I'm a new user and I would like to do the following in EFS:

ES #F should be the main symbol and i would like to have three different nonprice studies underneath(not overlaying each other!):

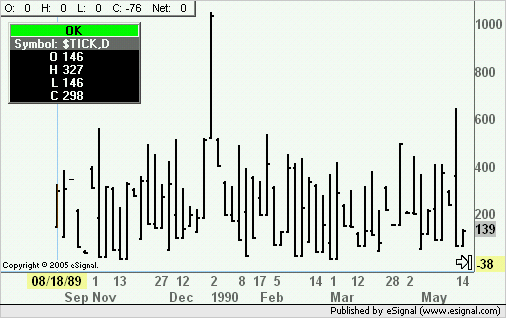

a 5 SMA of $TICK

a 10 SMA of $ADD

a 5 SMA of $TRIN overlaying a 10SMA of $TRIN

Does anyone have a solution?

Thanks for help!

ES #F should be the main symbol and i would like to have three different nonprice studies underneath(not overlaying each other!):

a 5 SMA of $TICK

a 10 SMA of $ADD

a 5 SMA of $TRIN overlaying a 10SMA of $TRIN

Does anyone have a solution?

Thanks for help!

Comment