File Name: FVEStrategy.efs

Description:

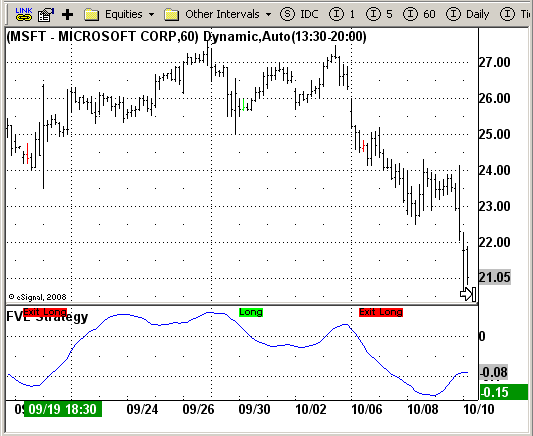

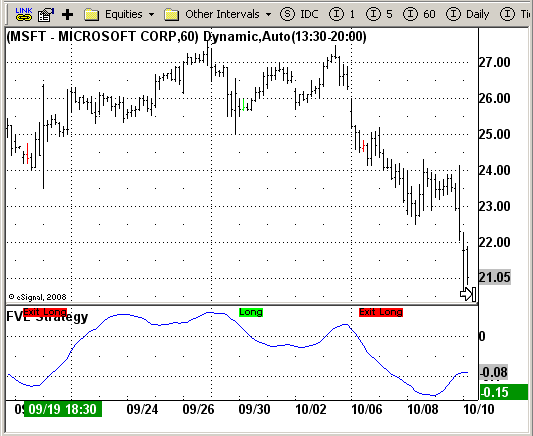

FVE Strategy

Formula Parameters:

Samples - number of bars to calculate FVE: 50

FVEenterl - lower entry level of FVE: -20

FVEenteru - upper entry level of FVE: 10

MA - number of bars to calculate MA: 40

LRPeriod - number of bars to calculate Linear regression: 20

Bangle - the angle to buy: 30

Sangle - the angle to sell: -30

LRC - number of bars to calculate Linear regression slope: 30

UB - limit for Linear regression rising: 0.1

LB - limit for Linear regression falling: -0.5

BarToExitOn - number of bars to exit position: 70

Notes:

This is a strategy based on FVE (Finite Volume Elements) indicator.

Download File:

FVEStrategy.efs

EFS Code:

Description:

FVE Strategy

Formula Parameters:

Samples - number of bars to calculate FVE: 50

FVEenterl - lower entry level of FVE: -20

FVEenteru - upper entry level of FVE: 10

MA - number of bars to calculate MA: 40

LRPeriod - number of bars to calculate Linear regression: 20

Bangle - the angle to buy: 30

Sangle - the angle to sell: -30

LRC - number of bars to calculate Linear regression slope: 30

UB - limit for Linear regression rising: 0.1

LB - limit for Linear regression falling: -0.5

BarToExitOn - number of bars to exit position: 70

Notes:

This is a strategy based on FVE (Finite Volume Elements) indicator.

Download File:

FVEStrategy.efs

EFS Code:

PHP Code:

/*********************************

Provided By:

eSignal (Copyright c eSignal), a division of Interactive Data

Corporation. 2008. All rights reserved. This sample eSignal

Formula Script (EFS) is for educational purposes only and may be

modified and saved under a new file name. eSignal is not responsible

for the functionality once modified. eSignal reserves the right

to modify and overwrite this EFS file with each new release.

Description:

FVE Strategy

Version: 1.0 10/14/2008

Notes:

This is a strategy based on FVE (Finite Volume Elements) indicator.

Formula Parameters: Default:

Samples - number of bars to calculate FVE 50

FVEenterl - lower entry level of FVE -20

FVEenteru - upper entry level of FVE 10

MA - number of bars to calculate MA 40

LRPeriod - number of bars to calculate Linear regression 20

Bangle - the angle to buy 30

Sangle - the angle to sell -30

LRC - number of bars to calculate Linear regression slope 30

UB - limit for Linear regression rising 0.1

LB - limit for Linear regression falling -0.5

BarToExitOn - number of bars to exit position 70

**********************************/

var fpArray = new Array();

var bInit = false;

function preMain(){

setPriceStudy(false);

setShowCursorLabel(false);

setShowTitleParameters( false );

setStudyTitle("FVE Strategy");

setColorPriceBars(true);

var x=0;

fpArray[x] = new FunctionParameter("Samples", FunctionParameter.NUMBER);

with(fpArray[x++]){

setName("Number Of Bars To Calculate FVE");

setLowerLimit(1);

setDefault(50);

