File Name: Kraut_ColoredBars.efs, Kraut_ColoredBarsInd.efs, Kraut_ColoredBarsIndWL.efs

Description:

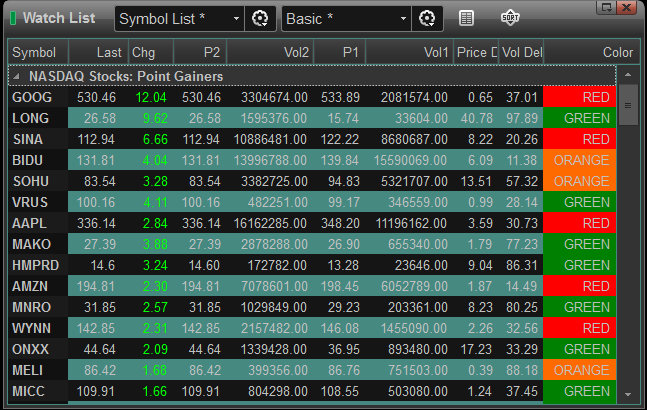

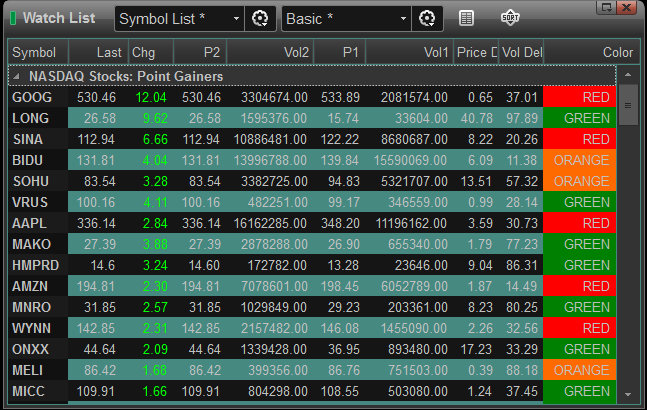

AA Color-Based System, Indicator And Watch-List-Indicator For Short-Term Trading

Formula Parameters:

Kraut_ColoredBars.efs

Change POINTS

Lookback 10

Trailing Percent 1

Kraut_ColoredBarsInd.efs

Change POINTS

Lookback 10

Kraut_ColoredBarsIndWL.efs

Change POINTS

Lookback 10

Notes:

The related article is copyrighted material. If you are not

a subscriber of Stocks & Commodities, please visit

www.traders.com.

Download File:

Kraut_ColoredBars.efs

Kraut_ColoredBarsInd.efs

Kraut_ColoredBarsIndWL.efs

EFS Code:

Kraut_ColoredBars.efs

Kraut_ColoredBarsInd.efs

Kraut_ColoredBarsIndWL.efs

Description:

AA Color-Based System, Indicator And Watch-List-Indicator For Short-Term Trading

Formula Parameters:

Kraut_ColoredBars.efs

Change POINTS

Lookback 10

Trailing Percent 1

Kraut_ColoredBarsInd.efs

Change POINTS

Lookback 10

Kraut_ColoredBarsIndWL.efs

Change POINTS

Lookback 10

Notes:

The related article is copyrighted material. If you are not

a subscriber of Stocks & Commodities, please visit

www.traders.com.

Download File:

Kraut_ColoredBars.efs

Kraut_ColoredBarsInd.efs

Kraut_ColoredBarsIndWL.efs

EFS Code:

Kraut_ColoredBars.efs

PHP Code:

/*********************************

Provided By:

Interactive Data Corporation (Copyright © 2010)

All rights reserved. This sample eSignal Formula Script (EFS)

is for educational purposes only. Interactive Data Corporation

reserves the right to modify and overwrite this EFS file with

each new release.

Description:

A Color-Based System For Short-Term Trading

Version: 1.0 16/05/2011

Formula Parameters: Default:

Change POINTS

Lookback 10

Trailing Percent 1

Notes:

The related article is copyrighted material. If you are not

a subscriber of Stocks & Commodities, please visit

[url]www.traders.com.[/url]

**********************************/

var fpArray = new Array();

var bVersion = null;

function preMain()

{

setPriceStudy(true);

var x=0;

fpArray[x] = new FunctionParameter("gChange", FunctionParameter.STRING);

with(fpArray[x++])

{

setName("Change");

addOption("POINTS");

addOption("PERCENT");

setDefault("POINTS");

}

fpArray[x] = new FunctionParameter("gLookBack", FunctionParameter.NUMBER);

with(fpArray[x++])

{

setName("Lookback");

setLowerLimit(1);

setDefault(10);

}

fpArray[x] = new FunctionParameter("gTrailing", FunctionParameter.NUMBER);

with(fpArray[x++])

{

setName("Trailing Percent");

setLowerLimit(1);

setUpperLimit(100);

setDefault(1);

}

}

var bInit = false;

var xCls = null;

var xVol = null;

var xChgCls = null;

var xChgVol = null;

var xDay = null;

var xMonth = null;

var xYear = null;

var stop = 0;

function main(gChange, gLookBack, gTrailing)

