All,

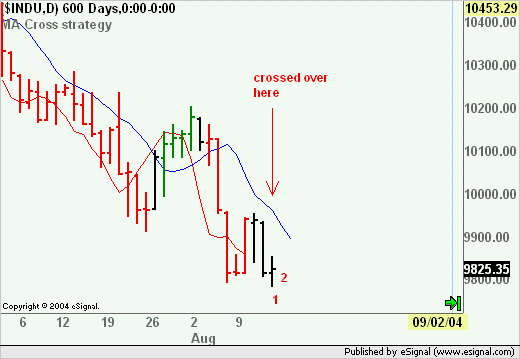

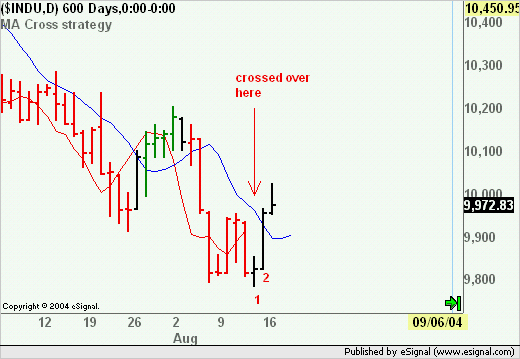

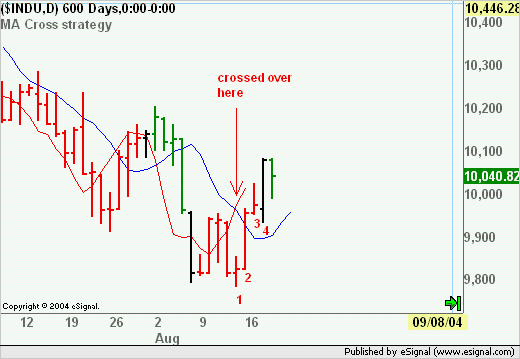

I have developed an efs strategy and have attached it to this. In the strategy I use to MA's both offset. One is offset -3 the other +2.

When I run it through the backtester I get great results. When I use it during a live trading day my offset -3 returns null and it seems that my offset +2 returns the MA value of the current bar not the +2 displaced value.

Why does this work in the backtester and not on live data?

Thanks,

Jon

I have developed an efs strategy and have attached it to this. In the strategy I use to MA's both offset. One is offset -3 the other +2.

When I run it through the backtester I get great results. When I use it during a live trading day my offset -3 returns null and it seems that my offset +2 returns the MA value of the current bar not the +2 displaced value.

Why does this work in the backtester and not on live data?

Thanks,

Jon

Comment