File Name: ECO.efs

Description:

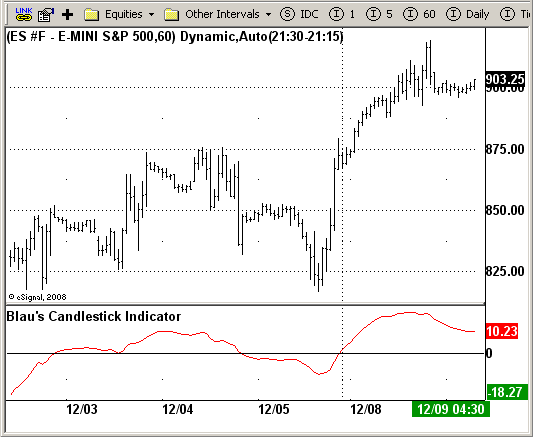

ECO (Blau`s Ergodic Candlestick Oscillator)

Formula Parameters:

Number To Calculate EMA: 32

Number To Calculate vEMA : 12

Notes:

We call this one the ECO for short, but it will be listed on the indicator list

at W. Blau╥s Ergodic Candlestick Oscillator. The ECO is a momentum indicator.

It is based on candlestick bars, and takes into account the size and direction

of the candlestick "body". We have found it to be a very good momentum indicator,

and especially smooth, because it is unaffected by gaps in price, unlike many other

momentum indicators.

We like to use this indicator as an additional trend confirmation tool, or as an

alternate trend definition tool, in place of a weekly indicator. The simplest way

of using the indicator is simply to define the trend based on which side of the "0"

line the indicator is located on. If the indicator is above "0", then the trend is up.

If the indicator is below "0" then the trend is down. You can add an additional

qualifier by noting the "slope" of the indicator, and the crossing points of the slow

and fast lines. Some like to use the slope alone to define trend direction. If the

lines are sloping upward, the trend is up. Alternately, if the lines are sloping

downward, the trend is down. In this view, the point where the lines "cross" is the

point where the trend changes.

When the ECO is below the "0" line, the trend is down, and we are qualified only to

sell on new short signals from the Hi-Lo Activator. In other words, when the ECO is

above 0, we are not allowed to take short signals, and when the ECO is below 0, we

are not allowed to take long signals.

Download File:

ECO.efs

EFS Code:

Description:

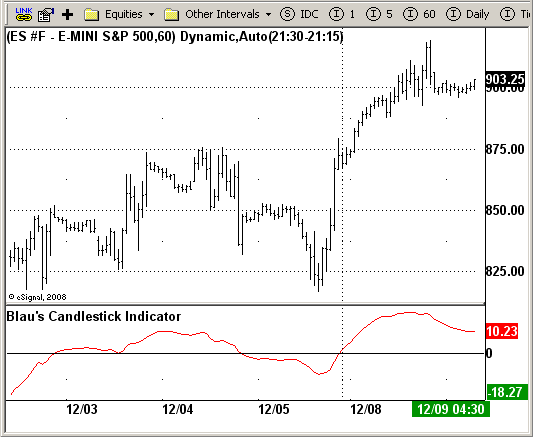

ECO (Blau`s Ergodic Candlestick Oscillator)

Formula Parameters:

Number To Calculate EMA: 32

Number To Calculate vEMA : 12

Notes:

We call this one the ECO for short, but it will be listed on the indicator list

at W. Blau╥s Ergodic Candlestick Oscillator. The ECO is a momentum indicator.

It is based on candlestick bars, and takes into account the size and direction

of the candlestick "body". We have found it to be a very good momentum indicator,

and especially smooth, because it is unaffected by gaps in price, unlike many other

momentum indicators.

We like to use this indicator as an additional trend confirmation tool, or as an

alternate trend definition tool, in place of a weekly indicator. The simplest way

of using the indicator is simply to define the trend based on which side of the "0"

line the indicator is located on. If the indicator is above "0", then the trend is up.

