I am trying to trigger alerts on a spread (one share price divided by another). The trigger works occaisionally. How can I reliably get an alert on a user defined spread price? Thx

Announcement

Collapse

No announcement yet.

Triggered Alerts on User Defined Spreads

Collapse

X

-

Triggered Alerts on User Defined Spreads

What I meant was the following:

I have created a small number of User Defined Spreads primarily A/B where A is the last price of a and B is the last price of b.

Next I have plotted this user defined spread (A/B) in an Advanced Chart and added Bollinger Bands and RSI to the price-time series.

Then by right clicking on the Advanced Chart, I went to FORMULA - WIZARD - ALERTS and selected Bollinger Bands Piercing and RSI Overbought/Oversold. These work fine on a single stock price-time series by alerting the user to when the Upper or Lower Bollinger Band is pierced by the price or when the RSI is above or below a certain value. This does not seem to work so well for a User Defined Spread.

Your suggested thread means that an alert is triggered at a specific price level. This is not what I want to achieve - I want to know when the price action pierces the B/Bands and/or RSI is > 80 or < 20.

I hope this helps explain in more detail what I am trying to achieve. Tks d

Comment

-

drooney

As far as I can see both efs are triggering the alerts correctly even with spreads (or ratios).

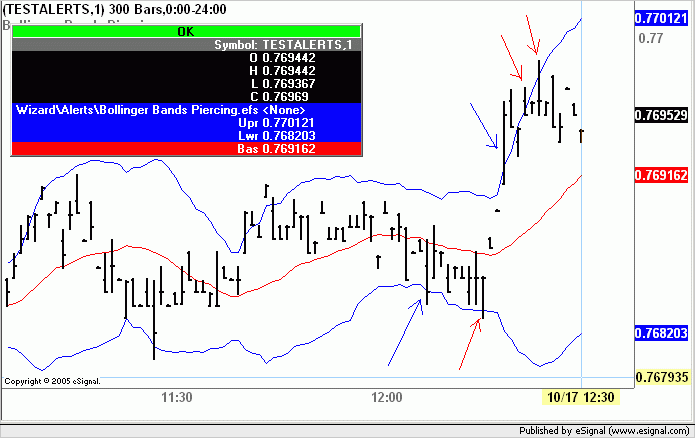

Having said that you need to understand the way the alerts are set up to be triggered in those scripts which is only on the first event per side. To illustrate what I mean see the following image showing also the Basic Studies Bollinger Bands for reference purposes

The blue arrows indicate the bar on which the alerts will be triggered. Subsequent alerts on the same side (ie the bars indicated by the red arrows) will not trigger any alerts. The reset for any one side is provided by an alert being triggerd on the opposite side. The same logic is implemented in the RSI Overbought-Oversold.efs

You would need to modify the studies using the Formula Wizard to change the behavior of the alerts which are currently set to trigger only the first time.

For information and examples on how to use the Formula Wizard see the Formula Wizard Guide in the EFS KnowledgeBase.

Also try running a search using alert* as the keyword and you should find several scripts that trigger alerts based on RSI and other studies that you can use as examples

Alex

Comment

Comment