File Name: HistVolatility.efs

Description:

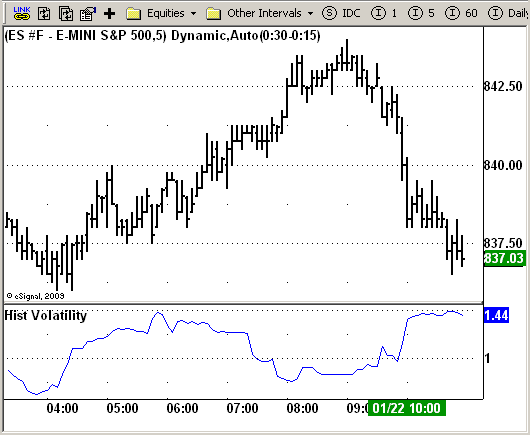

Historical Volatility

Formula Parameters:

LookBack : 20

Annual : 365

Notes:

Markets oscillate from periods of low volatility to high volatility

and back. The author`s research indicates that after periods of

extremely low volatility, volatility tends to increase and price

may move sharply. This increase in volatility tends to correlate

with the beginning of short- to intermediate-term moves in price.

They have found that we can identify which markets are about to make

such a move by measuring the historical volatility and the application

of pattern recognition.

The indicator is calculating as the standard deviation of day-to-day

logarithmic closing price changes expressed as an annualized percentage.

Download File:

HistVolatility.efs

EFS Code:

Description:

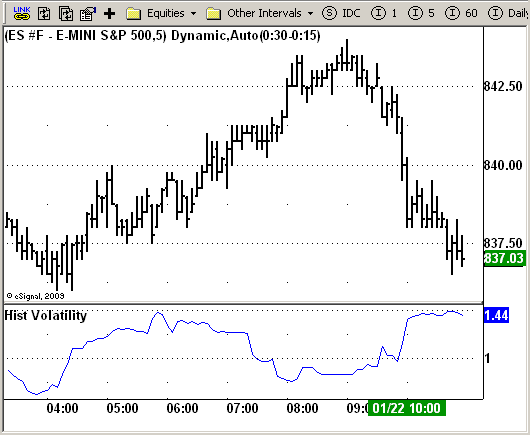

Historical Volatility

Formula Parameters:

LookBack : 20

Annual : 365

Notes:

Markets oscillate from periods of low volatility to high volatility

and back. The author`s research indicates that after periods of

extremely low volatility, volatility tends to increase and price

may move sharply. This increase in volatility tends to correlate

with the beginning of short- to intermediate-term moves in price.

They have found that we can identify which markets are about to make

such a move by measuring the historical volatility and the application

of pattern recognition.

The indicator is calculating as the standard deviation of day-to-day

logarithmic closing price changes expressed as an annualized percentage.

Download File:

HistVolatility.efs

EFS Code:

PHP Code:

/*********************************

Provided By:

eSignal (Copyright c eSignal), a division of Interactive Data

Corporation. 2008. All rights reserved. This sample eSignal

Formula Script (EFS) is for educational purposes only and may be

modified and saved under a new file name. eSignal is not responsible

for the functionality once modified. eSignal reserves the right

to modify and overwrite this EFS file with each new release.

Description:

Hist Volatility

Version: 1.0 01/19/2009

Formula Parameters: Default:

LookBack 20

Annual 365

Notes:

Markets oscillate from periods of low volatility to high volatility

and back. The author`s research indicates that after periods of

extremely low volatility, volatility tends to increase and price

may move sharply. This increase in volatility tends to correlate

with the beginning of short- to intermediate-term moves in price.

They have found that we can identify which markets are about to make

such a move by measuring the historical volatility and the application

of pattern recognition.

The indicator is calculating as the standard deviation of day-to-day

logarithmic closing price changes expressed as an annualized percentage.

**********************************/

var fpArray = new Array();

var bInit = false;

function preMain() {

setPriceStudy(false);

setStudyTitle("Hist Volatility");

setCursorLabelName("HisVol");

var x=0;

fpArray[x] = new FunctionParameter("LookBack", FunctionParameter.NUMBER);

with(fpArray[x++]){

setLowerLimit(1);

setDefault(20);

}

fpArray[x] = new FunctionParameter("Annual", FunctionParameter.NUMBER);

with(fpArray[x++]){

setLowerLimit(1);

setDefault(365);

}

}

var xPrice1 = null;

var xPrice1Avg = null;

var xStdDev = null;

function main(LookBack, Annual) {

var nState = getBarState();

var nPer = 0;

if(isIntraday() || isDaily()) nPer = 1;

if (nPer == 0) nPer = 7;

if (nState == BARSTATE_ALLBARS) {

if (LookBack == null) LookBack = 20;

if (Annual == null) Annual = 365;

}

if ( bInit == false ) {

xPrice1 = efsInternal("Calc_Price1");

xPrice1Avg = sma(LookBack, xPrice1);

xStdDev = efsInternal("Calc_StdDev", LookBack, xPrice1Avg, xPrice1);

bInit = true;

}

if (getCurrentBarCount() < LookBack + 1) return;

var nAvg = xPrice1Avg.getValue(0);

var HVol = (xStdDev.getValue(0) * Math.sqrt(Annual / nPer)) * 100;

return HVol;

}

function Calc_Price1() {

var nRes = 0;

if (close(-1) == null) return;

nRes = Math.log(close(0) / close(-1));

if (nRes == null) nRes = 1;

return nRes;

}

function Calc_StdDev(LookBack, xPrice1Avg, xPrice1) {

var nRes = 0;

if (xPrice1Avg.getValue(0) == null) return;

for (var i = 0; i < LookBack; i++) {

nRes += (xPrice1.getValue(-i) - xPrice1Avg.getValue(0)) * (xPrice1.getValue(-i) - xPrice1Avg.getValue(0));

}

nRes = Math.sqrt(nRes / LookBack);

if (nRes == null) nRes = 1;

return nRes;

}