Fabrizio --

I saw your post about the next direction for ES... (and, thought I'd start a new thread...)

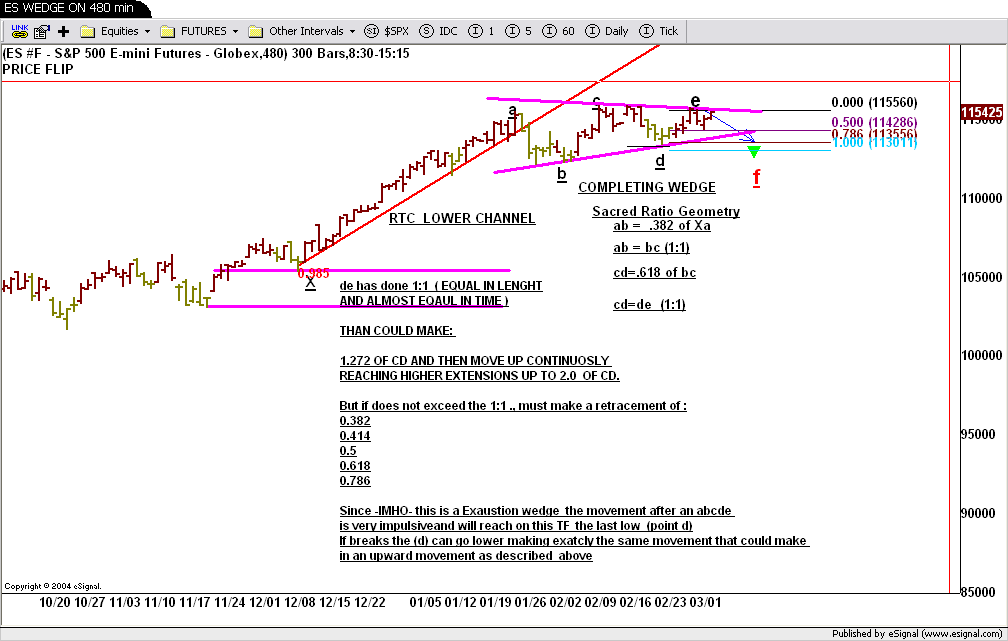

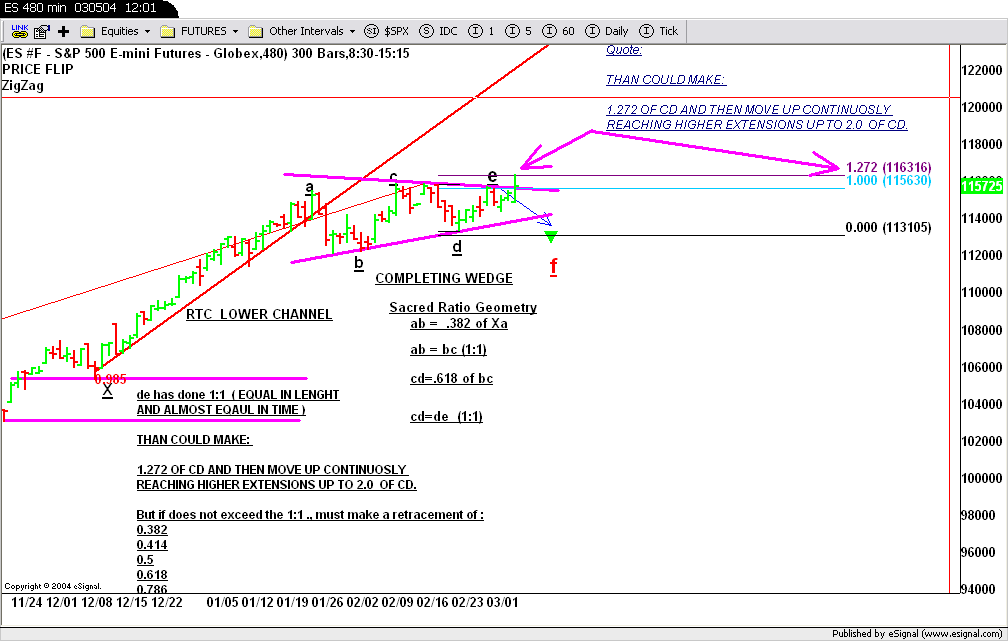

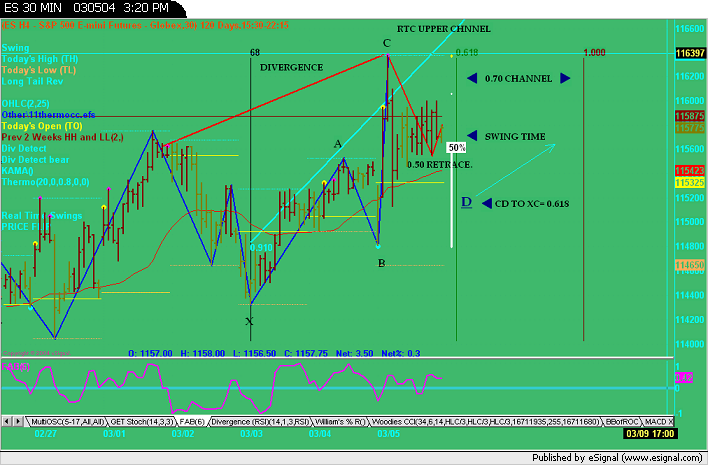

So, playing w/ AGET, I calculated THIS as the next direction.

Why (per AGET):

- Impulse/Correction pattern

- Good PTI

- Meeting ellipse levels

- Proper OSC setup

Why (non-AGET):

- INTC showing complete Wave 4 on weekly / ready to trend up

- Many large caps in indexes showing wave-4 completions

- TRINQ

- Sentiment: People looking for correction.

- Lows: We keep tripping STOP LOSS orders (break lows) but don't have a sell off -- i.e. we are all sold out.

Why would we go down:

- ? Couldn't find a real reason...

Is Tom Joseph around? I'd like him to slap me around a bit and tell me if I'm improperly applying AGET?

Thanks all,

-c

I saw your post about the next direction for ES... (and, thought I'd start a new thread...)

So, playing w/ AGET, I calculated THIS as the next direction.

Why (per AGET):

- Impulse/Correction pattern

- Good PTI

- Meeting ellipse levels

- Proper OSC setup

Why (non-AGET):

- INTC showing complete Wave 4 on weekly / ready to trend up

- Many large caps in indexes showing wave-4 completions

- TRINQ

- Sentiment: People looking for correction.

- Lows: We keep tripping STOP LOSS orders (break lows) but don't have a sell off -- i.e. we are all sold out.

Why would we go down:

- ? Couldn't find a real reason...

Is Tom Joseph around? I'd like him to slap me around a bit and tell me if I'm improperly applying AGET?

Thanks all,

-c

Comment