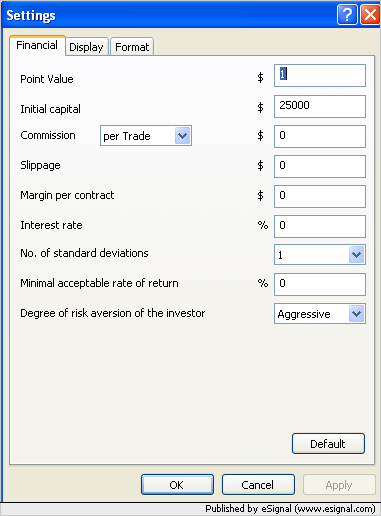

I have an intraday strategy that buys and sells stocks that i am trying to backtest.....i run the backtest and have the parameters set to sell (close the long position) at either a 1.00% gain or after a certain number of bars (time has elapsed).....i ran the back tester and then looked at the Strategy Analyzer and looked at my list of Trades.....I did the backtest on the stock QCOM.....The first trade it listed was this:

EntryLong 5/17/06 9:30 am Price=46.39 Contracts = 100

ExitLong 5/17/06 9:35 am Price =46.85 Contracts = 100

under the Profit column it says i made $46.39

Under the Profit (%) column it says .05%

My question is about the .05% profit %????

If you do the math....buy at 46.39 and sell at 46.85.....the return is 1.00% not .05%.......can somebody explain to me why the Strategy Analyzer has the wrong value????

EntryLong 5/17/06 9:30 am Price=46.39 Contracts = 100

ExitLong 5/17/06 9:35 am Price =46.85 Contracts = 100

under the Profit column it says i made $46.39

Under the Profit (%) column it says .05%

My question is about the .05% profit %????

If you do the math....buy at 46.39 and sell at 46.85.....the return is 1.00% not .05%.......can somebody explain to me why the Strategy Analyzer has the wrong value????

Comment