Oh....great ones that write in strange language.

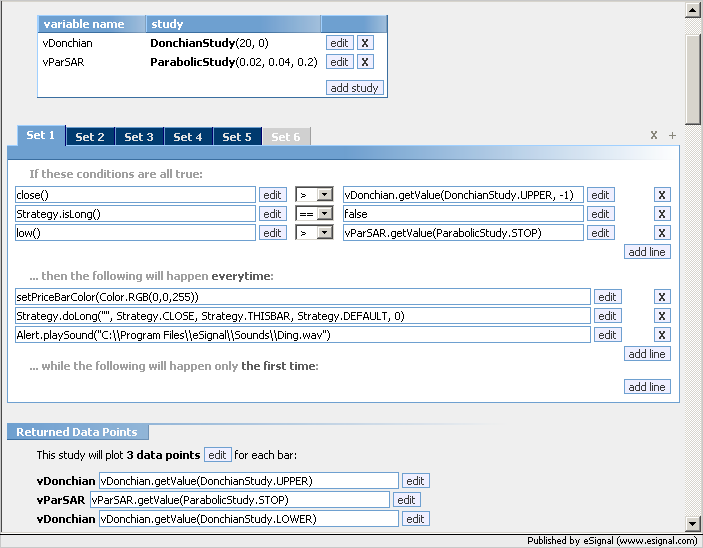

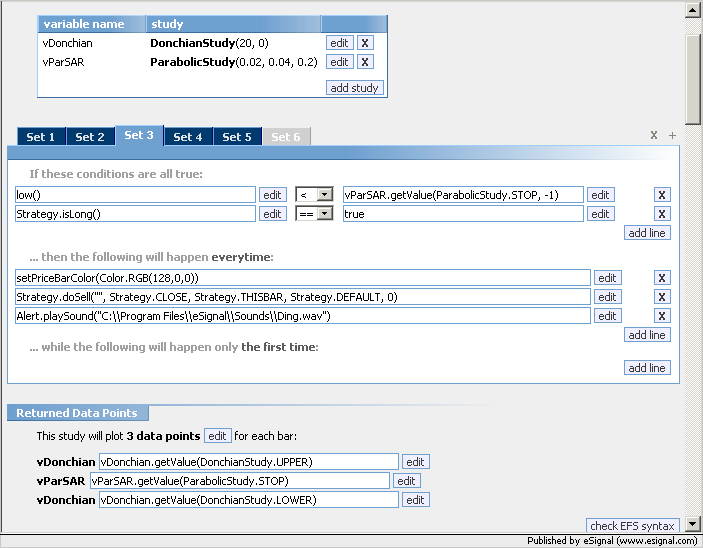

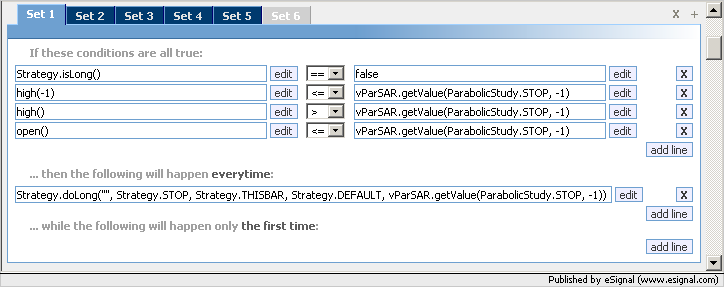

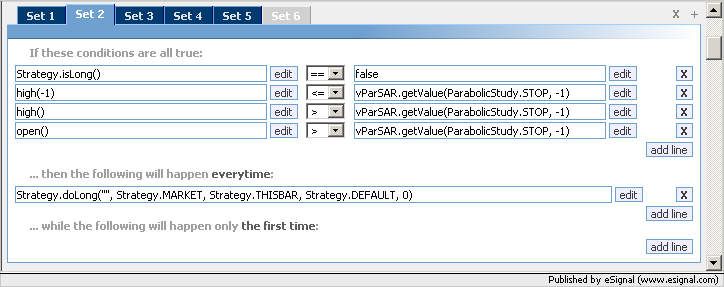

Can this EFS be modified to buy/sell the next open after a close above/below the Donchian Channel) with a protective/loss stop at the Parabolic S&R.

I made an attempt but it was a disaster.

Russ

Can this EFS be modified to buy/sell the next open after a close above/below the Donchian Channel) with a protective/loss stop at the Parabolic S&R.

I made an attempt but it was a disaster.

Russ

Comment