File Name: DTI.efs

Description:

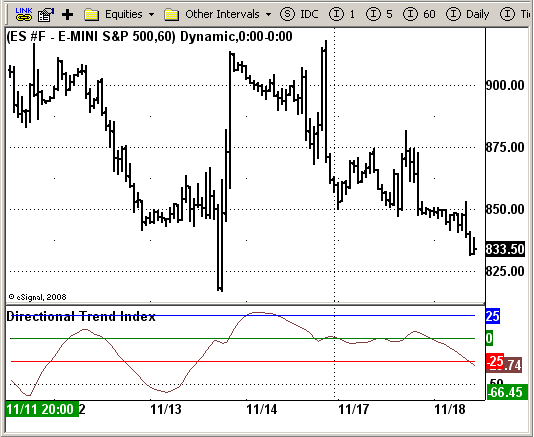

Directional Trend Index (DTI)

Formula Parameters:

r: 14

s: 10

u: 5

OB: 25

OS: -25

Notes:

This technique was described by William Blau in his book "Momentum,

Direction and Divergence" (1995). His book focuses on three key aspects

of trading: momentum, direction and divergence. Blau, who was an electrical

engineer before becoming a trader, thoroughly examines the relationship between

price and momentum in step-by-step examples. From this grounding, he then looks

at the deficiencies in other oscillators and introduces some innovative techniques,

including a fresh twist on Stochastics. On directional issues, he analyzes the

intricacies of ADX and offers a unique approach to help define trending and

non-trending periods.

Directional Trend Index is an indicator similar to DM+ developed by Welles Wilder.

The DM+ (a part of Directional Movement System which includes both DM+ and

DM- indicators) indicator helps determine if a security is "trending." William

Blau added to it a zeroline, relative to which the indicator is deemed positive or

negative. A stable uptrend is a period when the DTI value is positive and rising, a

downtrend when it is negative and falling.

Download File:

DTI.efs

EFS Code:

Description:

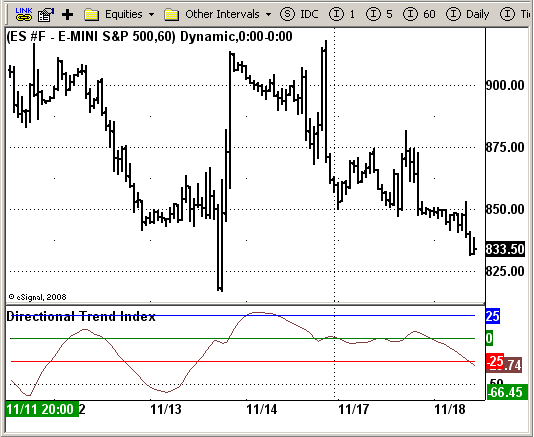

Directional Trend Index (DTI)

Formula Parameters:

r: 14

s: 10

u: 5

OB: 25

OS: -25

Notes:

This technique was described by William Blau in his book "Momentum,

Direction and Divergence" (1995). His book focuses on three key aspects

of trading: momentum, direction and divergence. Blau, who was an electrical

engineer before becoming a trader, thoroughly examines the relationship between

price and momentum in step-by-step examples. From this grounding, he then looks

at the deficiencies in other oscillators and introduces some innovative techniques,

including a fresh twist on Stochastics. On directional issues, he analyzes the

intricacies of ADX and offers a unique approach to help define trending and

non-trending periods.

Directional Trend Index is an indicator similar to DM+ developed by Welles Wilder.

The DM+ (a part of Directional Movement System which includes both DM+ and

DM- indicators) indicator helps determine if a security is "trending." William

Blau added to it a zeroline, relative to which the indicator is deemed positive or

negative. A stable uptrend is a period when the DTI value is positive and rising, a

downtrend when it is negative and falling.

Download File:

DTI.efs

EFS Code:

PHP Code:

/*********************************

Provided By:

eSignal (Copyright c eSignal), a division of Interactive Data

Corporation. 2008. All rights reserved. This sample eSignal

Formula Script (EFS) is for educational purposes only and may be

modified and saved under a new file name. eSignal is not responsible

for the functionality once modified. eSignal reserves the right

to modify and overwrite this EFS file with each new release.

