File Name: MACD_RevCrossover.efs

Description:

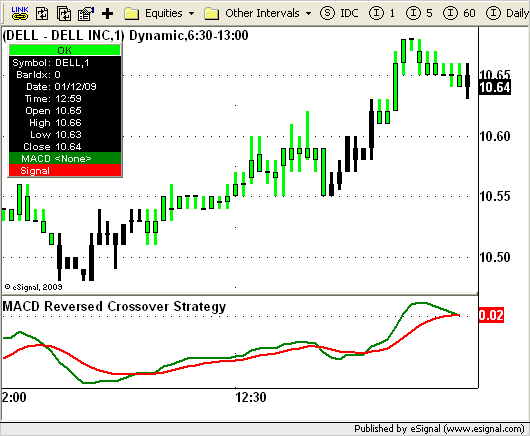

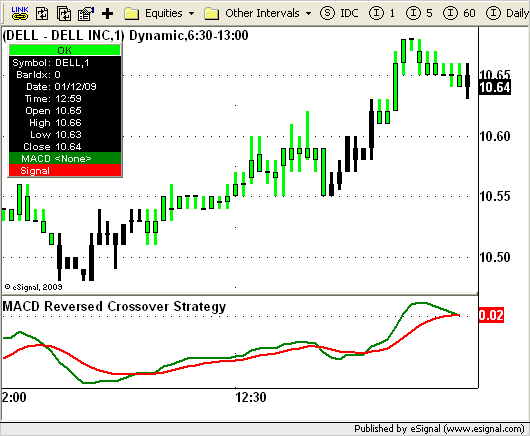

MACD Reversed Crossover Strategy, by Donald W. Pendergast Jr.

Formula Parameters:

Fast Length : 12

Slow Length : 26

Smoothing : 9

Notes:

The related article is copyrighted material. If you are not

a subscriber of Stocks & Commodities, please visit www.traders.com.

Download File:

MACD_RevCrossover.efs

EFS Code:

Description:

MACD Reversed Crossover Strategy, by Donald W. Pendergast Jr.

Formula Parameters:

Fast Length : 12

Slow Length : 26

Smoothing : 9

Notes:

The related article is copyrighted material. If you are not

a subscriber of Stocks & Commodities, please visit www.traders.com.

Download File:

MACD_RevCrossover.efs

EFS Code:

PHP Code:

/*********************************

Provided By:

eSignal (Copyright c eSignal), a division of Interactive Data

Corporation. 2009. All rights reserved. This sample eSignal

Formula Script (EFS) is for educational purposes only and may be

modified and saved under a new file name. eSignal is not responsible

for the functionality once modified. eSignal reserves the right

to modify and overwrite this EFS file with each new release.

Description:

MACD Reversed Crossover Strategy, by Donald W. Pendergast Jr.

Version: 1.0 01/08/2009

Formula Parameters: Default:

Fast Length 12

Slow Length 26

Smoothing 9

Notes:

The related article is copyrighted material. If you are not

a subscriber of Stocks & Commodities, please visit [url]www.traders.com.[/url]

**********************************/

var fpArray = new Array();

var bInit = false;

var bVersion = null;

function preMain() {

setPriceStudy(false);

setShowTitleParameters( false );

setStudyTitle("MACD Reversed Crossover Strategy");

setColorPriceBars(true);

setDefaultPriceBarColor(Color.black);

setCursorLabelName("MACD", 0);

setCursorLabelName("Signal", 1);

setDefaultBarFgColor(Color.green, 0);

setDefaultBarFgColor(Color.red, 1);

setDefaultBarThickness(2, 0);

setDefaultBarThickness(2, 1);

var x=0;

fpArray[x] = new FunctionParameter("FastLength", FunctionParameter.NUMBER);

with(fpArray[x++]){

setName("Fast Length");

setLowerLimit(1);

setDefault(12);

}

fpArray[x] = new FunctionParameter("SlowLength", FunctionParameter.NUMBER);

with(fpArray[x++]){

setName("Slow Length");

setLowerLimit(1);

setDefault(26);

}

fpArray[x] = new FunctionParameter("Smoothing", FunctionParameter.NUMBER);

with(fpArray[x++]){

setName("Smoothing");

setLowerLimit(0);

setDefault(9);

}

}

var xMACD = null;

var xSignal = null;

function main(FastLength, SlowLength , Smoothing) {

if (bVersion == null) bVersion = verify();

if (bVersion == false) return;

if (getCurrentBarIndex() == 0) return;

if ( bInit == false ) {

xMACD = macd(FastLength, SlowLength, Smoothing);

xSignal = macdSignal(FastLength, SlowLength, Smoothing);

bInit = true;

}

if (xSignal.getValue(-1) == null) return;

if(xSignal.getValue(-2) >= xMACD.getValue(-2) &&

xSignal.getValue(-1) < xMACD.getValue(-1) && !Strategy.isLong()) {

Strategy.doLong("Long", Strategy.MARKET, Strategy.THISBAR);

}

if(xSignal.getValue(-1) > xMACD.getValue(-1) && Strategy.isLong()) {

Strategy.doSell("Exit Long", Strategy.MARKET, Strategy.THISBAR);

}

if(Strategy.isLong())

setPriceBarColor(Color.lime);

else setPriceBarColor(Color.black);

return new Array(xMACD.getValue(0), xSignal.getValue(0));

}

function verify() {

var b = false;

if (getBuildNumber() < 779) {

drawTextAbsolute(5, 35, "This study requires version 8.0 or later.",

Color.white, Color.blue, Text.RELATIVETOBOTTOM|Text.RELATIVETOLEFT|Text.BOLD|Text.LEFT,

null, 13, "error");

drawTextAbsolute(5, 20, "Click HERE to upgrade.@URL=http://www.esignal.com/download/default.asp",

Color.white, Color.blue, Text.RELATIVETOBOTTOM|Text.RELATIVETOLEFT|Text.BOLD|Text.LEFT,

null, 13, "upgrade");

return b;

} else {

b = true;

}

return b;

}