}

fpArray[x] = new FunctionParameter("FVEenterl", FunctionParameter.NUMBER);

with(fpArray[x++]){

setName("Lower Entry Level Pf FVE");

setLowerLimit(-100);

setDefault(-20);

}

fpArray[x] = new FunctionParameter("FVEenteru", FunctionParameter.NUMBER);

with(fpArray[x++]){

setName("Upper Entry Level Of FVE");

setLowerLimit(1);

setDefault(10);

}

fpArray[x] = new FunctionParameter("MA", FunctionParameter.NUMBER);

with(fpArray[x++]){

setName("Length To Calculate MA");

setLowerLimit(1);

setDefault(40);

}

fpArray[x] = new FunctionParameter("LRPeriod", FunctionParameter.NUMBER);

with(fpArray[x++]){

setName("Length To Calculate Linear Regression");

setLowerLimit(1);

setDefault(20);

}

fpArray[x] = new FunctionParameter("Bangle", FunctionParameter.NUMBER);

with(fpArray[x++]){

setName("The Angle To Buy");

setLowerLimit(0);

setDefault(30);

}

fpArray[x] = new FunctionParameter("Sangle", FunctionParameter.NUMBER);

with(fpArray[x++]){

setName("The Angle To Sell");

setLowerLimit(-100);

setDefault(-30);

}

fpArray[x] = new FunctionParameter("LRC", FunctionParameter.NUMBER);

with(fpArray[x++]){

setName("Length Linear Regression Slope");

setLowerLimit(1);

setDefault(30);

}

fpArray[x] = new FunctionParameter("UB", FunctionParameter.NUMBER);

with(fpArray[x++]){

setName("Limit Ror Linear Regression Rising");

setLowerLimit(0);

setDefault(0.1);

}

fpArray[x] = new FunctionParameter("LB", FunctionParameter.NUMBER);

with(fpArray[x++]){

setName("Limit For Linear Regression Falling");

setLowerLimit(-100);

setDefault(-0.5);

}

fpArray[x] = new FunctionParameter("BarToExitOn", FunctionParameter.NUMBER);

with(fpArray[x++]){

setName("Length To Exit Position");

setLowerLimit(1);

setDefault(70);

}

}

var EMA_1 = 0;

var EMA = 0;

var VolumePlusMinusArray = new Array();

var FVEArray = new Array();

var BarsSinceEntry = 0;

var xTP = null;

function main(Samples, FVEenterl, FVEenteru, MA, LRPeriod, Bangle, Sangle, LRC, UB, LB, BarToExitOn){

var nState = getBarState();

var TP = 0,

TP1 = 0,

MF = 0,

Cintra = .1,

Cinter = .1,

CutOff = 0,

VolumePlusMinus = 0,

FVE = 0,

Fvesum = 0,

FveFactor = 0,

Intra = 0,

Inter = 0,

Vintra = 0,

Vinter = 0,

i = 0,

VolSum = 0;

K = 2 / (MA + 1),

vHL = high(0) - low(0),

vVar = vHL * 0.25,

vAddVar = vVar * 0.35,

Condition1 = false,

Condition2 = false,

Condition3 = false,

Condition4 = false,

Condition5 = false;

var IntraArray = new Array();

var InterArray = new Array();

if (nState == BARSTATE_ALLBARS) {

if(Samples == null) Samples = 50;

if(FVEenterl == null) FVEenterl = -20;

if(FVEenteru == null) FVEenteru = 10;

if(MA == null) MA = 40;

if(LRPeriod == null) LRPeriod = 20;

if(Bangle == null) Bangle = 30;

if(Sangle == null) Sangle = -30;

if(LRC == null) LRC = 30;

if(UB == null) UB = .1;

if(LB == null) LB = -.5;

if(BarToExitOn == null) BarToExitOn = 70;

}

if (bInit == false) {

xTP = hlc3();

bInit = true;

}

if(getCurrentBarIndex() == 0) return;

setPriceBarColor(Color.black);

for(i = 0; i < Samples; i++){

IntraArray[i] = Math.log(high(-i)) - Math.log(low(-i));

InterArray[i] = Math.log(xTP.getValue(-i)) - Math.log(xTP.getValue(-i-1));

}

Intra = Math.log(high(0)) - Math.log(low(0));

Vintra = StandardDev(IntraArray, Samples);

Inter = Math.log(xTP.getValue(0)) - Math.log(xTP.getValue(-1));

Vinter = StandardDev(InterArray, Samples);

CutOff = Cintra * Vintra + Cinter * Vinter;

MF = (close(0) - (high(0) + low(0))/2)+ xTP.getValue(0) - xTP.getValue(-1);

if(MF > CutOff * close(0))