{

if (bVersion == null) bVersion = verify();

if (bVersion == false) return;

if ( getCurrentBarIndex() == 0 ) return ;

if (!bInit)

{

xCls = close();

xVol = volume();

if (gChange == "POINTS" )

{

xChgCls = mom(gLookBack);

xChgVol = mom(gLookBack, xVol);

}

else{

xChgCls = roc(gLookBack);

xChgVol = roc(gLookBack, xVol);

}

bInit = true;

}

var vChgCls = xChgCls.getValue(0);

var vChgVol = xChgVol.getValue(0);

var vCls0 = xCls.getValue(0);

var vCls1 = xCls.getValue(-1);

if ( vChgCls == null ) return;

var cond = 0;

if ( vChgCls > 0 && vChgVol > 0 )

{

setBarFgColor(Color.green);

cond = 0;

}

if ( vChgCls > 0 && vChgVol < 0 )

{

setBarFgColor(Color.blue);

cond = 1;

}

if ( vChgCls < 0 && vChgVol < 0 )

{

setBarFgColor(Color.RGB(255, 106, 0));

cond = 2;

};

if ( vChgCls < 0 && vChgVol > 0 )

{

setBarFgColor(Color.red);

cond = 3;

};

if ( Strategy.isLong() )

{

if ( vCls0 <= stop )

{

Strategy.doSell( "Close Long", Strategy.CLOSE, Strategy.THISBAR );

stop = 0;

}

else

{

if (vCls0 > vCls1) stop = vCls0 * (1- gTrailing / 100);

}

}

else

{

if ( cond == 0 || cond == 1 ) Strategy.doLong("Entry Long", Strategy.CLOSE, Strategy.THISBAR);

}

if ( Strategy.isLong() ) setBarBgColor (Color.darkgreen);

}

function verify() {

var b = false;

if (getBuildNumber() < 779) {

drawTextAbsolute(5, 35, "This study requires version 8.0 or later.",

Color.white, Color.blue, Text.RELATIVETOBOTTOM|Text.RELATIVETOLEFT|Text.BOLD|Text.LEFT,

null, 13, "error");

drawTextAbsolute(5, 20, "Click HERE to upgrade.@URL=http://www.esignal.com/download/default.asp",

Color.white, Color.blue, Text.RELATIVETOBOTTOM|Text.RELATIVETOLEFT|Text.BOLD|Text.LEFT,

null, 13, "upgrade");

return b;

} else {

b = true;

}

return b;

}

PHP Code:

/*********************************

Provided By:

Interactive Data Corporation (Copyright © 2010)

All rights reserved. This sample eSignal Formula Script (EFS)

is for educational purposes only. Interactive Data Corporation

reserves the right to modify and overwrite this EFS file with

each new release.

Description:

A Color-Based Indicator For Short-Term Trading

Version: 1.0 16/05/2011

Formula Parameters: Default:

Change POINTS

Lookback 10

Notes:

The related article is copyrighted material. If you are not

a subscriber of Stocks & Commodities, please visit

[url]www.traders.com.[/url]

**********************************/

var fpArray = new Array();

var bVersion = null;

function preMain()

{

setCursorLabelName("Price Zone Analyzer", 0);

setPlotType(PLOTTYPE_HISTOGRAM,0);

var x=0;

fpArray[x] = new FunctionParameter("gChange", FunctionParameter.STRING);

with(fpArray[x++])

{

setName("Change");

addOption("POINTS");

addOption("PERCENT");

setDefault("POINTS");

}

fpArray[x] = new FunctionParameter("gLookBack", FunctionParameter.NUMBER);

with(fpArray[x++])

{

setName("Lookback");

setLowerLimit(1);

setDefault(10);

}

}

var bInit = false;

var xVol = null;

var xChgCls = null;

var xChgVol = null;

function main(gChange, gLookBack)

{

if (bVersion == null) bVersion = verify();

if (bVersion == false) return;

if (!bInit)

{

xVol = volume();

if (gChange == 'POINTS')

{

xChgCls = mom(gLookBack);

xChgVol = mom(gLookBack,xVol);

}

else

{

xChgCls = roc(gLookBack);

xChgVol = roc(gLookBack,xVol);

}

bInit = true;

}

var vVol = xVol.getValue(0);

var vChgCls = xChgCls.getValue(0);

var vChgVol = xChgVol.getValue(0);

if ( vChgCls == null ) return;

if ( vChgCls > 0 && vChgVol > 0 ) setBarFgColor(Color.green);

if ( vChgCls > 0 && vChgVol < 0 ) setBarFgColor(Color.blue);

if ( vChgCls < 0 && vChgVol < 0 ) setBarFgColor(Color.RGB(255, 106, 0));

if ( vChgCls < 0 && vChgVol > 0 ) setBarFgColor(Color.red);

return vVol;

}

function verify() {

var b = false;

if (getBuildNumber() < 779) {

drawTextAbsolute(5, 35, "This study requires version 8.0 or later.",

Color.white, Color.blue, Text.RELATIVETOBOTTOM|Text.RELATIVETOLEFT|Text.BOLD|Text.LEFT,

null, 13, "error");

drawTextAbsolute(5, 20, "Click HERE to upgrade.@URL=http://www.esignal.com/download/default.asp",

Color.white, Color.blue, Text.RELATIVETOBOTTOM|Text.RELATIVETOLEFT|Text.BOLD|Text.LEFT,

null, 13, "upgrade");

return b;

} else {

b = true;

}

return b;

}

PHP Code:

/*********************************

Provided By:

Interactive Data Corporation (Copyright © 2010)

All rights reserved. This sample eSignal Formula Script (EFS)

is for educational purposes only. Interactive Data Corporation

reserves the right to modify and overwrite this EFS file with

each new release.

