File Name: strStochCrsvr.efs

Description:

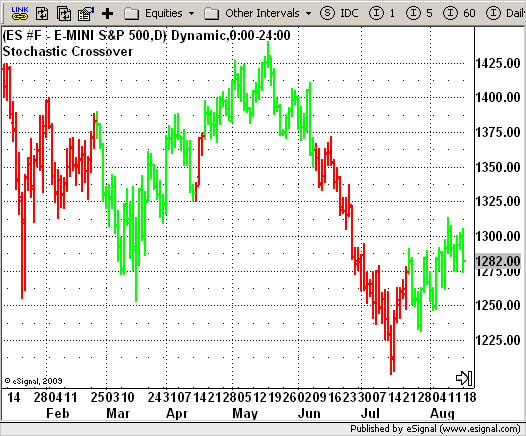

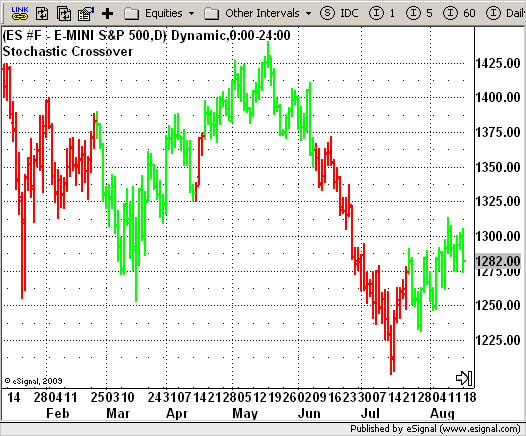

Stochastic Crossover

Formula Parameters:

nLength : 7

nSmoothing : 1

nDLength : 3

Overbought : 80

Oversold : 20

Notes:

This back testing strategy generates a long trade at the Open of the following

bar when the %K line crosses below the %D line and both are above the Overbought level.

It generates a short trade at the Open of the following bar when the %K line

crosses above the %D line and both values are below the Oversold level.

Download File:

strStochCrsvr.efs

EFS Code:

Description:

Stochastic Crossover

Formula Parameters:

nLength : 7

nSmoothing : 1

nDLength : 3

Overbought : 80

Oversold : 20

Notes:

This back testing strategy generates a long trade at the Open of the following

bar when the %K line crosses below the %D line and both are above the Overbought level.

It generates a short trade at the Open of the following bar when the %K line

crosses above the %D line and both values are below the Oversold level.

Download File:

strStochCrsvr.efs

EFS Code:

PHP Code:

/*********************************

Provided By:

eSignal (Copyright c eSignal), a division of Interactive Data

Corporation. 2009. All rights reserved. This sample eSignal

Formula Script (EFS) is for educational purposes only and may be

modified and saved under a new file name. eSignal is not responsible

for the functionality once modified. eSignal reserves the right

to modify and overwrite this EFS file with each new release.

Description:

Stochastic Crossover

Version: 1.0 05/12/2009

Formula Parameters: Default:

nLength 7

nSmoothing 1

nDLength 3

Overbought 80

Oversold 20

Notes:

This back testing strategy generates a long trade at the Open of the following

bar when the %K line crosses below the %D line and both are above the Overbought level.

It generates a short trade at the Open of the following bar when the %K line

crosses above the %D line and both values are below the Oversold level.

**********************************/

var fpArray = new Array();

var bInit = false;

function preMain() {

setPriceStudy(true);

setColorPriceBars(true);

setStudyTitle("Stochastic Crossover");

setDefaultPriceBarColor(Color.black);

var x = 0;

fpArray[x] = new FunctionParameter("nLength", FunctionParameter.NUMBER);

with(fpArray[x++]) {

setLowerLimit(1);

setDefault(7);

}

fpArray[x] = new FunctionParameter("nSmoothing", FunctionParameter.NUMBER);

with(fpArray[x++]) {

setLowerLimit(1);

setDefault(1);

}

fpArray[x] = new FunctionParameter("nDLength", FunctionParameter.NUMBER);

with(fpArray[x++]) {

setLowerLimit(1);

setDefault(3);

}

fpArray[x] = new FunctionParameter("Oversold", FunctionParameter.NUMBER);

with(fpArray[x++]) {

setLowerLimit(1);

setDefault(20);

}

fpArray[x] = new FunctionParameter("Overbought", FunctionParameter.NUMBER);

with(fpArray[x++]) {

setLowerLimit(1);

setDefault(80);

}

}

var xStochK = null;

var xStochD = null;

function main(nLength, nSmoothing, nDLength, Oversold, Overbought) {

var nBarState = getBarState();

if (nBarState == BARSTATE_ALLBARS) {

if (nLength == null) nLength = 7;

if (nSmoothing == null) nSmoothing = 1;

if (nDLength == null) nDLength = 3;

if (Overbought == null) Overbought = 80;

if (Oversold == null) Oversold = 20;

}

if (bInit == false) {

xStochK = stochK(nLength, nSmoothing, nDLength);

xStochD = stochD(nLength, nSmoothing, nDLength);

bInit = true;

}

if(getCurrentBarIndex() == 0) return;

var vFast = xStochK.getValue(0);

var vSlow = xStochD.getValue(0);

if(vFast == null || vSlow == null) return;

if(vFast < vSlow && vFast > Overbought && vSlow > Overbought && !Strategy.isLong())

Strategy.doLong("Long", Strategy.MARKET, Strategy.NEXTBAR);

if(vFast >= vSlow && vFast < Oversold && vSlow < Oversold && !Strategy.isShort())

Strategy.doShort("Short", Strategy.MARKET, Strategy.NEXTBAR);

if(Strategy.isLong())

setPriceBarColor(Color.lime);

else if(Strategy.isShort())

setPriceBarColor(Color.red);

return;

}