File Name: TDI.efs

Description:

TDI (Trend Direction Index)

Formula Parameters:

Period : 12

Notes:

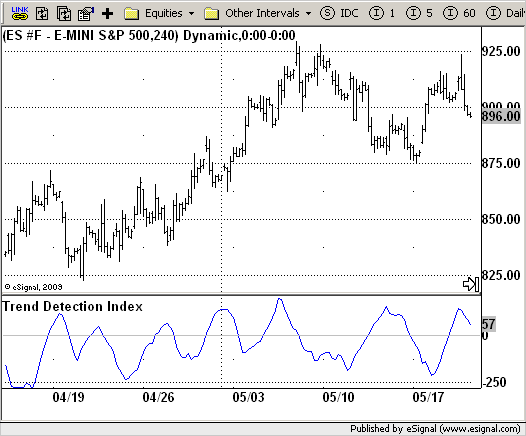

The Trend Detection Index (TDI) was introduced by M. H. Pee. TDI is used

to detect when a trend has begun and when it has come to an end. The TDI

can be used as a stand-alone indicator or combined with others; it will

perform well in detecting the beginning of trends. TDI should be used in

conjunction with protective stops as well as trailing stops. These stops

are required to protect against large losses when the indicator generates

a losing trade. The TDI can trade a diverse portfolio of markets profitably

over many years, using the same parameters throughout.

To calculate the 20-day trend detection index, first find the value of the

momentum indicator. After the market closes, calculate today's 20-day momentum

by subtracting the close 20 days ago from that of today. Next, find the 20-day

absolute momentum, which is defined as the absolute value of today's 20-day momentum.

More details can be found in the formula section above.

The trend detection index will signal a trend if it shows a positive value and a

consolidation if it shows a negative value. As a trend-follower, the position should

be entered in the direction of the trend when the TDI is positive. To determine the

current direction of the trend, the direction indicator can be used, which is defined

as the sum of the 20-day momentum of the last 20 days. An uptrend is signaled by a positive

direction indicator value, whereas a downtrend is signaled by a negative value. Basically,

it comes down to this: Enter long tomorrow at the open if both the TDI and direction indicator

are positive after today's close or enter short at the open if the TDI is positive and the

direction indicator is negative.

Download File:

TDI.efs

EFS Code:

Description:

TDI (Trend Direction Index)

Formula Parameters:

Period : 12

Notes:

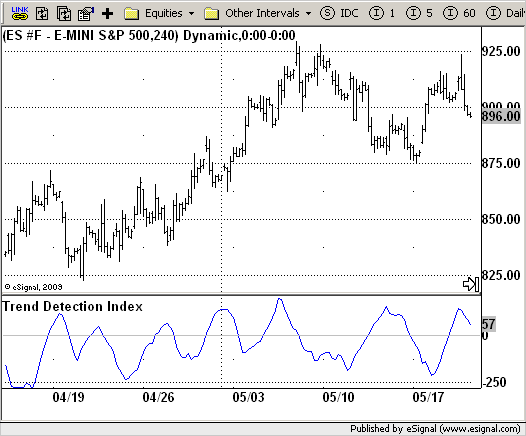

The Trend Detection Index (TDI) was introduced by M. H. Pee. TDI is used

to detect when a trend has begun and when it has come to an end. The TDI

can be used as a stand-alone indicator or combined with others; it will

perform well in detecting the beginning of trends. TDI should be used in

conjunction with protective stops as well as trailing stops. These stops

are required to protect against large losses when the indicator generates

a losing trade. The TDI can trade a diverse portfolio of markets profitably

over many years, using the same parameters throughout.

To calculate the 20-day trend detection index, first find the value of the

momentum indicator. After the market closes, calculate today's 20-day momentum

by subtracting the close 20 days ago from that of today. Next, find the 20-day

absolute momentum, which is defined as the absolute value of today's 20-day momentum.

More details can be found in the formula section above.

