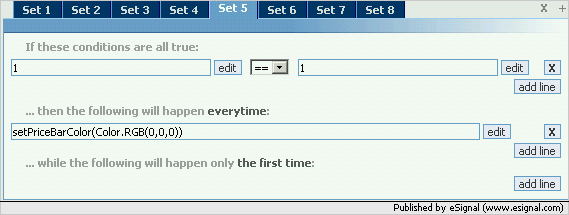

attached is a formula that sets the entry/exit price at the value of the donchian.

how do i make the entry/exit price the donchian or the opening price, whichever is the worst so that the backtest will be as realistic as possible.

thanks for the help.

regards

richard

how do i make the entry/exit price the donchian or the opening price, whichever is the worst so that the backtest will be as realistic as possible.

thanks for the help.

regards

richard

Comment