FveFactor = 1;

else if(MF < -1 * CutOff * close(0))

FveFactor = -1;

else

FveFactor=0;

VolumePlusMinus = volume(0) * FveFactor;

for(i = Samples - 1; i > 0; i--)

VolumePlusMinusArray[i] = VolumePlusMinusArray[i - 1];

VolumePlusMinusArray[0] = VolumePlusMinus;

for(i = 0; i < Samples; i++){

Fvesum += VolumePlusMinusArray[i];

VolSum += volume(-i);

}

if(VolumePlusMinusArray[Samples - 1] != null){

FVE = (Fvesum / VolSum) * 100;

for(i = LRPeriod - 1; i > 0; i--)

FVEArray[i] = FVEArray[i - 1];

FVEArray[0] = FVE;

if (getBarState() == BARSTATE_NEWBAR)

EMA_1 = EMA;

EMA = K * FVE + (1 - K) * EMA_1;

}

else

return;

if(FVEArray[LRPeriod - 1] != null){

BarsSinceEntry++;

if(FVE > FVEenterl && FVE < FVEenteru){

Condition1 = true;

}

if(LinearReg(FVEArray,LRPeriod,"AngleFC",LRC-1) > Bangle){

Condition2 = true;

}

if(FVE > EMA){

Condition3 = true;

}

if(LinearReg(close(0,-LRC),LRC,"Slope",LRC-1) < UB * LinearReg(close(0,-LRC),LRC,"Value",LRC-1) / 100 && LinearReg(close(0,-LRC),LRC,"Slope",LRC-1) > LB * LinearReg(close(0,-LRC),LRC,"Value",LRC-1) / 100){

Condition4 = true;

}

if(LinearReg(FVEArray,LRPeriod,"AngleFC",LRC-1) < Sangle){

Condition5 = true;

}

if(!Strategy.isLong() && Condition1 && Condition2 && Condition3 && Condition4){

Strategy.doLong("BUY", Strategy.CLOSE, Strategy.THISBAR);

setPriceBarColor(Color.lime);

drawTextRelative(-1, 0, "Long", Color.black, Color.lime, Text.VCENTER | Text.BOLD | Text.PRESET, null, null, "buyTxt" + getValue("time"));

BarsSinceEntry = 0;

}

if(Condition5 && Strategy.isLong()){

Strategy.doSell("FVE EXIT", Strategy.CLOSE, Strategy.THISBAR);

setPriceBarColor(Color.red);

drawTextRelative(-1, 0, "Exit Long", Color.black, Color.red, Text.VCENTER | Text.BOLD | Text.PRESET, null, null, "buyTxt" + getValue("time"));

}

if(BarsSinceEntry == BarToExitOn && Strategy.isLong()){

Strategy.doSell("TimeBarsLX", Strategy.CLOSE, Strategy.THISBAR);

setPriceBarColor(Color.red);

drawTextRelative(-1, 0, "Exit Long", Color.black, Color.red, Text.VCENTER | Text.BOLD | Text.PRESET, null, null, "buyTxt" + getValue("time"));

}

return LinearReg(close(0,-LRC),LRC,"Slope",LRC-1);

}

else

return;

}

function StandardDev(Array, Length, Type){

var i;

var vSum = 0;

var SumSqr = 0;

var StdDev = 0;

for(i = 0; i < Length; i++)

vSum += Array[i];

if(Length != 0)

for(i = 0; i < Length; i++)

SumSqr += (Array[i] - vSum / Length) * (Array[i] - vSum / Length);

StdDev = Math.sqrt(SumSqr / Length);

return StdDev;

}

function LinearReg(Array, Length, Type, TargetB){

var i = 0, num1 = 0, num2 = 0, SumBars = 0, SumSqrBars = 0, SumY = 0, Sum1 = 0, Sum2 = 0, Slope = 0, Intercept = 0;

if(Length == 0)

return 0;

SumBars = Length * (Length - 1) * .5;

SumSqrBars = (Length - 1) * Length * (2 * Length - 1) / 6;

Sum1 = 0;

for(i = 0; i < Length; i++){

Sum1 += i * Array[i];

SumY += Array[i];

}

Sum2 = SumBars * SumY;

Num1 = Length * Sum1 - Sum2;

Num2 = SumBars * SumBars - Length * SumSqrBars;

if(Num2 != 0)

Slope = Num1 / Num2;

else

Slope = 0;

if(Type == "AngleFC")

return Math.atan(Slope);

else if(Type == "Slope")

return Slope;

else if(Type == "Value"){

Intercept = (SumY - Slope * SumBars) / Length;

return Intercept + Slope * (Length - 1 - TargetB);

}

}