File Name: TripleExponentialAverage.efs

Description:

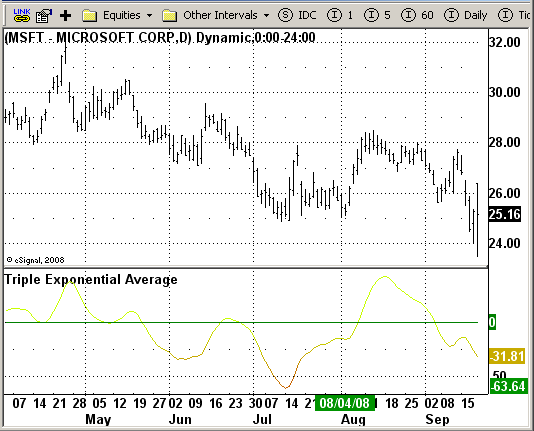

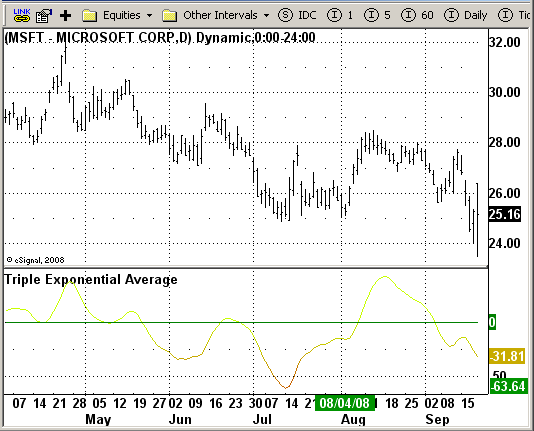

Triple Exponential Average

Formula Parameters:

Color line null: Green

Length: 9

Gradient Color: 200

Display Title Value: False

Notes:

The Triple Exponential Average (TRIX) indicator is an oscillator used

to identify oversold and overbought markets and it can also be used

as a momentum indicator. As is common with many oscillators, TRIX

oscillates around a zero line. When used as an oscillator, a positive

value indicates an overbought market while a negative value indicates

an oversold market. As a momentum indicator, a positive value suggests

momentum is increasing while a negative value suggests momentum is

decreasing.

Download File:

TripleExponentialAverage.efs

EFS Code:

Description:

Triple Exponential Average

Formula Parameters:

Color line null: Green

Length: 9

Gradient Color: 200

Display Title Value: False

Notes:

The Triple Exponential Average (TRIX) indicator is an oscillator used

to identify oversold and overbought markets and it can also be used

as a momentum indicator. As is common with many oscillators, TRIX

oscillates around a zero line. When used as an oscillator, a positive

value indicates an overbought market while a negative value indicates

an oversold market. As a momentum indicator, a positive value suggests

momentum is increasing while a negative value suggests momentum is

decreasing.

Download File:

TripleExponentialAverage.efs

EFS Code:

PHP Code:

/*********************************

Provided By:

eSignal (Copyright c eSignal), a division of Interactive Data

Corporation. 2008. All rights reserved. This sample eSignal

Formula Script (EFS) is for educational purposes only and may be

modified and saved under a new file name. eSignal is not responsible

for the functionality once modified. eSignal reserves the right

to modify and overwrite this EFS file with each new release.

Description:

Triple Exponential Average

Version: 1.0 08/08/2008

Notes:

The Triple Exponential Average (TRIX) indicator is an oscillator used

to identify oversold and overbought markets and it can also be used

as a momentum indicator. As is common with many oscillators, TRIX

oscillates around a zero line. When used as an oscillator, a positive

value indicates an overbought market while a negative value indicates

an oversold market. As a momentum indicator, a positive value suggests

momentum is increasing while a negative value suggests momentum is

decreasing.

Formula Parameters: Default:

* Color line null Green

* Length 9

* Gradient Color 200

* Display Title Value False

**********************************/

var fpArray = new Array();

var bInit = false;

var myTRIX = null;

var Max = 1;

var Min = -1;

function preMain() {

setPriceStudy(false);

setShowCursorLabel(false);

setShowTitleParameters( false );

setStudyTitle("Triple Exponential Average");

setCursorLabelName("TRIX", 0);

setCursorLabelName("NULL", 1);

setDefaultBarFgColor(Color.blue, 0);

setDefaultBarFgColor(Color.green, 1);

setPlotType(PLOTTYPE_LINE, 0);

setPlotType(PLOTTYPE_LINE, 1);

setDefaultBarThickness(1, 0);

setDefaultBarThickness(1, 1);

askForInput();

var x=0;

fpArray[x] = new FunctionParameter("LineColor", FunctionParameter.COLOR);

with(fpArray[x++]){

setName("Color line null");

setDefault(Color.green);

}

fpArray[x] = new FunctionParameter("Length", FunctionParameter.NUMBER);

with(fpArray[x++]){

setLowerLimit(1);

setDefault(9);

}

fpArray[x] = new FunctionParameter("ViewValue", FunctionParameter.BOOLEAN);

with(fpArray[x++]){

setName("Display Title Value");

setDefault(false);

}

fpArray[x] = new FunctionParameter("GradientColor", FunctionParameter.NUMBER);

with(fpArray[x++]){

setName("Color Gradient");

addOption(0);

addOption(50);

addOption(100);

addOption(150);

addOption(200);

addOption(250);

setDefault(200);

}

}

function main(LineColor, ViewValue, Length, GradientColor) {

var nmyTRIX;

var nmyTRIX2;

var Rez;

var inc;

if(getCurrentBarCount() < Length) return;

if ( bInit == false ) {

myTRIX = efsInternal("TRIXLog", close(), Length);

myTRIX = ema(Length, myTRIX);

myTRIX = ema(Length, myTRIX);

myTRIX = ema(Length, myTRIX);

setDefaultBarFgColor(LineColor, 1);

bInit = true;

}

nmyTRIX = myTRIX.getValue(0);

nmyTRIX2 = myTRIX.getValue(-1);

if (nmyTRIX2 == null) nmyTRIX2 = 0;

Rez = (nmyTRIX - nmyTRIX2) * 10000 ;

inc = Math.round(Rez);

if (inc > Max) Max = inc;

if (inc < Min) Min = inc;

inc = RGB_G(inc, Max, Min);

if (inc == null) inc = 0;

setDefaultBarFgColor(Color.RGB(GradientColor,inc,0),0);

return new Array (Rez, 0);

}

function TRIXLog(DataArray, Length) {

var tmp;

tmp = DataArray.getValue(0);

return (Math.log(tmp));

}

function RGB_G(Val, Max, Min) {

var tmpG = 0;

var Perc1 = 0;

if (Val > 0) {

Perc1 = (Val * 100) / Max;

tmpG = 255 - (Perc1*255)/100;

return Math.round(tmpG);

} else {

Perc1 = ((Val*-1) * 100) / (Min*-1);

tmpG = 255 - (Perc1*255)/100;

return Math.round(tmpG);

}

return tmpG;

}