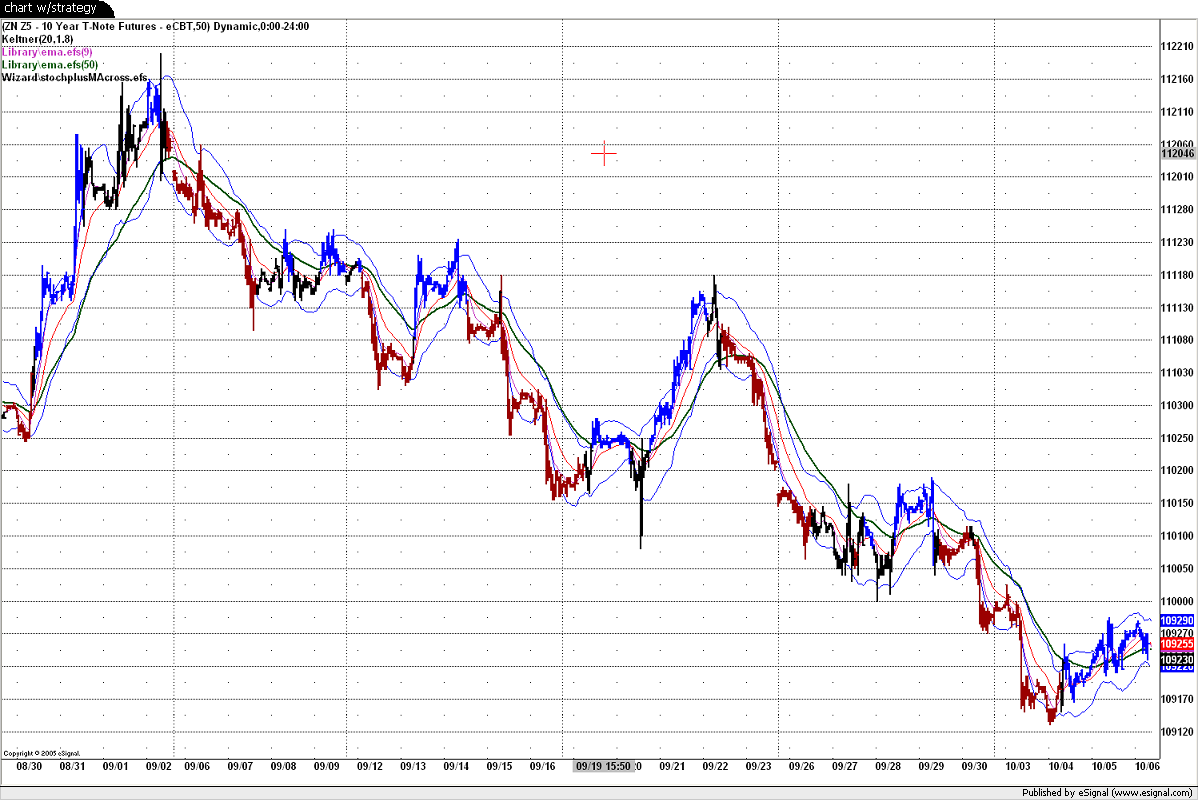

I have created a trading strategy in formula wizard. I am up to the point where I am getting the bars on my chart to be blue when my strategy is bullish, red when my strategy is bearish, and black when it is neutral. I go to the backtester and test this strategy, and it just says calculating for a while, then I try to close the window, and I have to shut down esignal because the program doesn't respond.

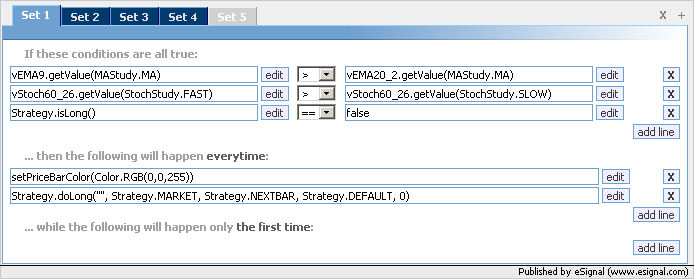

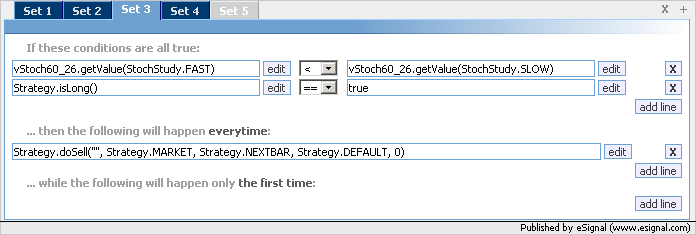

I really want to backtest my strategy. I am thinking there is more coding to be done for the strategy, but I don't know what it is. I even put the "doLong" line in when I want to buy, and "doShort" line in when I want to sell. But apparently, there is more to do.I have read some info in the knowledge base, and I am not figuring out "where to put what" so to speak.

I know I can source this work to a third party that Esignal is linked with, or any EFS expert for that matter. I want to see if I can complete this without using that option though.

I appreciate any help you can provide.

I really want to backtest my strategy. I am thinking there is more coding to be done for the strategy, but I don't know what it is. I even put the "doLong" line in when I want to buy, and "doShort" line in when I want to sell. But apparently, there is more to do.I have read some info in the knowledge base, and I am not figuring out "where to put what" so to speak.

I know I can source this work to a third party that Esignal is linked with, or any EFS expert for that matter. I want to see if I can complete this without using that option though.

I appreciate any help you can provide.

Comment