File Name: AdaptivePriceZone.efs

Description:

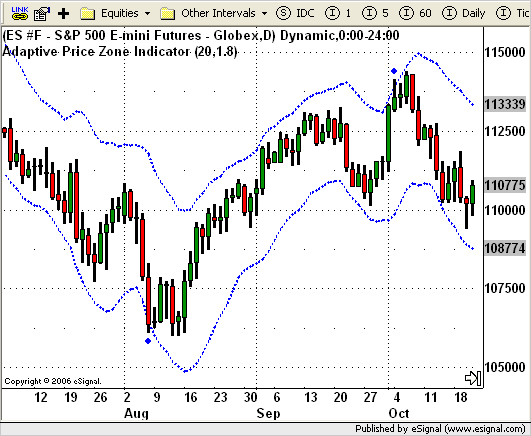

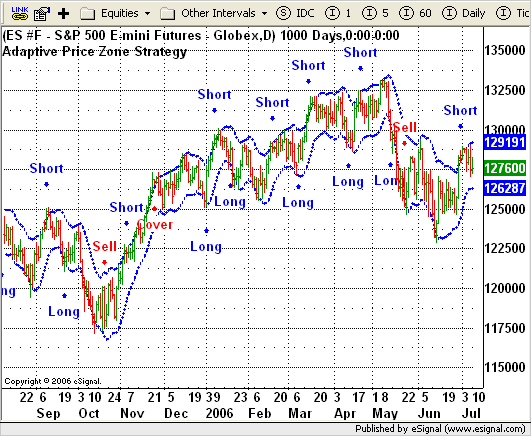

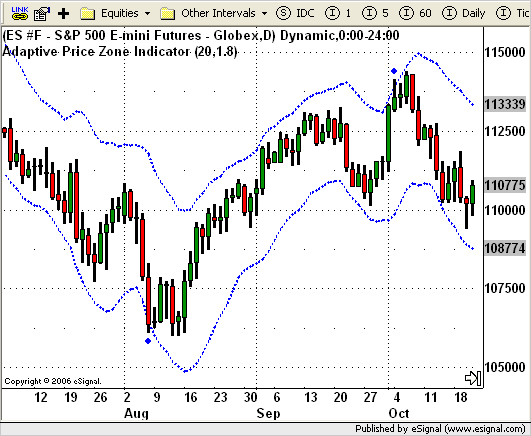

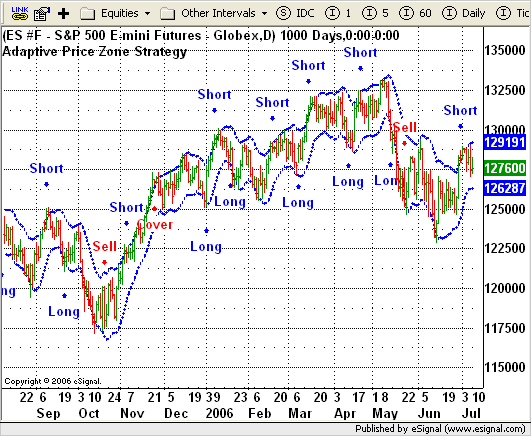

These studies are based on the September 2006 article, Trading With An Adaptive Price Zone, by Lee Leibfarth.

Formula Parameters:

AdaptivePriceZone.efs

Period: 20

Band Percent: 2

APZ_Strategy.efs

Period: 20

Band Percent: 2

ADX Period: 14

ADX Smoothing: 14

ADX Threshold: 30

Notes:

The APZ_Strategy.efs study is compatible for back testing and real time usage. These formulas require eSignal version 8.0.0 or later. The related article is copyrighted material. If you are not a subscriber of Stocks & Commodities, please visit www.traders.com.

Download File:

AdaptivePriceZone.efs

APZ_Strategy.efs

EFS Code:

Description:

These studies are based on the September 2006 article, Trading With An Adaptive Price Zone, by Lee Leibfarth.

