Morning, wondered if you can help me. I want to back test trading a stock with the following rules....

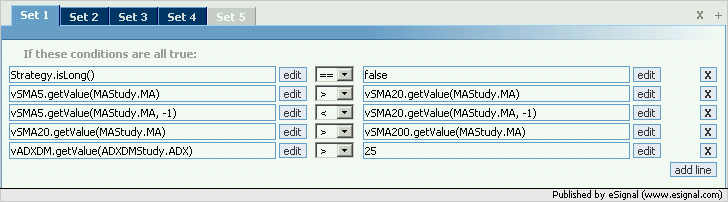

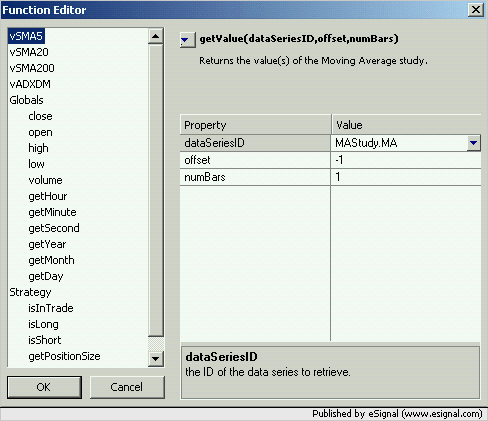

When (5 day simple mov aver) SMA5 becomes > SMA20, only when SMA20 > SMA200, then go long. When SMA5 becomes < SMA20 only when SMA20 > SMA200, then close this long position.

When (5 day simple mov aver) SMA5 becomes < SMA20, only when SMA20 < SMA200, then go short. When SMA5 becomes > SMA20 only when SMA20 < SMA200, then close this short position.

When (5 day simple mov aver) SMA5 becomes > SMA20, only when SMA20 > SMA200, then go long. When SMA5 becomes < SMA20 only when SMA20 > SMA200, then close this long position.

When (5 day simple mov aver) SMA5 becomes < SMA20, only when SMA20 < SMA200, then go short. When SMA5 becomes > SMA20 only when SMA20 < SMA200, then close this short position.

Comment