Description:

A Color-Based Indicator For Short-Term Trading For WL

Version: 1.0 16/05/2011

Formula Parameters: Default:

Change POINTS

Lookback 10

Notes:

The related article is copyrighted material. If you are not

a subscriber of Stocks & Commodities, please visit

[url]www.traders.com.[/url]

**********************************/

var fpArray = new Array();

var bVersion = null;

function preMain()

{

setCursorLabelName("Date P2", 0);

setCursorLabelName("P2", 1);

setCursorLabelName("Vol2", 2);

setCursorLabelName("Date P1", 3);

setCursorLabelName("P1", 4);

setCursorLabelName("Vol1", 5);

setCursorLabelName("Price Delta", 6);

setCursorLabelName("Vol Delta", 7);

setCursorLabelName("Price Delta, %", 8);

setCursorLabelName("Vol Delta, %", 9);

setCursorLabelName("Color", 10);

var x=0;

fpArray[x] = new FunctionParameter("gChange", FunctionParameter.STRING);

with(fpArray[x++])

{

setName("Change");

addOption("POINTS");

addOption("PERCENT");

setDefault("POINTS");

}

fpArray[x] = new FunctionParameter("gLookBack", FunctionParameter.NUMBER);

with(fpArray[x++])

{

setName("Lookback");

setLowerLimit(1);

setDefault(10);

}

}

var bInit = false;

var xVol = null;

var xCls = null;

var xMomCls = null;

var xMomVol = null;

var xRocCls = null;

var xRocVol = null;

var xDay = null;

var xMonth = null;

var xYear = null;

function main(gChange, gLookBack)

{

if (bVersion == null) bVersion = verify();

if (bVersion == false) return;

if (!bInit)

{

xCls = close();

xVol = volume();

xRocCls = roc(gLookBack);

xRocVol = roc(gLookBack, xVol);

xMomCls = mom(gLookBack);

xMomVol = mom(gLookBack, xVol);

xDay = day();

xMonth = month();

xYear = year();

bInit = true;

}

var vCls = xCls.getValue(0);

var vVol = xVol.getValue(0);

var vClsPrev = xCls.getValue(-gLookBack);

var vVolPrev = xVol.getValue(-gLookBack);

var vMomCls = xMomCls.getValue(0);

var vMomVol = xMomVol.getValue(0);

var vRocCls = xRocCls.getValue(0);

var vRocVol = xRocVol.getValue(0);

if ( vClsPrev == null ) return;

var vP2Day = ""+xMonth.getValue(0)+"/"+xDay.getValue(0)+"/"+xYear.getValue(0);

var vP1Day = ""+xMonth.getValue(-gLookBack)+"/"+xDay.getValue(-gLookBack)+"/"+xYear.getValue(-gLookBack);

var vChgCls = (gChange=='POINTS')? vMomCls : vRocCls;

var vChgVol = (gChange=='POINTS')? vMomVol : vRocVol;

var vColor = "na";

if ( vChgCls >= 0 && vChgVol >= 0 )

{

setBarBgColor(Color.green,10);

vColor = "GREEN"

};

if ( vChgCls >= 0 && vChgVol <= 0 )

{

setBarBgColor(Color.blue, 10);

vColor = "BLUE"

};

if ( vChgCls <= 0 && vChgVol <= 0 )

{

setBarBgColor(Color.RGB(255, 106, 0), 10);

vColor = "ORANGE"

};

if ( vChgCls <= 0 && vChgVol >= 0 )

{

setBarBgColor(Color.red, 10);

vColor = "RED"

};

return new Array (vP2Day, vCls, vVol, vP1Day, vClsPrev, vVolPrev,

Math.abs(vMomCls), Math.abs(vMomVol), Math.abs(vRocCls), Math.abs(vRocVol), vColor);

}

function verify() {

var b = false;

if (getBuildNumber() < 779) {

drawTextAbsolute(5, 35, "This study requires version 8.0 or later.",

Color.white, Color.blue, Text.RELATIVETOBOTTOM|Text.RELATIVETOLEFT|Text.BOLD|Text.LEFT,

null, 13, "error");

drawTextAbsolute(5, 20, "Click HERE to upgrade.@URL=http://www.esignal.com/download/default.asp",

Color.white, Color.blue, Text.RELATIVETOBOTTOM|Text.RELATIVETOLEFT|Text.BOLD|Text.LEFT,

null, 13, "upgrade");

return b;

} else {

b = true;

}

return b;

}