File Name: PremiereStochastic.efs

Description:

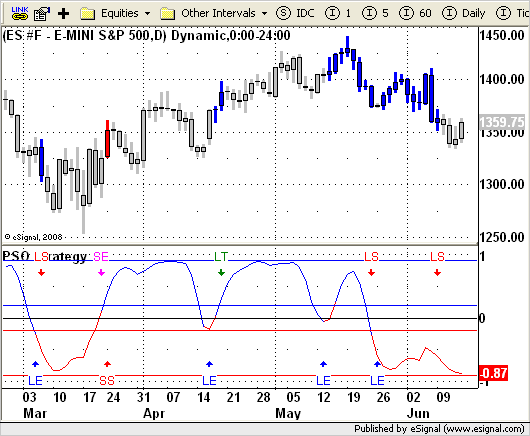

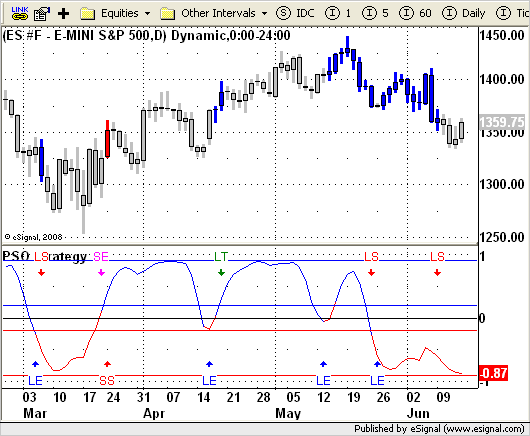

The following studies are based on the August 2008 article, Premier Stochastic Oscillator, by Lee Leibfarth.

Formula Parameters:

PremiereStochastic.efs

Stoch Length: 8

Period: 25

Line1: .9

Line2: .2

PSO_Strategy.efs

Stoch Length: 8

Period: 25

Line1: .9

Line2: .2

Profit Target %: 3

Stop Loss %: 1.5

Notes:

The related article is copyrighted material. If you are not a subscriber of Stocks & Commodities, please visit www.traders.com.

Download File:

PremiereStochastic.efs

PSO_Strategy.efs

EFS Code:

PremierStochastic.efs

PSO_Strategy.efs

Description:

The following studies are based on the August 2008 article, Premier Stochastic Oscillator, by Lee Leibfarth.

Formula Parameters:

PremiereStochastic.efs

Stoch Length: 8

Period: 25

Line1: .9

Line2: .2

PSO_Strategy.efs

Stoch Length: 8

Period: 25

Line1: .9

Line2: .2

Profit Target %: 3

Stop Loss %: 1.5

Notes:

The related article is copyrighted material. If you are not a subscriber of Stocks & Commodities, please visit www.traders.com.

Download File:

PremiereStochastic.efs

PSO_Strategy.efs

EFS Code:

PremierStochastic.efs

PHP Code:

/*********************************

Provided By:

eSignal (Copyright © eSignal), a division of Interactive Data

Corporation. 2008. All rights reserved. This sample eSignal

Formula Script (EFS) is for educational purposes only and may be

modified and saved under a new file name. eSignal is not responsible

for the functionality once modified. eSignal reserves the right

to modify and overwrite this EFS file with each new release.

Description: Premier Stochastic Oscillator

by Lee Leibfarth

Version: 1.0 6/11/2008

Notes:

* August 2008 Issue of Stocks and Commodities Magazine

* Study requires version 10.1 or later.

