File Name: Z_Score.efs

Description:

Z-Score

Formula Parameters:

Period : 20

Notes:

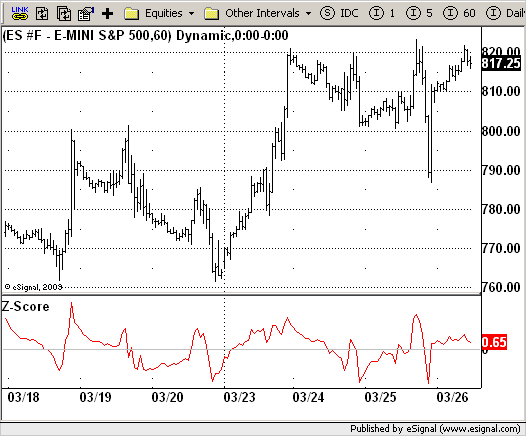

The author of this indicator is Veronique Valcu. The z-score (z) for a data

item x measures the distance (in standard deviations StdDev) and direction

of the item from its mean (U):

z = (x-StdDev) / U

A value of zero indicates that the data item x is equal to the mean U, while

positive or negative values show that the data item is above (x>U) or below

(x Values of +2 and -2 show that the data item is two standard deviations

above or below the chosen mean, respectively, and over 95.5% of all data

items are contained within these two horizontal references (see Figure 1).

We substitute x with the closing price C, the mean U with simple moving

average (SMA) of n periods (n), and StdDev with the standard deviation of

closing prices for n periods, the above formula becomes:

Z_score = (C - SMA(n)) / StdDev(C,n)

The z-score indicator is not new, but its use can be seen as a supplement to

Bollinger bands. It offers a simple way to assess the position of the price

vis-a-vis its resistance and support levels expressed by the Bollinger Bands.

In addition, crossings of z-score averages may signal the start or the end of

a tradable trend. Traders may take a step further and look for stronger signals

by identifying common crossing points of z-score, its average, and average of average.

Download File:

Z_Score.efs

EFS Code:

Description:

Z-Score

Formula Parameters:

Period : 20

Notes:

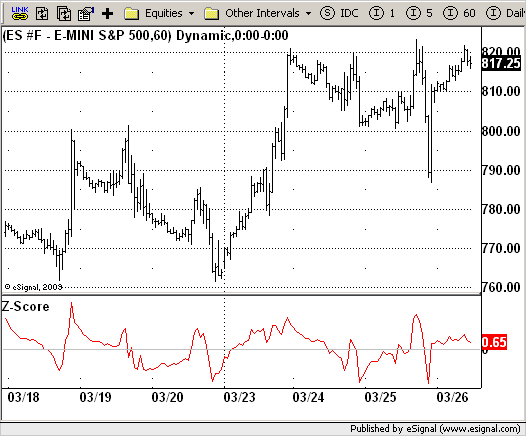

The author of this indicator is Veronique Valcu. The z-score (z) for a data

item x measures the distance (in standard deviations StdDev) and direction

of the item from its mean (U):

z = (x-StdDev) / U

A value of zero indicates that the data item x is equal to the mean U, while

positive or negative values show that the data item is above (x>U) or below

(x Values of +2 and -2 show that the data item is two standard deviations

above or below the chosen mean, respectively, and over 95.5% of all data

items are contained within these two horizontal references (see Figure 1).

We substitute x with the closing price C, the mean U with simple moving

average (SMA) of n periods (n), and StdDev with the standard deviation of

closing prices for n periods, the above formula becomes:

Z_score = (C - SMA(n)) / StdDev(C,n)

The z-score indicator is not new, but its use can be seen as a supplement to

Bollinger bands. It offers a simple way to assess the position of the price

vis-a-vis its resistance and support levels expressed by the Bollinger Bands.

In addition, crossings of z-score averages may signal the start or the end of

a tradable trend. Traders may take a step further and look for stronger signals

by identifying common crossing points of z-score, its average, and average of average.

Download File:

Z_Score.efs

EFS Code:

PHP Code:

/*********************************

Provided By:

eSignal (Copyright c eSignal), a division of Interactive Data

Corporation. 2009. All rights reserved. This sample eSignal

Formula Script (EFS) is for educational purposes only and may be

modified and saved under a new file name. eSignal is not responsible

for the functionality once modified. eSignal reserves the right

to modify and overwrite this EFS file with each new release.

Description:

Z-Score

Version: 1.0 03/24/2009

Formula Parameters: Default:

Period 20

Notes:

The author of this indicator is Veronique Valcu. The z-score (z) for a data

item x measures the distance (in standard deviations StdDev) and direction

of the item from its mean (U):

z = (x-StdDev) / U

A value of zero indicates that the data item x is equal to the mean U, while

positive or negative values show that the data item is above (x>U) or below

(x Values of +2 and -2 show that the data item is two standard deviations

above or below the chosen mean, respectively, and over 95.5% of all data

items are contained within these two horizontal references (see Figure 1).

We substitute x with the closing price C, the mean U with simple moving

average (SMA) of n periods (n), and StdDev with the standard deviation of

closing prices for n periods, the above formula becomes:

Z_score = (C - SMA(n)) / StdDev(C,n)

The z-score indicator is not new, but its use can be seen as a supplement to

Bollinger bands. It offers a simple way to assess the position of the price

vis-a-vis its resistance and support levels expressed by the Bollinger Bands.

In addition, crossings of z-score averages may signal the start or the end of

a tradable trend. Traders may take a step further and look for stronger signals

by identifying common crossing points of z-score, its average, and average of average.

**********************************/

var fpArray = new Array();

var bInit = false;

function preMain() {

setStudyTitle("Z-Score");

setCursorLabelName("Z-Score", 0);

setDefaultBarFgColor(Color.red, 0);

addBand(0, PS_SOLID, 1, Color.lightgrey);

var x=0;

fpArray[x] = new FunctionParameter("Period", FunctionParameter.NUMBER);

with(fpArray[x++]){

setLowerLimit(1);

setDefault(20);

}

}

var xZ_Score = null;

function main(Period) {

var nBarState = getBarState();

var nZ_Score = 0;

if (nBarState == BARSTATE_ALLBARS) {

if(Period == null) Period = 20;

}

if (bInit == false) {

xZ_Score = efsInternal("Calc_Z_Score", Period, sma(Period), close());

bInit = true;

}

nZ_Score = xZ_Score.getValue(0);

if (nZ_Score == null) return;

return nZ_Score;

}

function Calc_Z_Score(Period, xMA, xClose) {

var nRes = 0;

var StdDev = 0;

var SumSqr = 0;

var counter = 0;

if(xMA.getValue(0) == null) return;

for(counter = 0; counter < Period; counter++)

SumSqr += Math.pow((xClose.getValue(-counter) - xMA.getValue(0)), 2);

StdDev = Math.sqrt(SumSqr / Period);

nRes = (xClose.getValue(0) - xMA.getValue(0)) / StdDev;

return nRes;

}