How can we program ATR as an amount for different securities to use in setting volatility stops?

Announcement

Collapse

No announcement yet.

Average True Range

Collapse

X

-

Premier

Before running the efs indicated by Duane you may want to open it using the Editor (Tools->EFS->Editor) and preceed lines 50, 51 and 52 with a // thereby commenting them out (the lines should be now all grey). Once you have done that Save the efs. This will help speed up the efs considerably.

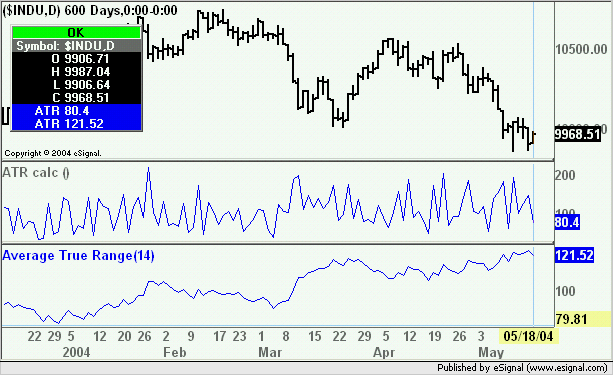

The next thing you want to do is compare apples with apples. The default length for the ATR calc efs is 1 whereas the builtin ATR is set to 14 hence the differences you may be seeing (see top image).

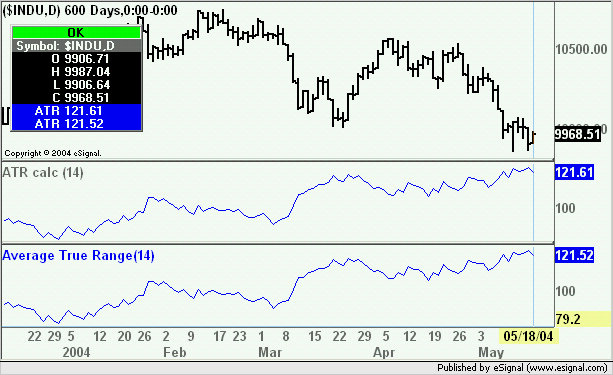

Right click the ATR calc window, select Edit Studies and set nLength to 14. At that point you should see similar plots with some very marginal differences in the values of the two indicators (see bottom image)

Alex

Comment

Comment