File Name: TAI.efs

Description:

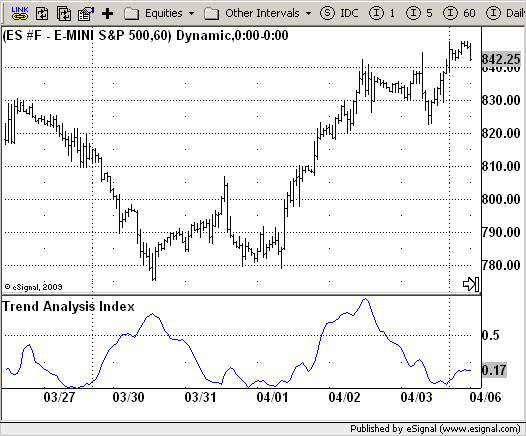

Trend Analysis Index (TAI)

Formula Parameters:

AvgLen : 28

TAILen : 5

Source of TAI : Close

Notes:

In essence, it is simply the standard deviation of the last x bars of a

y-bar moving average. Thus, the TAI is a simple trend indicator when prices

trend with authority, the slope of the moving average increases, and when

prices meander in a trendless range, the slope of the moving average decreases.

Download File:

TAI.efs

EFS Code:

Description:

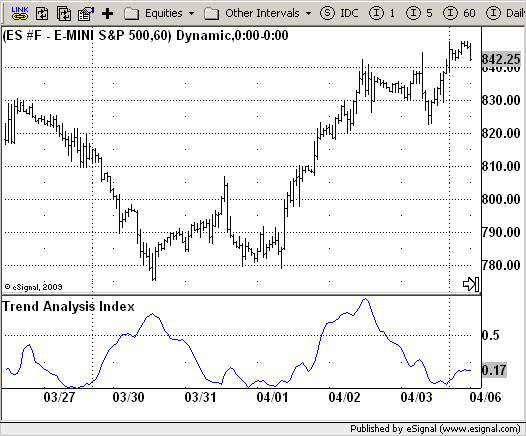

Trend Analysis Index (TAI)

Formula Parameters:

AvgLen : 28

TAILen : 5

Source of TAI : Close

Notes:

In essence, it is simply the standard deviation of the last x bars of a

y-bar moving average. Thus, the TAI is a simple trend indicator when prices

trend with authority, the slope of the moving average increases, and when

prices meander in a trendless range, the slope of the moving average decreases.

Download File:

TAI.efs

EFS Code:

PHP Code:

/*********************************

Provided By:

eSignal (Copyright c eSignal), a division of Interactive Data

Corporation. 2009. All rights reserved. This sample eSignal

Formula Script (EFS) is for educational purposes only and may be

modified and saved under a new file name. eSignal is not responsible

for the functionality once modified. eSignal reserves the right

to modify and overwrite this EFS file with each new release.

Description:

Trend Analysis Index

Version: 1.0 05/20/2009

Formula Parameters: Default:

AvgLen 28

TAILen 5

Source of TAI Close

Notes:

In essence, it is simply the standard deviation of the last x bars of a

y-bar moving average. Thus, the TAI is a simple trend indicator when prices

trend with authority, the slope of the moving average increases, and when

prices meander in a trendless range, the slope of the moving average decreases.

**********************************/

var fpArray = new Array();

var bInit = false;

function preMain() {

setPriceStudy(false);

setStudyTitle("Trend Analysis Index");

setCursorLabelName("TAI");

var x = 0;

fpArray[x] = new FunctionParameter("AvgLen", FunctionParameter.NUMBER);

with(fpArray[x++]) {

setLowerLimit(1);

setDefault(28);

}

fpArray[x] = new FunctionParameter("TAILen", FunctionParameter.NUMBER);

with(fpArray[x++]) {

setLowerLimit(1);

setDefault(5);

}

fpArray[x] = new FunctionParameter("sPrice", FunctionParameter.STRING);

with(fpArray[x++]){

setName("Source of TAI");

addOption("open");

addOption("high");

addOption("low");

addOption("close");

addOption("hl2");

addOption("hlc3");

addOption("ohlc4");

setDefault("close");

}

}

var xTAI = null;

function main(sPrice, AvgLen, TAILen) {

var nBarState = getBarState();

var nTAI = 0;

if (nBarState == BARSTATE_ALLBARS) {

if (sPrice == null) sPrice = "close";

if (AvgLen == null) AvgLen = 28;

if (TAILen == null) TAILen = 5;

}

if (bInit == false) {

xTAI = efsInternal("Calc_TAI", sPrice, AvgLen, TAILen);

bInit = true;

}

nTAI = xTAI.getValue(0);

if (nTAI == null) return;

return nTAI;

}

var bSecondInit = false;

var xSMA = null;

var xHH = null;

var xLL = null;

var xPrice = null;

function Calc_TAI(sPrice, AvgLen, TAILen) {

var nRes = 0;

if (bSecondInit == false) {

xPrice = eval(sPrice)();

xSMA = sma(AvgLen, xPrice);

xHH = upperDonchian(TAILen, xSMA);

xLL = lowerDonchian(TAILen, xSMA);

bSecondInit = true;

}

if (xHH.getValue(0) == null) return;

nRes = (xHH.getValue(0) - xLL.getValue(0)) * 100 / xPrice.getValue(0);

return nRes;

}