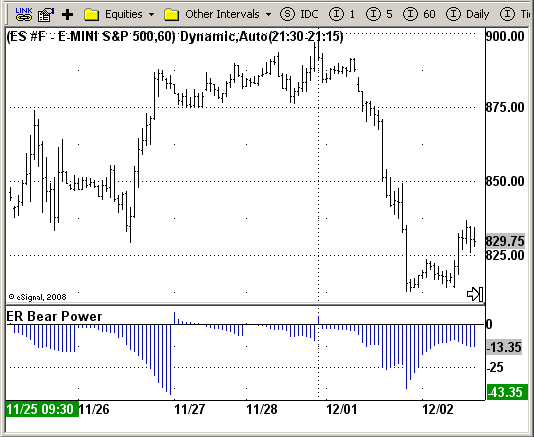

File Name: ERBearPower.efs

Description:

Elder Ray (Bear Power)

Formula Parameters:

Length : 13

Price : Close

Notes:

Developed by Dr Alexander Elder, the Elder-ray indicator measures buying

and selling pressure in the market. The Elder-ray is often used as part

of the Triple Screen trading system but may also be used on its own.

Dr Elder uses a 13-day exponential moving average (EMA) to indicate the

market consensus of value. Bear Power measures the ability of sellers to

drive prices below the consensus of value. Bear Power reflects the ability

of sellers to drive prices below the average consensus of value.

Bull Power is calculated by subtracting the 13-day EMA from the day's High.

Bear power subtracts the 13-day EMA from the day's Low.

Download File:

ERBearPower.efs

EFS Code:

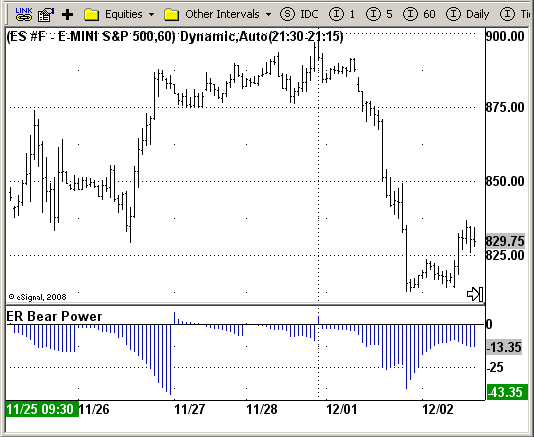

Description:

Elder Ray (Bear Power)

Formula Parameters:

Length : 13

Price : Close

Notes:

Developed by Dr Alexander Elder, the Elder-ray indicator measures buying

and selling pressure in the market. The Elder-ray is often used as part

of the Triple Screen trading system but may also be used on its own.

Dr Elder uses a 13-day exponential moving average (EMA) to indicate the

market consensus of value. Bear Power measures the ability of sellers to

drive prices below the consensus of value. Bear Power reflects the ability

of sellers to drive prices below the average consensus of value.

Bull Power is calculated by subtracting the 13-day EMA from the day's High.

Bear power subtracts the 13-day EMA from the day's Low.

Download File:

ERBearPower.efs

EFS Code:

PHP Code:

/*********************************

Provided By:

eSignal (Copyright c eSignal), a division of Interactive Data

Corporation. 2008. All rights reserved. This sample eSignal

Formula Script (EFS) is for educational purposes only and may be

modified and saved under a new file name. eSignal is not responsible

for the functionality once modified. eSignal reserves the right

to modify and overwrite this EFS file with each new release.

Description:

Elder Ray (Bear Power)

Version: 1.0 12/03/2008

Formula Parameters: Default:

Length 13

Price Close

Notes:

Developed by Dr Alexander Elder, the Elder-ray indicator measures buying

and selling pressure in the market. The Elder-ray is often used as part

of the Triple Screen trading system but may also be used on its own.

Dr Elder uses a 13-day exponential moving average (EMA) to indicate the

market consensus of value. Bear Power measures the ability of sellers to

drive prices below the consensus of value. Bear Power reflects the ability

of sellers to drive prices below the average consensus of value.

Bull Power is calculated by subtracting the 13-day EMA from the day's High.

Bear power subtracts the 13-day EMA from the day's Low.

**********************************/

var fpArray = new Array();

var bInit = false;

function preMain() {

setPriceStudy(false);

setStudyTitle("ER Bear Power");

setCursorLabelName("ER Bear Power");

setPlotType(PLOTTYPE_HISTOGRAM);

addBand(0, PS_SOLID, 1, Color.black);

var x=0;

fpArray[x] = new FunctionParameter("Length", FunctionParameter.NUMBER);

with(fpArray[x++]){

setLowerLimit(1);

setDefault(13);

}

fpArray[x] = new FunctionParameter("Price", FunctionParameter.STRING);

with(fpArray[x++]){

addOption("open");

addOption("high");

addOption("low");

addOption("close");

addOption("hl2");

addOption("hlc3");

addOption("ohlc4");

setDefault("close");

}

}

var DayLow = null;

var DayLow_1 = null;

var xPrice = null;

var xMA = null;

function main(Price, Length) {

var nState = getBarState();

if (nState == BARSTATE_ALLBARS) {

if (Price == null) Price = "close";

if (Length == null) Length = 13;

}

if ( bInit == false ) {

xPrice = eval(Price)();

xMA = ema(Length, xPrice);

bInit = true;

}

if(getBarState()==BARSTATE_NEWBAR) DayLow_1 = DayLow;

if (day(0) != day(-1)) {

DayLow = low(0);

}else{

DayLow = Math.min(low(0), DayLow_1)

}

return DayLow - xMA.getValue(0);

}