Formula Parameters:

AdaptivePriceZone.efs

Period: 20

Band Percent: 2

APZ_Strategy.efs

Period: 20

Band Percent: 2

ADX Period: 14

ADX Smoothing: 14

ADX Threshold: 30

Notes:

The APZ_Strategy.efs study is compatible for back testing and real time usage. These formulas require eSignal version 8.0.0 or later. The related article is copyrighted material. If you are not a subscriber of Stocks & Commodities, please visit www.traders.com.

Download File:

AdaptivePriceZone.efs

APZ_Strategy.efs

EFS Code:

PHP Code:

/***************************************

Provided By : eSignal (c) Copyright 2006

Description: Trading With An Adaptive Price Zone

by Lee Leibfarth

Version 1.0 07/06/2006

Notes:

* Sept 2006 Issue of Stocks and Commodities Magazine

* Study requires version 8.0 or higher.

Formula Parameters: Defaults:

Period 20

Band Percent 2

***************************************/

function preMain() {

setPriceStudy(true);

setStudyTitle("Adaptive Price Zone Indicator ");

setCursorLabelName("Upper Band", 0);

setCursorLabelName("Lower Band", 1);

setDefaultBarThickness(2, 0);

setDefaultBarThickness(2, 1);

setDefaultBarStyle(PS_DOT, 0);

setDefaultBarStyle(PS_DOT, 1);

var fp1 = new FunctionParameter("nPeriods", FunctionParameter.NUMBER);

fp1.setName("Period");

fp1.setLowerLimit(1);

fp1.setDefault(20);

var fp2 = new FunctionParameter("nBandPct", FunctionParameter.NUMBER);

fp2.setName("Band Percent");

fp2.setLowerLimit(0);

fp2.setDefault(2);

}

var bVersion = null;

var bInit = false;

var xAPZ = null;

var xAPZ_Upper = null; // Upper Band

var xAPZ_Lower = null; // Lower Band

function main(nPeriods, nBandPct) {

if (bVersion == null) bVersion = verify();

if (bVersion == false) return;

if (bInit == false) {

xAPZ = efsInternal("calcAPZ", nPeriods, nBandPct);

bInit = true;

}

if (xAPZ_Upper == null) xAPZ_Upper = getSeries(xAPZ, 0); // Upper Band

if (xAPZ_Lower == null) var xAPZ_Lower = getSeries(xAPZ, 1); // Lower Band

var nAPZ_Upper = xAPZ_Upper.getValue(0);

var nAPZ_Lower = xAPZ_Lower.getValue(0);

if (nAPZ_Upper == null || nAPZ_Lower == null) return;

if (high(0) > nAPZ_Upper) {

drawShape(Shape.CIRCLE, AboveBar1, Color.blue, rawtime(0));

} else if (low(0) < nAPZ_Lower) {

drawShape(Shape.CIRCLE, BelowBar1, Color.blue, rawtime(0));

}

return new Array(nAPZ_Upper, nAPZ_Lower);

}

var xHL = null;

function calcAPZ(nPeriods, nBandPct) {

if (xHL == null) xHL = efsInternal("calcHL");

if (isNaN(xHL.getValue(0))) return;

//nPeriods = Math.round(Math.sqrt(nPeriods));

nPeriods = Math.ceil(Math.sqrt(nPeriods));

var Value1 = ema(nPeriods, ema(nPeriods), 0);

var Value2 = ema(nPeriods, ema(nPeriods, xHL), 0);

if (Value1 == null || Value2 == null) return;

var UpBand = nBandPct * Value2 + Value1;

var DnBand = Value1 - nBandPct * Value2;

if (UpBand == null || DnBand == null) return;

return new Array(UpBand, DnBand);

}

function calcHL() {

return high(0) - low(0);

