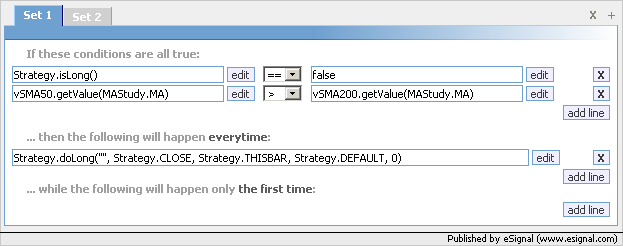

I'm trying to put together an EFS strategy where when the 50day MA crosses over the 200day MA it triggers a BUY. When the two moving averages do the opposite a sell is triggered.

When I am making a new EFS formula the only strategy I can develop creates buys for EVERY DAY the 50day MA is above the 200day MA and vice versa on the downside. This is not what I'm looking to accomplish.

How can I input a constraint that will show within the strategy a SINGLE buy and a SINGLE sell every time the MA's crossover eachother. Any help to this effect would be great!

When I am making a new EFS formula the only strategy I can develop creates buys for EVERY DAY the 50day MA is above the 200day MA and vice versa on the downside. This is not what I'm looking to accomplish.

How can I input a constraint that will show within the strategy a SINGLE buy and a SINGLE sell every time the MA's crossover eachother. Any help to this effect would be great!

Comment