If the indicator is below "0" then the trend is down. You can add an additional

qualifier by noting the "slope" of the indicator, and the crossing points of the slow

and fast lines. Some like to use the slope alone to define trend direction. If the

lines are sloping upward, the trend is up. Alternately, if the lines are sloping

downward, the trend is down. In this view, the point where the lines "cross" is the

point where the trend changes.

When the ECO is below the "0" line, the trend is down, and we are qualified only to

sell on new short signals from the Hi-Lo Activator. In other words, when the ECO is

above 0, we are not allowed to take short signals, and when the ECO is below 0, we

are not allowed to take long signals.

Download File:

ECO.efs

EFS Code:

PHP Code:

/*********************************

Provided By:

eSignal (Copyright c eSignal), a division of Interactive Data

Corporation. 2008. All rights reserved. This sample eSignal

Formula Script (EFS) is for educational purposes only and may be

modified and saved under a new file name. eSignal is not responsible

for the functionality once modified. eSignal reserves the right

to modify and overwrite this EFS file with each new release.

Description:

ECO (Blau`s Ergodic Candlestick Oscillator)

Version: 1.0 12/03/2008

Formula Parameters: Default:

Number To Calculate EMA 32

Number To Calculate vEMA 12

Notes:

We call this one the ECO for short, but it will be listed on the indicator list

at W. Blau╥s Ergodic Candlestick Oscillator. The ECO is a momentum indicator.

It is based on candlestick bars, and takes into account the size and direction

of the candlestick "body". We have found it to be a very good momentum indicator,

and especially smooth, because it is unaffected by gaps in price, unlike many other

momentum indicators.

We like to use this indicator as an additional trend confirmation tool, or as an

alternate trend definition tool, in place of a weekly indicator. The simplest way

of using the indicator is simply to define the trend based on which side of the "0"

line the indicator is located on. If the indicator is above "0", then the trend is up.

If the indicator is below "0" then the trend is down. You can add an additional

qualifier by noting the "slope" of the indicator, and the crossing points of the slow

and fast lines. Some like to use the slope alone to define trend direction. If the

lines are sloping upward, the trend is up. Alternately, if the lines are sloping

downward, the trend is down. In this view, the point where the lines "cross" is the

point where the trend changes.

When the ECO is below the "0" line, the trend is down, and we are qualified only to

sell on new short signals from the Hi-Lo Activator. In other words, when the ECO is

above 0, we are not allowed to take short signals, and when the ECO is below 0, we

are not allowed to take long signals.

**********************************/

var fpArray = new Array();

var bInit = false;

function preMain() {

setStudyTitle("Blau's Candlestick Indicator");

setCursorLabelName("Blau's Candlestick Indicator",0);

setDefaultBarFgColor(Color.red,0);

addBand(0, PS_SOLID, 1, Color.black);

var x=0;

fpArray[x] = new FunctionParameter("r", FunctionParameter.NUMBER);

with(fpArray[x++]){

setLowerLimit(1);

setDefault(32);

}

fpArray[x] = new FunctionParameter("s", FunctionParameter.NUMBER);

with(fpArray[x++]){

setLowerLimit(1);

setDefault(12);

}

}

var xEMA = null;

var xvEMA = null;

function main(r, s) {

var nState = getBarState();

if (nState == BARSTATE_ALLBARS) {

if (r == null) r = 32;

if (s == null) s = 12;

}

if ( bInit == false ) {

xEMA = ema(s, ema(r, efsInternal("CloseOpen")));

xvEMA = ema(s, ema(r, efsInternal("HighLow")));

bInit = true;

}

if (getCurrentBarCount() < Math.max(r,s)) return;

if(xvEMA.getValue(0) != 0)

return 100 * (xEMA.getValue(0) / xvEMA.getValue(0));

else

return;

}

function CloseOpen() {

var nRes = 0;

nRes = close(0) - open(0);

if (nRes == null) nRes = 1;

return nRes;

}

function HighLow() {

var nRes = 0;

nRes = high(0) - low(0);

if (nRes == null) nRes = 1;

return nRes;

}