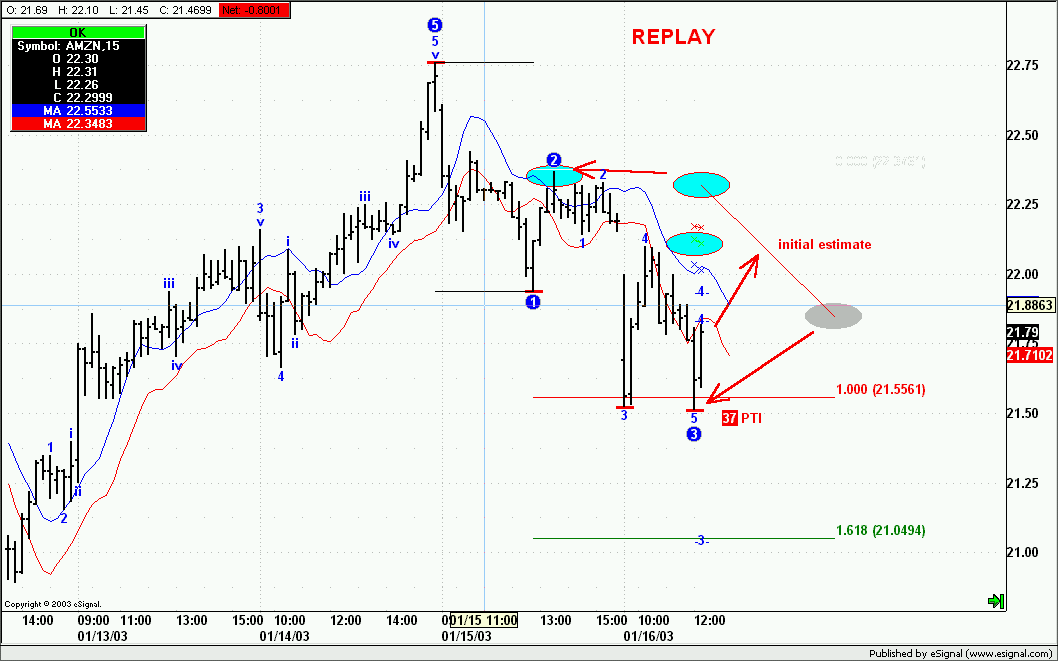

I took the liberty of grabbing on of Alexis' screenshots and am reposting it for re-use.

In this particular example. I see you are using Fibonnaci Extensions. The first extensions were drawn from the 5->1, the next portion was from the 1->2.

So a bunch of Fib questions...

My guess is you then focus on the 1.00 and 1.618 retracements. Are there other numbers worth using?

Instead of 5->1->2 what other waves might you draw the fib numbers from?

Could you show some examples where you would use Fibonnacci Retracements instead of extensions?

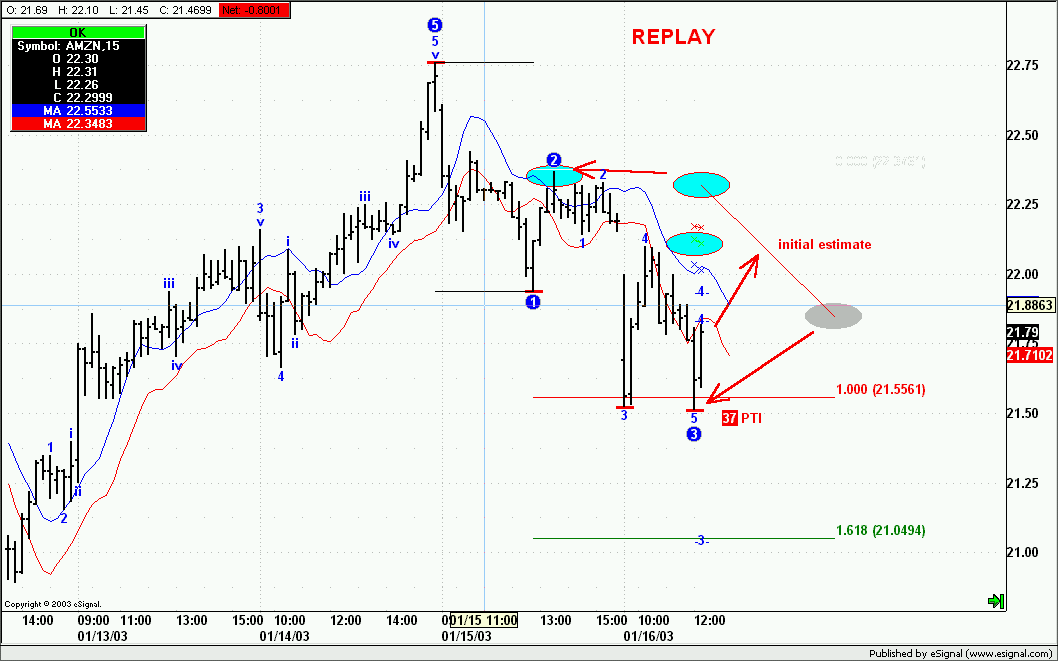

In this particular example. I see you are using Fibonnaci Extensions. The first extensions were drawn from the 5->1, the next portion was from the 1->2.

So a bunch of Fib questions...

My guess is you then focus on the 1.00 and 1.618 retracements. Are there other numbers worth using?

Instead of 5->1->2 what other waves might you draw the fib numbers from?

Could you show some examples where you would use Fibonnacci Retracements instead of extensions?

Comment