The trend detection index will signal a trend if it shows a positive value and a

consolidation if it shows a negative value. As a trend-follower, the position should

be entered in the direction of the trend when the TDI is positive. To determine the

current direction of the trend, the direction indicator can be used, which is defined

as the sum of the 20-day momentum of the last 20 days. An uptrend is signaled by a positive

direction indicator value, whereas a downtrend is signaled by a negative value. Basically,

it comes down to this: Enter long tomorrow at the open if both the TDI and direction indicator

are positive after today's close or enter short at the open if the TDI is positive and the

direction indicator is negative.

Download File:

TDI.efs

EFS Code:

PHP Code:

/*********************************

Provided By:

eSignal (Copyright c eSignal), a division of Interactive Data

Corporation. 2009. All rights reserved. This sample eSignal

Formula Script (EFS) is for educational purposes only and may be

modified and saved under a new file name. eSignal is not responsible

for the functionality once modified. eSignal reserves the right

to modify and overwrite this EFS file with each new release.

Description:

TDI (Trend Direction Index)

Version: 1.0 05/19/2009

Formula Parameters: Default:

Period 12

Notes:

The Trend Detection Index (TDI) was introduced by M. H. Pee. TDI is used

to detect when a trend has begun and when it has come to an end. The TDI

can be used as a stand-alone indicator or combined with others; it will

perform well in detecting the beginning of trends. TDI should be used in

conjunction with protective stops as well as trailing stops. These stops

are required to protect against large losses when the indicator generates

a losing trade. The TDI can trade a diverse portfolio of markets profitably

over many years, using the same parameters throughout.

To calculate the 20-day trend detection index, first find the value of the

momentum indicator. After the market closes, calculate today's 20-day momentum

by subtracting the close 20 days ago from that of today. Next, find the 20-day

absolute momentum, which is defined as the absolute value of today's 20-day momentum.

More details can be found in the formula section above.

The trend detection index will signal a trend if it shows a positive value and a

consolidation if it shows a negative value. As a trend-follower, the position should

be entered in the direction of the trend when the TDI is positive. To determine the

current direction of the trend, the direction indicator can be used, which is defined

as the sum of the 20-day momentum of the last 20 days. An uptrend is signaled by a positive

direction indicator value, whereas a downtrend is signaled by a negative value. Basically,

it comes down to this: Enter long tomorrow at the open if both the TDI and direction indicator

are positive after today's close or enter short at the open if the TDI is positive and the

direction indicator is negative.

**********************************/

var fpArray = new Array();

var bInit = false;

function preMain(){

setStudyTitle("Trend Detection Index");

setCursorLabelName("TDI",0);

setDefaultBarFgColor(Color.blue,0);

addBand(0, PS_SOLID, 1, Color.lightgrey);

var x = 0;

fpArray[x] = new FunctionParameter("Period", FunctionParameter.NUMBER);

with(fpArray[x++]) {

setLowerLimit(1);

setDefault(12);

}

}

var xTDI = null;

function main(Period) {

var nBarState = getBarState();

var nTDI = 0;

if (nBarState == BARSTATE_ALLBARS) {

if(Period == null) Period = 12;

}

if (bInit == false) {

xTDI = efsInternal("Calc_TDI", Period);

bInit = true;

}

nTDI = xTDI.getValue(0);

if (nTDI == null) return;

return nTDI;

}

var bSecondInit = false;

var xmom = null;

function Calc_TDI(Period) {

var nRes = 0;

var MomSum = 0;

var MomSumAbs = 0;

var MomAbsSum = 0;

var MomAbsSum2 = 0;

if (getCurrentBarCount() <= Period * 2) return;

if (bSecondInit == false) {

xmom = mom(Period);

bSecondInit = true;

}

for(i = Period * 2; i--; i >= 0) {

nRes = xmom.getValue(-i);

if (i < Period) {

MomSum += nRes;

MomAbsSum += Math.abs(nRes);

}

MomAbsSum2 += Math.abs(nRes);

}

MomSumAbs = Math.abs(MomSum);

nRes = MomSumAbs - (MomAbsSum2 - MomAbsSum);

return nRes;

}