nRes = Math.sqrt(sum / Period);

return nRes;

}