**********************************/

function preMain(){

setStudyTitle("Premiere Stochastic Oscillator");

setCursorLabelName("PSO",0);

setShowCursorLabel(false,1);

setShowTitleParameters(false);

setPlotType(PLOTTYPE_LINE,0);

setPlotType(PLOTTYPE_HISTOGRAM,1);

setDefaultBarFgColor(Color.black,0);

setDefaultBarFgColor(Color.blue,1);

setStudyMax(1.1);

setStudyMin(-1.1);

var fp1 = new FunctionParameter("StochLength", FunctionParameter.NUMBER);

fp1.setName("Stoch Length");

fp1.setLowerLimit(1);

fp1.setDefault(8);

var fp2 = new FunctionParameter("Period", FunctionParameter.NUMBER);

fp2.setName("Period");

fp2.setLowerLimit(1);

fp2.setDefault(25);

var fp3 = new FunctionParameter("Line1", FunctionParameter.NUMBER);

fp3.setName("Line1");

fp3.setLowerLimit(0);

fp3.setDefault(.9);

var fp4 = new FunctionParameter("Line2", FunctionParameter.NUMBER);

fp4.setName("Line2");

fp4.setLowerLimit(0);

fp4.setDefault(.2);

}

var bVersion = null;

var bInit = false;

var xPremiere = null;

function main(StochLength,Period,Line1,Line2){

if (bVersion == null) bVersion = verify();

if (bVersion == false) return;

if(bInit == false){

xPremiere = efsInternal("calcPremiere",StochLength,Period);

addBand(Line1,PS_SOLID,1,Color.blue,"Line1");

addBand(Line2,PS_SOLID,1,Color.blue,"Line2");

addBand(Line1*(-1),PS_SOLID,1,Color.red,"Line3");

addBand(Line2*(-1),PS_SOLID,1,Color.red,"Line4");

addBand(0, PS_SOLID, 1, Color.black, "0");

bInit = true;

}

var nPremiere = xPremiere.getValue(0);

if(nPremiere==null) return;

if(nPremiere>=0) setBarFgColor(Color.blue,1);

else setBarFgColor(Color.red,1);

return new Array (nPremiere,nPremiere);

}

var xSmoothStoch = null;

function calcPremiere(_stochlength,_period){

if(_period<0)

var Length = 1;

else

var Length = Math.sqrt(_period);

if(xSmoothStoch==null) xSmoothStoch = ema(Length,ema(Length,efsInternal("normStoch",_stochlength)));

var nSmoothStoch = xSmoothStoch.getValue(0);

if(nSmoothStoch==null) return;

return (Math.exp(1*nSmoothStoch)-1)/(Math.exp(1*nSmoothStoch)+1);

}

var xStochK = null;

function normStoch(_stochlength){

if(xStochK==null) xStochK = stochK(_stochlength,1,1)

var nStochK = xStochK.getValue(0);

if(nStochK==null) return;

return (.1*(nStochK-50));

}

function verify() {

var b = false;

if (getBuildNumber() < 999) {

drawTextAbsolute(5, 35, "This study requires version 10.1 or later.",

Color.white, Color.blue, Text.RELATIVETOBOTTOM|Text.RELATIVETOLEFT|Text.BOLD|Text.LEFT,

null, 13, "error");

drawTextAbsolute(5, 20, "Click HERE to upgrade.@URL=http://www.esignal.com/download/default.asp",

Color.white, Color.blue, Text.RELATIVETOBOTTOM|Text.RELATIVETOLEFT|Text.BOLD|Text.LEFT,

null, 13, "upgrade");

return b;

} else {

b = true;

}

return b;

}

PSO_Strategy.efs

PHP Code:

/*********************************

Provided By:

eSignal (Copyright © eSignal), a division of Interactive Data

Corporation. 2008. All rights reserved. This sample eSignal

Formula Script (EFS) is for educational purposes only and may be

modified and saved under a new file name. eSignal is not responsible

for the functionality once modified. eSignal reserves the right

to modify and overwrite this EFS file with each new release.

Description: Premier Stochastic Oscillator

by Lee Leibfarth

Version: 1.0 6/11/2008

Notes:

* August 2008 Issue of Stocks and Commodities Magazine

* Study requires version 10.1 or later.

* Study is back testing compatible.

