File Name: ArnOsc.efs

Description:

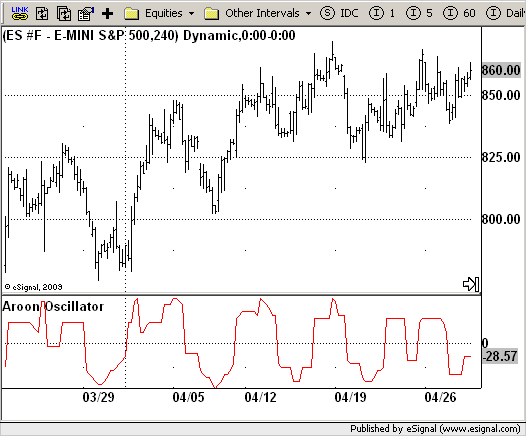

Aroon Oscillator

Formula Parameters:

Length : 14

Notes:

This formula requires the AroonUp.efs and AroonDown.efs formulas which

must be in the same folder.

Developed by Tushar Chande in 1995, the Aroon is an indicator system

that can be used to determine whether a stock is trending or not and

how strong the trend is. "Aroon" means "Dawn's Early Light" in Sanskrit

and Chande choose that name for this indicator since it is designed to

reveal the beginning of a new trend.

The Aroon indicator consists of two lines, Aroon(up) and Aroon(down).

The Aroon Oscillator is a single line that is defined as the difference

between Aroon(up) and Aroon(down). All three take a single parameter which

is the number of time periods to use in the calculation. Since Aroon(up)

and Aroon(down) both oscillate between 0 and +100, the Aroon Oscillator

ranges from -100 to +100 with zero serving as the crossover line.

Aroon Oscillator indicator is calculated according to this formula:

AroonOscillator = AroonUp - AroonDown

Download File:

ArnOsc.efs

AroonUp.efs

AroonDown.efs

EFS Code:

Description:

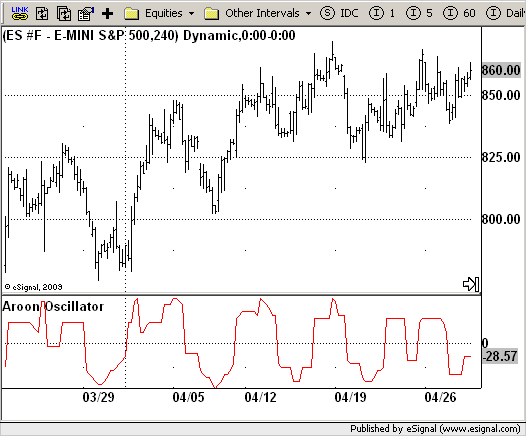

Aroon Oscillator

Formula Parameters:

Length : 14

Notes:

This formula requires the AroonUp.efs and AroonDown.efs formulas which

must be in the same folder.

Developed by Tushar Chande in 1995, the Aroon is an indicator system

that can be used to determine whether a stock is trending or not and

how strong the trend is. "Aroon" means "Dawn's Early Light" in Sanskrit

and Chande choose that name for this indicator since it is designed to

reveal the beginning of a new trend.

The Aroon indicator consists of two lines, Aroon(up) and Aroon(down).

The Aroon Oscillator is a single line that is defined as the difference

between Aroon(up) and Aroon(down). All three take a single parameter which

is the number of time periods to use in the calculation. Since Aroon(up)

and Aroon(down) both oscillate between 0 and +100, the Aroon Oscillator

ranges from -100 to +100 with zero serving as the crossover line.

Aroon Oscillator indicator is calculated according to this formula:

AroonOscillator = AroonUp - AroonDown

Download File:

ArnOsc.efs

AroonUp.efs

AroonDown.efs

EFS Code:

PHP Code:

/*********************************

Provided By:

eSignal (Copyright c eSignal), a division of Interactive Data

Corporation. 2009. All rights reserved. This sample eSignal

Formula Script (EFS) is for educational purposes only and may be

modified and saved under a new file name. eSignal is not responsible

for the functionality once modified. eSignal reserves the right

to modify and overwrite this EFS file with each new release.

Description:

Aroon Oscillator

Version: 1.0 05/15/2009

Formula Parameters: Default:

Length 14

Notes:

This formula requires the AroonUp.efs and AroonDown.efs formulas which

must be in the same folder.

Developed by Tushar Chande in 1995, the Aroon is an indicator system

that can be used to determine whether a stock is trending or not and

how strong the trend is. "Aroon" means "Dawn's Early Light" in Sanskrit

and Chande choose that name for this indicator since it is designed to

reveal the beginning of a new trend.

The Aroon indicator consists of two lines, Aroon(up) and Aroon(down).

The Aroon Oscillator is a single line that is defined as the difference

between Aroon(up) and Aroon(down). All three take a single parameter which

is the number of time periods to use in the calculation. Since Aroon(up)

and Aroon(down) both oscillate between 0 and +100, the Aroon Oscillator

ranges from -100 to +100 with zero serving as the crossover line.

Aroon Oscillator indicator is calculated according to this formula:

AroonOscillator = AroonUp - AroonDown

**********************************/

function preMain() {

setStudyTitle("Aroon Oscillator");

setCursorLabelName("ArnOsc",0);

setDefaultBarFgColor(Color.red,0);

var fp1 = new FunctionParameter("nInputLength", FunctionParameter.NUMBER);

fp1.setName("Length");

fp1.setLowerLimit(1);

fp1.setDefault(14);

}

var bInit = false;

var xArnUp = null;

var xArnDn = null;

function main(nInputLength){

if (bInit == false) {

xArnUp = efsExternal("AroonUP.efs", nInputLength);

xArnDn = efsExternal("AroonDown.efs", nInputLength);

bInit = true;

}

return (xArnUp.getValue(0) - xArnDn.getValue(0));

}