File Name: TimeSeriesForecast.efs

Description:

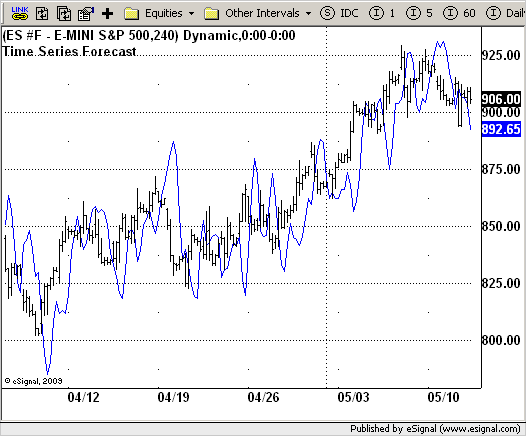

Time Series Forecast (TSF)

Formula Parameters:

nLength : 5

nBarPlus : 7

Notes:

This technical indicator is based on linear regression analysis.

The value of TSF for each bar is based on a regression analysis

of the preceding N bars. N is called the regression period in

the setup window for TSF. The user specifies a forecast period

F. F is used to derive a predicted (forecasted) price value F

periods in the future based on the slope of the regression line

for the preceding N periods.

Download File:

TimeSeriesForecast.efs

EFS Code:

Description:

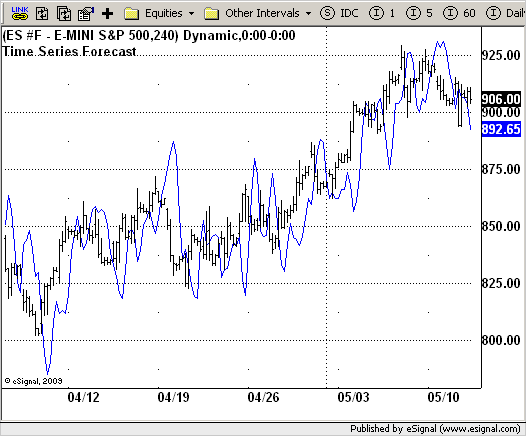

Time Series Forecast (TSF)

Formula Parameters:

nLength : 5

nBarPlus : 7

Notes:

This technical indicator is based on linear regression analysis.

The value of TSF for each bar is based on a regression analysis

of the preceding N bars. N is called the regression period in

the setup window for TSF. The user specifies a forecast period

F. F is used to derive a predicted (forecasted) price value F

periods in the future based on the slope of the regression line

for the preceding N periods.

Download File:

TimeSeriesForecast.efs

EFS Code:

PHP Code:

/*********************************

Provided By:

eSignal (Copyright c eSignal), a division of Interactive Data

Corporation. 2009. All rights reserved. This sample eSignal

Formula Script (EFS) is for educational purposes only and may be

modified and saved under a new file name. eSignal is not responsible

for the functionality once modified. eSignal reserves the right

to modify and overwrite this EFS file with each new release.

Description:

Time Series Forecast (TSF)

Version: 1.0 05/12/2009

Formula Parameters: Default:

nLength 5

nBarPlus 7

Notes:

This technical indicator is based on linear regression analysis.

The value of TSF for each bar is based on a regression analysis

of the preceding N bars. N is called the regression period in

the setup window for TSF. The user specifies a forecast period

F. F is used to derive a predicted (forecasted) price value F

periods in the future based on the slope of the regression line

for the preceding N periods.

**********************************/

var fpArray = new Array();

var bInit = false;

function preMain() {

setPriceStudy(true);

setStudyTitle("Time Series Forecast");

setCursorLabelName("TSF");

var x = 0;

fpArray[x] = new FunctionParameter("nLength", FunctionParameter.NUMBER);

with(fpArray[x++]) {

setLowerLimit(1);

setDefault(5);

}

fpArray[x] = new FunctionParameter("nBarPlus", FunctionParameter.NUMBER);

with(fpArray[x++]) {

setLowerLimit(1);

setDefault(7);

}

}

var xTimeSeriesForecast = null;

function main(nLength, nBarPlus) {

var nBarState = getBarState();

var nTimeSeriesForecast = 0;

if (nBarState == BARSTATE_ALLBARS) {

if (nLength == null) nLength = nLength;

if (nBarPlus == null) nLength = nBarPlus;

}

if (bInit == false) {

xTimeSeriesForecast = efsInternal("Calc_TSF", nLength, nBarPlus);

bInit = true;

}

nTimeSeriesForecast = xTimeSeriesForecast.getValue(0);

if (nTimeSeriesForecast == null) return;

return nTimeSeriesForecast;

}

var xClose = null;

var bSecondInit = false;

function Calc_TSF(nLength, nBarPlus) {

var SL = 0;

var TSF = 0;

var SumBars = nLength * (nLength - 1) * 0.5;

var SumSqrBars = (nLength - 1) * nLength * (2 * nLength - 1) / 6;

var Sum1 = 0;

var SumY = 0;

var i = 0;

var Slope = 0;

var Intercept = 0;

if (getCurrentBarCount() <= nLength) return;

if(bSecondInit == false){

xClose = close();

bSecondInit = true;

}

for (i = 0; i < nLength; i++) {

Sum1 += i * xClose.getValue(-i);

SumY += xClose.getValue(-i);

}

var Sum2 = SumBars * SumY;

var Num1 = nLength * Sum1 - Sum2;

var Num2 = SumBars * SumBars - nLength * SumSqrBars;

if (Num2 == 0) return;

Slope = Num1 / Num2;

SL = Num1 / Num2;

Intercept = (SumY - Slope * SumBars) / nLength;

TSF = Intercept + Slope * (nLength - 1 - nBarPlus);

return TSF;

}