Hi

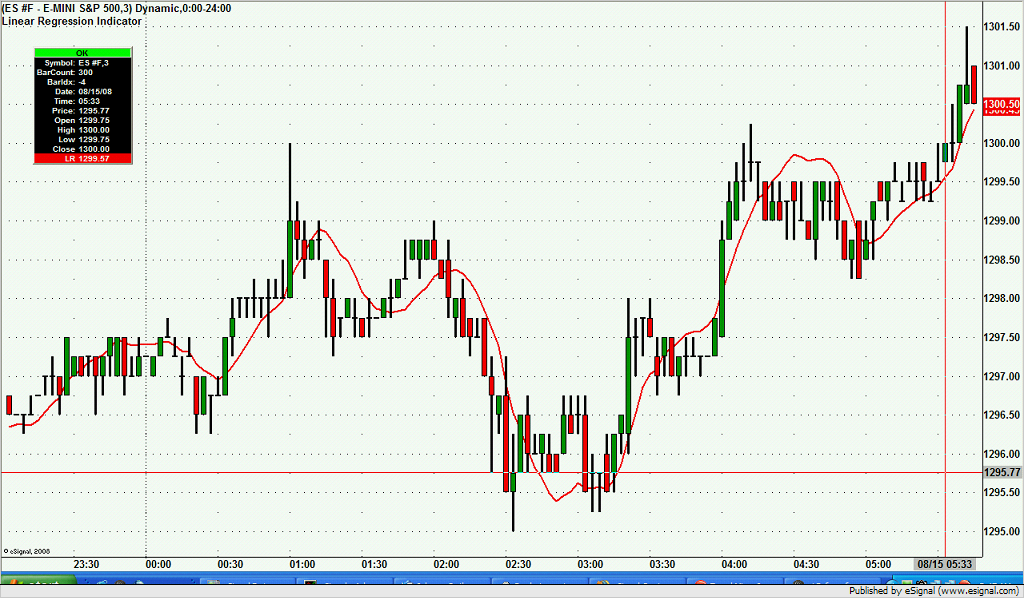

I have just started to use e signal after using amibroker for a while. I have created formulas in AB for backtesting but am struggling to convert them to EFS. Could somebody please advise how to convert the following.

Buy = LinearReg( Close , 13 ) > Ref( LinearReg( Close , 13 ) , -1 )

AND Ref( LinearReg( Close , 13) , -1 ) > Ref( LinearReg( Close , 13 ) , -2 )

Pretty much it says to create a buy signal at open on the next bar when the LRI has risen for the last 2 bars. Any help is appreciated.

Thanks

Dean

I have just started to use e signal after using amibroker for a while. I have created formulas in AB for backtesting but am struggling to convert them to EFS. Could somebody please advise how to convert the following.

Buy = LinearReg( Close , 13 ) > Ref( LinearReg( Close , 13 ) , -1 )

AND Ref( LinearReg( Close , 13) , -1 ) > Ref( LinearReg( Close , 13 ) , -2 )

Pretty much it says to create a buy signal at open on the next bar when the LRI has risen for the last 2 bars. Any help is appreciated.

Thanks

Dean

Comment