}

function verify() {

var b = false;

if (getBuildNumber() < 779) {

drawTextAbsolute(5, 35, "This study requires version 8.0 or later.",

Color.white, Color.blue, Text.RELATIVETOBOTTOM|Text.RELATIVETOLEFT|Text.BOLD|Text.LEFT,

null, 13, "error");

drawTextAbsolute(5, 20, "Click HERE to upgrade.@URL=http://www.esignal.com/download/default.asp",

Color.white, Color.blue, Text.RELATIVETOBOTTOM|Text.RELATIVETOLEFT|Text.BOLD|Text.LEFT,

null, 13, "upgrade");

return b;

} else {

b = true;

}

return b;

}

/***************************************

Provided By : eSignal (c) Copyright 2006

Description: Trading With An Adaptive Price Zone

by Lee Leibfarth

Version 1.0 07/06/2006

Notes:

* Sept 2006 Issue of Stocks and Commodities Magazine

* Study requires version 8.0 or higher.

* Study is designed for Back Testing.

Formula Parameters: Defaults:

Period 20

Band Percent 2

ADX Period 14

ADX Smoothing 14

ADX Threshold 30

***************************************/

function preMain() {

setPriceStudy(true);

setStudyTitle("Adaptive Price Zone Strategy ");

setShowTitleParameters(false);

setCursorLabelName("Upper Band", 0);

setCursorLabelName("Lower Band", 1);

setCursorLabelName("ADX", 2);

setDefaultBarFgColor(Color.blue, 0);

setDefaultBarFgColor(Color.blue, 1);

setDefaultBarFgColor(Color.green, 2);

setDefaultBarThickness(2, 0);

setDefaultBarThickness(2, 1);

setDefaultBarStyle(PS_DOT, 0);

setDefaultBarStyle(PS_DOT, 1);

setDefaultFont("Ariel", 12);

var fp1 = new FunctionParameter("nPeriods", FunctionParameter.NUMBER);

fp1.setName("Period");

fp1.setLowerLimit(1);

fp1.setDefault(20);

var fp2 = new FunctionParameter("nBandPct", FunctionParameter.NUMBER);

fp2.setName("Band Percent");

fp2.setLowerLimit(0);

fp2.setDefault(2);

var fp3 = new FunctionParameter("nADXPeriods", FunctionParameter.NUMBER);

fp3.setName("ADX Period");

fp3.setLowerLimit(1);

fp3.setDefault(14);

var fp4 = new FunctionParameter("nADXSmoothing", FunctionParameter.NUMBER);

fp4.setName("ADX Smoothing");

fp4.setLowerLimit(1);

fp4.setDefault(14);

var fp5 = new FunctionParameter("nADXThreshold", FunctionParameter.NUMBER);

fp5.setName("ADX Threshold");

fp5.setLowerLimit(0);

fp5.setDefault(30);

}

var bVersion = null;

var bInit = false;

var bBackTest = true;

var vPosition = null;

var xAPZ = null;

var xAPZ_Upper = null; // Upper Band

var xAPZ_Lower = null; // Lower Band

function main(nPeriods, nBandPct, nADXPeriods, nADXSmoothing, nADXThreshold) {

if (bVersion == null) bVersion = verify();

if (bVersion == false) return;

if (bInit == false) {

xAPZ = efsInternal("calcAPZ", nPeriods, nBandPct);

bInit = true;

}

if (xAPZ_Upper == null) xAPZ_Upper = getSeries(xAPZ, 0); // Upper Band

if (xAPZ_Lower == null) var xAPZ_Lower = getSeries(xAPZ, 1); // Lower Band

var nAPZ_Upper = xAPZ_Upper.getValue(0);

var nAPZ_Lower = xAPZ_Lower.getValue(0);

var nAPZ_Upper_1 = xAPZ_Upper.getValue(-1);

var nAPZ_Lower_1 = xAPZ_Lower.getValue(-1);

var nADX_0 = adx(nADXPeriods, nADXSmoothing, 0);