Description:

Directional Trend Index (DTI)

Version: 1.0 09/26/2008

Formula Parameters: Default:

r 14

s 10

u 5

OB 25

OS -25

Notes:

This technique was described by William Blau in his book "Momentum,

Direction and Divergence" (1995). His book focuses on three key aspects

of trading: momentum, direction and divergence. Blau, who was an electrical

engineer before becoming a trader, thoroughly examines the relationship between

price and momentum in step-by-step examples. From this grounding, he then looks

at the deficiencies in other oscillators and introduces some innovative techniques,

including a fresh twist on Stochastics. On directional issues, he analyzes the

intricacies of ADX and offers a unique approach to help define trending and

non-trending periods.

Directional Trend Index is an indicator similar to DM+ developed by Welles Wilder.

The DM+ (a part of Directional Movement System which includes both DM+ and

DM- indicators) indicator helps determine if a security is "trending." William

Blau added to it a zeroline, relative to which the indicator is deemed positive or

negative. A stable uptrend is a period when the DTI value is positive and rising, a

downtrend when it is negative and falling.

**********************************/

var fpArray = new Array();

var bInit = false;

function preMain() {

setPriceStudy(false);

setStudyTitle("Directional Trend Index");

setCursorLabelName("DTI", 0);

setCursorLabelName("OB", 1);

setCursorLabelName("OS", 2);

setCursorLabelName("ZeroLine", 3);

setDefaultBarFgColor(Color.brown, 0);

setDefaultBarFgColor(Color.blue, 1);

setDefaultBarFgColor(Color.red, 2);

setDefaultBarFgColor(Color.green, 3);

var x=0;

fpArray[x] = new FunctionParameter("r", FunctionParameter.NUMBER);

with(fpArray[x++]){

setLowerLimit(1);

setDefault(14);

}

fpArray[x] = new FunctionParameter("s", FunctionParameter.NUMBER);

with(fpArray[x++]){

setLowerLimit(1);

setDefault(10);

}

fpArray[x] = new FunctionParameter("u", FunctionParameter.NUMBER);

with(fpArray[x++]){

setLowerLimit(1);

setDefault(5);

}

fpArray[x] = new FunctionParameter("OB", FunctionParameter.NUMBER);

with(fpArray[x++]){

setDefault(25);

}

fpArray[x] = new FunctionParameter("OS", FunctionParameter.NUMBER);

with(fpArray[x++]){

setDefault(-25);

}

}

var xHMU = null;

var xLMD = null;

var xPrice = null;

var xPriceAbs = null;

var xuXA = null;

var xuXAAbs = null;

function main(r, s, u, OB, OS) {

if ( bInit == false ) {

xHMU = efsInternal("Calc_HMU");

xLMD = efsInternal("Calc_LMD");

xPrice = efsInternal("Calc_Price", xHMU, xLMD);

xPriceAbs = efsInternal("Calc_PriceAbs", xPrice);

xuXA = ema(u, ema(s, ema(r, xPrice)));

xuXAAbs = ema(u, ema(s, ema(r, xPriceAbs)));

bInit = true;

}

if (getCurrentBarCount() < Math.max(Math.max(r, s), u)) return;

var Val1 = 100 * xuXA.getValue(0);

var Val2 = xuXAAbs.getValue(0);

var DTI = 0;

if (Val2 != 0) DTI = Val1 / Val2;

else DTI = 0;

return new Array(DTI, OB, OS, 0);

}

function Calc_PriceAbs(xPrice) {

var nRes = 0;

nRes = Math.abs(xPrice.getValue(0));

if (nRes == null) nRes = 1;

return nRes;

}

function Calc_Price(xHMU, xLMD) {

var nRes = 0;

nRes = xHMU.getValue(0) - xLMD.getValue(0);

if (nRes == null) nRes = 1;

return nRes;

}

function Calc_HMU() {

var nRes = 0;

if ((high(0) - high(-1)) > 0)

{

nRes = high(0) - high(-1);

}

else nRes = 0;

if (nRes == null) nRes = 1;

return nRes;

}

function Calc_LMD() {

var nRes = 0;

if ((low(0) - low(-1)) < 0)

{

nRes = -(low(0) - low(-1));

}

else nRes = 0;

return nRes;

}