I want to backtest a simple system for a 5min chart.

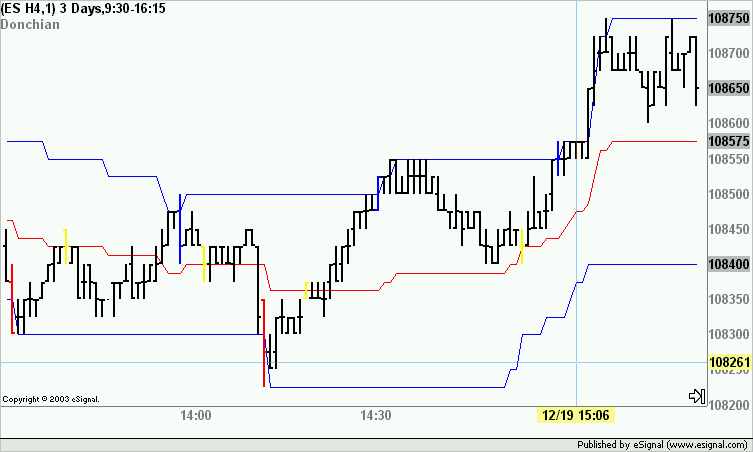

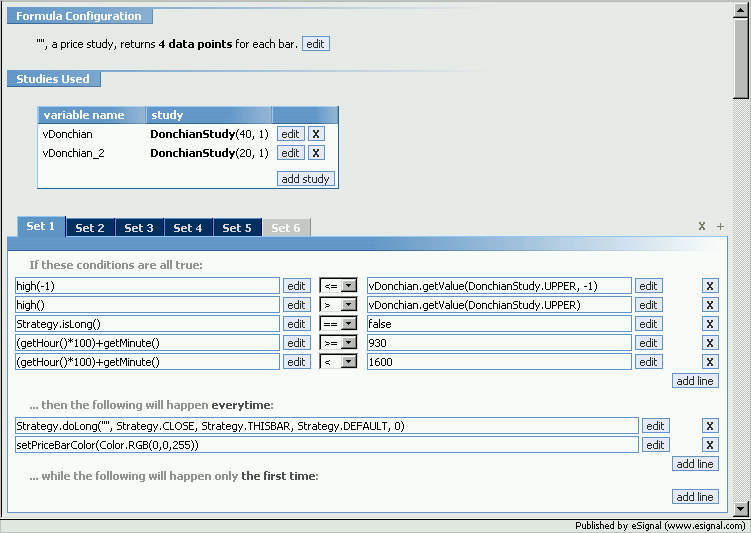

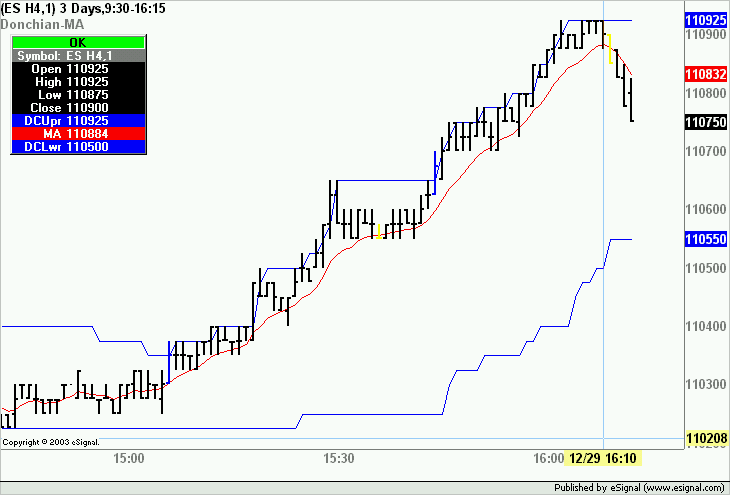

Its basically a donchian system that using a 40 bar high to enter long and 40 bar low to exit long. Since the system always has a position on.. it also uses a 40 bar low to short and 40 bar high to exit.

Can someone please code this up so I can run some backtests?

Thanks.

Its basically a donchian system that using a 40 bar high to enter long and 40 bar low to exit long. Since the system always has a position on.. it also uses a 40 bar low to short and 40 bar high to exit.

Can someone please code this up so I can run some backtests?

Thanks.

Comment