**********************************/

function preMain(){

setStudyTitle("PSO Strategy");

setCursorLabelName("PSO", 0);

setShowTitleParameters(false);

setDefaultFont("Ariel", 11);

setColorPriceBars(true);

setDefaultPriceBarColor(Color.lightgrey);

setStudyMax(1.1);

setStudyMin(-1.1);

var fp1 = new FunctionParameter("StochLength", FunctionParameter.NUMBER);

fp1.setName("Stoch Length");

fp1.setLowerLimit(1);

fp1.setDefault(8);

var fp2 = new FunctionParameter("Period", FunctionParameter.NUMBER);

fp2.setName("Period");

fp2.setLowerLimit(1);

fp2.setDefault(25);

var fp3 = new FunctionParameter("Line1", FunctionParameter.NUMBER);

fp3.setName("Line1");

fp3.setLowerLimit(0);

fp3.setDefault(.9);

var fp4 = new FunctionParameter("Line2", FunctionParameter.NUMBER);

fp4.setName("Line2");

fp4.setLowerLimit(0);

fp4.setDefault(.2);

var fp5 = new FunctionParameter("Profit", FunctionParameter.NUMBER);

fp5.setName("Profit Target %");

fp5.setLowerLimit(0);

fp5.setDefault(3);

var fp6 = new FunctionParameter("Stop", FunctionParameter.NUMBER);

fp6.setName("Stop Loss %");

fp6.setLowerLimit(0);

fp6.setDefault(1.5);

}

var bVersion = null;

var bInit = false;

var bBT = true;

var xPremiere = null;

var TargetPrice = 0;

var StopPrice = 0;

var vPosition = 0; // 1=long, 0=flat, -1=short

function main(StochLength,Period,Line1,Line2,Profit,Stop){

if (bVersion == null) bVersion = verify();

if (bVersion == false) return;

if (bInit == false) {

xPremiere = efsInternal("calcPremiere",StochLength,Period);

addBand(Line1,PS_SOLID,1,Color.blue,"Line1");

addBand(Line2,PS_SOLID,1,Color.blue,"Line2");

addBand(Line1*(-1),PS_SOLID,1,Color.red,"Line3");

addBand(Line2*(-1),PS_SOLID,1,Color.red,"Line4");

addBand(0, PS_SOLID, 1, Color.black, "0");

bInit = true;

}

var nPremiere_0 = xPremiere.getValue(0);

var nPremiere_1 = xPremiere.getValue(-1);

var nPremiere_2 = xPremiere.getValue(-2);

if(nPremiere_2==null) return;

if (getCurrentBarIndex() >= -1) bBT = false;

if(vPosition == 1 ) { // Long Exit

if(high(0)>=TargetPrice) {

if (bBT) Strategy.doSell("Long

Target",Strategy.LIMIT,Strategy.THISBAR,Strategy.ALL,Math.max(open(0),TargetPrice));

drawShape(Shape.DOWNARROW,TopRow2,Color.green,"LongTarget"+rawtime(0));

drawText("LT",TopRow1,Color.green,Text.CENTER,"LT"+rawtime(0));

vPosition = 0;

}

if(low(0)<=StopPrice) {

if (bBT) Strategy.doSell("Long

Stop",Strategy.STOP,Strategy.THISBAR,Strategy.ALL,Math.min(open(0),StopPrice));

drawShape(Shape.DOWNARROW,TopRow2,Color.red,"LongStop"+rawtime(0));

drawText("LS",TopRow1,Color.red,Text.CENTER,"LS"+rawtime(0));

vPosition = 0;

}

}

if(vPosition == -1) { // Short Exit

if(low(0)<=TargetPrice){

if (bBT) Strategy.doCover("Short

Target",Strategy.LIMIT,Strategy.THISBAR,Strategy.ALL,Math.min(open(0),TargetPrice));

drawShape(Shape.UPARROW,BottomRow2,Color.green,"ShortTarget"+rawtime(0));

drawText("ST",BottomRow1,Color.green,Text.CENTER,"ST"+rawtime(0));

vPosition = 0;