var nADX_1 = adx(nADXPeriods, nADXSmoothing, -1);

if (nAPZ_Upper_1 == null || nAPZ_Lower_1 == null || nADX_1 == null) return;

if (getCurrentBarIndex() == 0) bBackTest = false;

if (vPosition != null && nADX_1 > nADXThreshold) { // Exit signal

if (vPosition == "long") {

drawText("Sell", AboveBar3, Color.red, Text.BOLD|Text.CENTER, "t"+rawtime(0));

drawShape(Shape.DOWNARROW, AboveBar2, Color.red, "s"+rawtime(0));

vPosition = null;

Alert.playSound("ding.wav");

if (bBackTest == true) {

Strategy.doSell("Sell", Strategy.MARKET, Strategy.THISBAR);

}

} else if (vPosition == "short") {

drawText("Cover", BelowBar3, Color.red, Text.BOLD|Text.CENTER, "t"+rawtime(0));

drawShape(Shape.UPARROW, BelowBar2, Color.red, "s"+rawtime(0));

vPosition = null;

Alert.playSound("ding.wav");

if (bBackTest == true) {

Strategy.doCover("Cover", Strategy.MARKET, Strategy.THISBAR);

}

}

} else if (nADX_1 <= nADXThreshold) { // Entry signal

if (vPosition != "short" && high(-1) >= nAPZ_Upper_1) { // Short signal

vPosition = "short";

drawText("Short", AboveBar3, Color.blue, Text.BOLD|Text.CENTER, "t"+rawtime(0));

drawShape(Shape.DOWNARROW, AboveBar2, Color.blue, "s"+rawtime(0));

Alert.playSound("pop.wav");

if (bBackTest == true) {

Strategy.doShort("Short", Strategy.MARKET, Strategy.THISBAR);

}

}

if (vPosition != "long" && low(-1) <= nAPZ_Lower_1) { // Long signal

vPosition = "long";

drawText("Long", BelowBar3, Color.blue, Text.BOLD|Text.CENTER, "t"+rawtime(0));

drawShape(Shape.UPARROW, BelowBar2, Color.blue, "s"+rawtime(0));

Alert.playSound("pop.wav");

if (bBackTest == true) {

Strategy.doLong("Long", Strategy.MARKET, Strategy.THISBAR);

}

}

}

return new Array(nAPZ_Upper, nAPZ_Lower, nADX_0.toFixed(6));

}

var xHL = null;

function calcAPZ(nPeriods, nBandPct) {

if (xHL == null) xHL = efsInternal("calcHL");

if (isNaN(xHL.getValue(0))) return;

//nPeriods = Math.round(Math.sqrt(nPeriods));

nPeriods = Math.ceil(Math.sqrt(nPeriods));

var Value1 = ema(nPeriods, ema(nPeriods), 0);

var Value2 = ema(nPeriods, ema(nPeriods, xHL), 0);

if (Value1 == null || Value2 == null) return;

var UpBand = nBandPct * Value2 + Value1;

var DnBand = Value1 - nBandPct * Value2;

if (UpBand == null || DnBand == null) return;

return new Array(UpBand, DnBand);

}

function calcHL() {

return high(0) - low(0);

}

function verify() {

var b = false;

if (getBuildNumber() < 779) {

drawTextAbsolute(5, 35, "This study requires version 8.0 or later.",

Color.white, Color.blue, Text.RELATIVETOBOTTOM|Text.RELATIVETOLEFT|Text.BOLD|Text.LEFT,

null, 13, "error");

drawTextAbsolute(5, 20, "Click HERE to upgrade.@URL=http://www.esignal.com/download/default.asp",

Color.white, Color.blue, Text.RELATIVETOBOTTOM|Text.RELATIVETOLEFT|Text.BOLD|Text.LEFT,

null, 13, "upgrade");

return b;

} else {

b = true;

}

return b;

}