File Name: RMI.efs

Description:

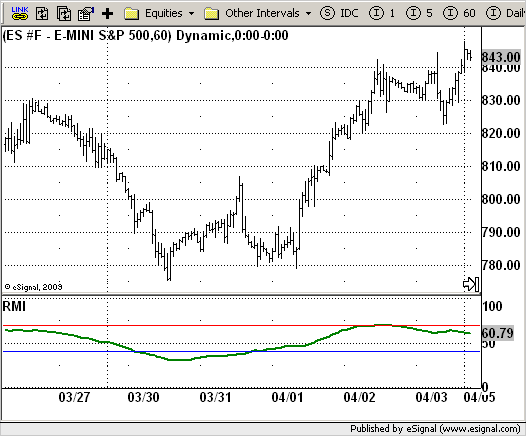

Relative Momentum Index (RMI)

Formula Parameters:

Length : 20

BuyZone : 40

SellZone : 70

Source of Price : Close

Notes:

The Relative Momentum Index (RMI) was developed by Roger Altman. Impressed

with the Relative Strength Index's sensitivity to the number of look-back

periods, yet frustrated with it's inconsistent oscillation between defined

overbought and oversold levels, Mr. Altman added a momentum component to the RSI.

As mentioned, the RMI is a variation of the RSI indicator. Instead of counting

up and down days from close to close as the RSI does, the RMI counts up and down

days from the close relative to the close x-days ago where x is not necessarily

1 as required by the RSI). So as the name of the indicator reflects, "momentum" is

substituted for "strength".

Download File:

RMI.efs

EFS Code:

Description:

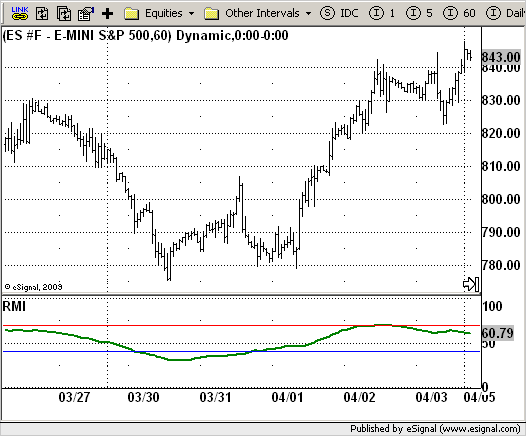

Relative Momentum Index (RMI)

Formula Parameters:

Length : 20

BuyZone : 40

SellZone : 70

Source of Price : Close

Notes:

The Relative Momentum Index (RMI) was developed by Roger Altman. Impressed

with the Relative Strength Index's sensitivity to the number of look-back

periods, yet frustrated with it's inconsistent oscillation between defined

overbought and oversold levels, Mr. Altman added a momentum component to the RSI.

As mentioned, the RMI is a variation of the RSI indicator. Instead of counting

up and down days from close to close as the RSI does, the RMI counts up and down

days from the close relative to the close x-days ago where x is not necessarily

1 as required by the RSI). So as the name of the indicator reflects, "momentum" is

substituted for "strength".

Download File:

RMI.efs

EFS Code:

PHP Code:

/*********************************

Provided By:

eSignal (Copyright c eSignal), a division of Interactive Data

Corporation. 2009. All rights reserved. This sample eSignal

Formula Script (EFS) is for educational purposes only and may be

modified and saved under a new file name. eSignal is not responsible

for the functionality once modified. eSignal reserves the right

to modify and overwrite this EFS file with each new release.

Description:

Relative Momentum Index (RMI)

Version: 1.0 04/29/2009

Formula Parameters: Default:

Length 20

BuyZone 40

SellZone 70

Source of Price Close

Notes:

The Relative Momentum Index (RMI) was developed by Roger Altman. Impressed

with the Relative Strength Index's sensitivity to the number of look-back

periods, yet frustrated with it's inconsistent oscillation between defined

overbought and oversold levels, Mr. Altman added a momentum component to the RSI.

As mentioned, the RMI is a variation of the RSI indicator. Instead of counting

up and down days from close to close as the RSI does, the RMI counts up and down

days from the close relative to the close x-days ago where x is not necessarily

1 as required by the RSI). So as the name of the indicator reflects, "momentum" is

substituted for "strength".

**********************************/

var fpArray = new Array();

var bInit = false;

function preMain() {

setPriceStudy(false);

setStudyTitle("RMI");

setCursorLabelName("RMI", 0);

setShowTitleParameters(false);

setDefaultBarFgColor(Color.green, 0);

setDefaultBarThickness(2, 0);

setStudyMax(101);

setStudyMin(-1);

var x = 0;

fpArray[x] = new FunctionParameter("Length", FunctionParameter.NUMBER);

with(fpArray[x++]) {

setLowerLimit(1);

setDefault(20);

}

fpArray[x] = new FunctionParameter("BuyZone", FunctionParameter.NUMBER);

with(fpArray[x++]) {

setLowerLimit(1);

setDefault(40);

}

fpArray[x] = new FunctionParameter("SellZone", FunctionParameter.NUMBER);

with(fpArray[x++]) {

setLowerLimit(1);

setDefault(70);

}

fpArray[x] = new FunctionParameter("sPrice", FunctionParameter.STRING);

with(fpArray[x++]){

setName("Source of Price");

addOption("open");

addOption("high");

addOption("low");

addOption("close");

addOption("hl2");

addOption("hlc3");

addOption("ohlc4");

setDefault("close");

}

}

var xRMI = null;

function main(sPrice, Length, BuyZone, SellZone) {

var nBarState = getBarState();

var nRMI = 0;

if (nBarState == BARSTATE_ALLBARS) {

if (sPrice == null) sPrice = "close";

if (Length == null) Length = 20;

if (BuyZone == null) BuyZone = 40;

if (SellZone == null) SellZone = 70;

}

if (bInit == false) {

addBand(BuyZone, PS_SOLID, 1, Color.blue, "Buy");

addBand(SellZone, PS_SOLID, 1, Color.red, "Sell");

xRMI = efsInternal("Calc_RMI", sPrice, Length)

bInit = true;

}

nRMI = xRMI.getValue(0);

if (nRMI == null) return;

return nRMI;

}

var bSecondInit = false;

var xMU = null;

var xMD = null;

var xMOM = null;

function Calc_RMI(sPrice, Length) {

var Momentum = 0;

var nMU = 0;

var nMD = 0;

if (getCurrentBarCount() <= Length) return;

if (bSecondInit == false) {

xMOM = mom(Length, eval(sPrice)());

xMU = efsInternal("Calc_MU", Length, xMOM);

xMD = efsInternal("Calc_MD", Length, xMOM);

bSecondInit = true;

}

nMU = xMU.getValue(0);

nMD = xMD.getValue(0);

if (nMU == null || nMD == null) return;

var RM = nMU / nMD;

var RMI = 100 * (RM / (1 + RM));

return RMI;

}

function Calc_MU(Length, xSeries) {

var nRes = null;

var nRef = ref(-1);

var Momentum = xSeries.getValue(0);

if (xSeries.getValue(-1) == null) return;

if (Momentum >= 0) nRes = nRef - (nRef / Length) + Momentum

else nRes = nRef;

if (nRes == null) return;

return nRes;

}

function Calc_MD(Length, xSeries) {

var nRes = null;

var nRef = ref(-1);

var Momentum = xSeries.getValue(0);

if (xSeries.getValue(-1) == null) return;

if (Momentum <= 0) nRes = nRef - (nRef / Length) + Math.abs(Momentum)

else nRes = nRef;

if (nRes == null) return;

return nRes;

}