}

if(high(0)>=StopPrice) {

if (bBT) Strategy.doCover("Short

Stop",Strategy.STOP,Strategy.THISBAR,Strategy.ALL,Math.max(open(0),StopPrice));

drawShape(Shape.UPARROW,BottomRow2,Color.red,"ShortStop"+rawtime(0));

drawText("SS",BottomRow1,Color.red,Text.CENTER,"SS"+rawtime(0));

vPosition = 0;

}

}

if(getBarState()==BARSTATE_NEWBAR) {

// Long Entry

if(vPosition != 1 && nPremiere_2>Line1&&nPremiere_1<Line1||nPremiere_2>Line2&&nPremiere_1<Line2) {

if (bBT) Strategy.doLong("Long Entry",Strategy.MARKET,Strategy.THISBAR,Strategy.DEFAULT);

drawShape(Shape.UPARROW,BottomRow2,Color.blue,"LongEntry"+rawtime(0));

drawText("LE",BottomRow1,Color.blue,Text.CENTER,"LE"+rawtime(0));

TargetPrice = open(0)*(1+(Profit/100));

StopPrice = open(0)*(1-(Stop/100));

vPosition = 1;

}

// Short Entry

if(vPosition != -1 &&

nPremiere_2<Line1*(-1)&&nPremiere_1>Line1*(-1)||nPremiere_2<Line2*(-1)&&nPremiere_1>Line2*(-1)) {

if (bBT) Strategy.doShort("Short Entry",Strategy.MARKET,Strategy.THISBAR,Strategy.DEFAULT);

drawShape(Shape.DOWNARROW,TopRow2,Color.magenta,"ShortEntry"+rawtime(0));

drawText("SE",TopRow1,Color.magenta,Text.CENTER,"SE"+rawtime(0));

TargetPrice = open(0)*(1-(Profit/100));

StopPrice = open(0)*(1+(Stop/100));

vPosition = -1;

}

}

if (nPremiere_0 >= 0) setBarFgColor(Color.blue);

else setBarFgColor(Color.red);

if (vPosition == 1) setDefaultPriceBarColor(Color.blue);

else if (vPosition == -1) setDefaultPriceBarColor(Color.red);

else setDefaultPriceBarColor(Color.lightgrey);

return nPremiere_0;

}

var xSmoothStoch = null;

function calcPremiere(_stochlength,_period) {

if(_period<0)

var Length = 1;

else

var Length = Math.sqrt(_period);

if(xSmoothStoch==null) xSmoothStoch = ema(Length,ema(Length,efsInternal("normStoch",_stochlength)));

var nSmoothStoch = xSmoothStoch.getValue(0);

if(nSmoothStoch==null) return;

return (Math.exp(1*nSmoothStoch)-1)/(Math.exp(1*nSmoothStoch)+1);

}

var xStochK = null;

function normStoch(_stochlength) {

if(xStochK==null) xStochK = stochK(_stochlength,1,1)

var nStochK = xStochK.getValue(0);

if(nStochK==null) return;

return (.1*(nStochK-50));

}

function verify() {

var b = false;

if (getBuildNumber() < 999) {

drawTextAbsolute(5, 35, "This study requires version 10.1 or later.",

Color.white, Color.blue, Text.RELATIVETOBOTTOM|Text.RELATIVETOLEFT|Text.BOLD|Text.LEFT,

null, 13, "error");

drawTextAbsolute(5, 20, "Click HERE to upgrade.@URL=http://www.esignal.com/download/default.asp",

Color.white, Color.blue, Text.RELATIVETOBOTTOM|Text.RELATIVETOLEFT|Text.BOLD|Text.LEFT,

null, 13, "upgrade");

return b;

} else {

b = true;

}

return b;

}