File Name: CMO_Abs.efs

Description:

CMOabs

Formula Parameters:

Length : 9

TopBand : 70

LowBand : 20

Notes:

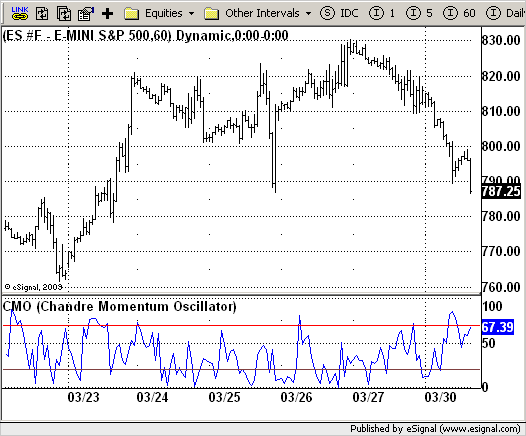

This indicator plots the absolute value of CMO. CMO was developed by Tushar

Chande. A scientist, an inventor, and a respected trading system developer,

Mr. Chande developed the CMO to capture what he calls "pure momentum". For

more definitive information on the CMO and other indicators we recommend the

book The New Technical Trader by Tushar Chande and Stanley Kroll.

The CMO is closely related to, yet unique from, other momentum oriented indicators

such as Relative Strength Index, Stochastic, Rate-of-Change, etc. It is most closely

related to Welles Wilder`s RSI, yet it differs in several ways:

- It uses data for both up days and down days in the numerator, thereby directly

measuring momentum;

- The calculations are applied on unsmoothed data. Therefore, short-term extreme

movements in price are not hidden. Once calculated, smoothing can be applied to

the CMO, if desired;

- The scale is bounded between +100 and -100, thereby allowing you to clearly see

changes in net momentum using the 0 level. The bounded scale also allows you to

conveniently compare values across different securities.

Download File:

CMO_Abs.efs

EFS Code:

Description:

CMOabs

Formula Parameters:

Length : 9

TopBand : 70

LowBand : 20

Notes:

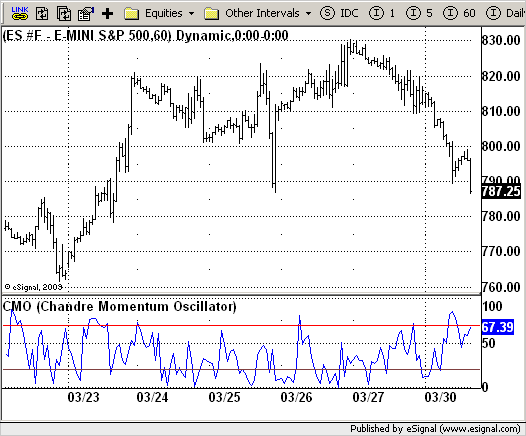

This indicator plots the absolute value of CMO. CMO was developed by Tushar

Chande. A scientist, an inventor, and a respected trading system developer,

Mr. Chande developed the CMO to capture what he calls "pure momentum". For

more definitive information on the CMO and other indicators we recommend the

book The New Technical Trader by Tushar Chande and Stanley Kroll.

The CMO is closely related to, yet unique from, other momentum oriented indicators

such as Relative Strength Index, Stochastic, Rate-of-Change, etc. It is most closely

related to Welles Wilder`s RSI, yet it differs in several ways:

- It uses data for both up days and down days in the numerator, thereby directly

measuring momentum;

- The calculations are applied on unsmoothed data. Therefore, short-term extreme

movements in price are not hidden. Once calculated, smoothing can be applied to

the CMO, if desired;

- The scale is bounded between +100 and -100, thereby allowing you to clearly see

changes in net momentum using the 0 level. The bounded scale also allows you to

conveniently compare values across different securities.

Download File:

CMO_Abs.efs

EFS Code:

PHP Code:

/*********************************

Provided By:

eSignal (Copyright c eSignal), a division of Interactive Data

Corporation. 2009. All rights reserved. This sample eSignal

Formula Script (EFS) is for educational purposes only and may be

modified and saved under a new file name. eSignal is not responsible

for the functionality once modified. eSignal reserves the right

to modify and overwrite this EFS file with each new release.

Description:

CMOabs

Version: 1.0 03/27/2009

Formula Parameters: Default:

Length 9

TopBand 70

LowBand 20

Notes:

This indicator plots the absolute value of CMO. CMO was developed by Tushar

Chande. A scientist, an inventor, and a respected trading system developer,

Mr. Chande developed the CMO to capture what he calls "pure momentum". For

more definitive information on the CMO and other indicators we recommend the

book The New Technical Trader by Tushar Chande and Stanley Kroll.

The CMO is closely related to, yet unique from, other momentum oriented indicators

such as Relative Strength Index, Stochastic, Rate-of-Change, etc. It is most closely

related to Welles Wilder`s RSI, yet it differs in several ways:

- It uses data for both up days and down days in the numerator, thereby directly

measuring momentum;

- The calculations are applied on unsmoothed data. Therefore, short-term extreme

movements in price are not hidden. Once calculated, smoothing can be applied to

the CMO, if desired;

- The scale is bounded between +100 and -100, thereby allowing you to clearly see

changes in net momentum using the 0 level. The bounded scale also allows you to

conveniently compare values across different securities.

**********************************/

var fpArray = new Array();

var bInit = false;

function preMain() {

setPriceStudy(false);

setStudyTitle("CMO (Chandre Momentum Oscillator)");

setCursorLabelName("CMO", 0);

setDefaultBarFgColor(Color.blue, 0);

setStudyMax(101);

setStudyMin(-1);

var x=0;

fpArray[x] = new FunctionParameter("Length", FunctionParameter.NUMBER);

with(fpArray[x++]){

setLowerLimit(1);

setDefault(9);

}

fpArray[x] = new FunctionParameter("TopBand", FunctionParameter.NUMBER);

with(fpArray[x++]){

setLowerLimit(1);

setDefault(70);

}

fpArray[x] = new FunctionParameter("LowBand", FunctionParameter.NUMBER);

with(fpArray[x++]){

setLowerLimit(0);

setDefault(20);

}

}

var xCMO = null

function main(Length, TopBand, LowBand) {

var nBarState = getBarState();

var nCMO = 0;

if (nBarState == BARSTATE_ALLBARS) {

if (Length == null) Length = 9;

if (TopBand == null) TopBand = 70;

if (LowBand == null) LowBand = 20;

}

if (bInit == false) {

xCMO = efsInternal("Calc_CMO", Length);

addBand(TopBand, PS_SOLID, 1, Color.red, "TopBand");

addBand(LowBand, PS_SOLID, 1, Color.brown, "LowBand");

bInit = true;

}

nCMO = xCMO.getValue(0);

if (nCMO == null) return;

return nCMO;

}

var xSecondInit = false;

var xSMA = null;

var xMOM = null;

function Calc_CMO(LenCMO) {

var nRes = 0;

if(xSecondInit == false){

xSMA = sma(LenCMO, efsInternal("Calc_Price"));

xMOM = mom(LenCMO);

xSecondInit = true

}

var nSMA = xSMA.getValue(0);

if (nSMA == null) return;

nRes = Math.abs(100 * (xMOM.getValue(0) / (nSMA * LenCMO)));

return nRes;

}

var yMOM = null;

function Calc_Price(){

if(yMOM==null) yMOM = mom(1);

return Math.abs(yMOM.getValue(0));

}