Description:

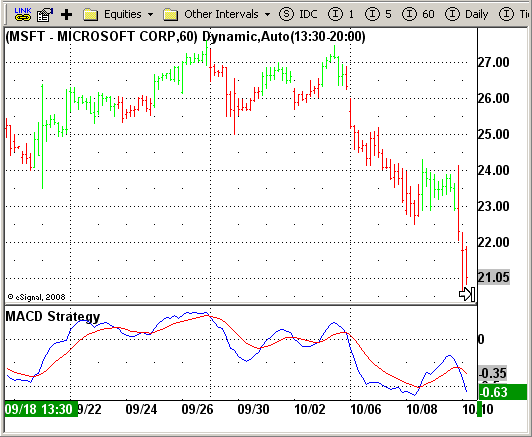

MACD Crossover

Formula Parameters:

Notes:

MACD Ö Moving Average Convergence Divergence. The MACD is calculated

by subtracting a 26-day moving average of a security's price from a

12-day moving average of its price. The result is an indicator that

oscillates above and below zero. When the MACD is above zero, it means

the 12-day moving average is higher than the 26-day moving average.

This is bullish as it shows that current expectations (i.e., the 12-day

moving average) are more bullish than previous expectations (i.e., the

26-day average). This implies a bullish, or upward, shift in the supply/demand

lines. When the MACD falls below zero, it means that the 12-day moving average

is less than the 26-day moving average, implying a bearish shift in the

supply/demand lines.

A 9-day moving average of the MACD (not of the security's price) is usually

plotted on top of the MACD indicator. This line is referred to as the "signal"

line. The signal line anticipates the convergence of the two moving averages

(i.e., the movement of the MACD toward the zero line).

Let's consider the rational behind this technique. The MACD is the difference

between two moving averages of price. When the shorter-term moving average rises

above the longer-term moving average (i.e., the MACD rises above zero), it means

that investor expectations are becoming more bullish (i.e., there has been an

upward shift in the supply/demand lines). By plotting a 9-day moving average of

the MACD, we can see the changing of expectations (i.e., the shifting of the

supply/demand lines) as they occur.

Download File:

MACDStrategy.efs

EFS Code:

PHP Code:

/*********************************

Provided By:

eSignal (Copyright c eSignal), a division of Interactive Data

Corporation. 2008. All rights reserved. This sample eSignal

Formula Script (EFS) is for educational purposes only and may be

modified and saved under a new file name. eSignal is not responsible

for the functionality once modified. eSignal reserves the right

to modify and overwrite this EFS file with each new release.

Description:

MACD Crossover

Version: 1.0 10/15/2008

Notes:

MACD Ö Moving Average Convergence Divergence. The MACD is calculated

by subtracting a 26-day moving average of a security's price from a

12-day moving average of its price. The result is an indicator that

oscillates above and below zero. When the MACD is above zero, it means

the 12-day moving average is higher than the 26-day moving average.

This is bullish as it shows that current expectations (i.e., the 12-day

moving average) are more bullish than previous expectations (i.e., the

26-day average). This implies a bullish, or upward, shift in the supply/demand

lines. When the MACD falls below zero, it means that the 12-day moving average

is less than the 26-day moving average, implying a bearish shift in the

supply/demand lines.

A 9-day moving average of the MACD (not of the security's price) is usually

plotted on top of the MACD indicator. This line is referred to as the "signal"

line. The signal line anticipates the convergence of the two moving averages

(i.e., the movement of the MACD toward the zero line).

Let's consider the rational behind this technique. The MACD is the difference

between two moving averages of price. When the shorter-term moving average rises

above the longer-term moving average (i.e., the MACD rises above zero), it means

that investor expectations are becoming more bullish (i.e., there has been an

upward shift in the supply/demand lines). By plotting a 9-day moving average of

the MACD, we can see the changing of expectations (i.e., the shifting of the

supply/demand lines) as they occur.

Formula Parameters: Default:

**********************************/

var bInit = false;

function preMain() {

setPriceStudy(false);

setColorPriceBars(true);

setDefaultPriceBarColor(Color.grey);

setStudyTitle("MACD Strategy");

setCursorLabelName("MACD", 0);

setCursorLabelName("SIGNAL", 1);

setDefaultBarFgColor(Color.blue, 0);

setDefaultBarFgColor(Color.red, 1);

}

var xMACD = null;

var xSignal = null;

function main() {

if (bInit == false) {

xMACD = macd(8, 16, 11);

xSignal = macdSignal(8, 16, 11);

bInit = true;

}

if (getCurrentBarCount() < 16) return;

if (getCurrentBarIndex() == 0) return;

if(xSignal.getValue(0) < xMACD.getValue(0) && !Strategy.isLong()) {

Strategy.doLong("Long", Strategy.CLOSE , Strategy.NEXTBAR);

}

if(xSignal.getValue(0) > xMACD.getValue(0) && !Strategy.isShort()) {

Strategy.doShort("Short", Strategy.CLOSE , Strategy.NEXTBAR);

}

if(Strategy.isLong())

setPriceBarColor(Color.lime);

else if(Strategy.isShort())

setPriceBarColor(Color.red);

return new Array(xMACD.getValue(0), xSignal.getValue(0));

}