Description:

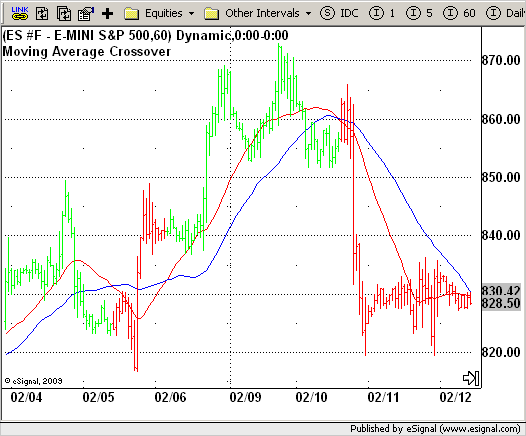

Moving Average Crossover

Formula Parameters:

Length Fast SMA : 20

Length Slow SMA : 40

Notes:

The Moving Average Crossover trading strategy is possibly the most popular

trading strategy in the world of trading. First of them were written in the

middle of XX century, when commodities trading strategies became popular.

This strategy is a good example of so-called traditional strategies. Traditional

strategies are always long or short. That means they are never out of the market.

The concept of having a strategy that is always long or short may be scary,

particularly in today?s market where you don?t know what is going to happen as

far as risk on any one market. But a lot of traders believe that the concept is

still valid, especially for those of traders who do their own research or their

own discretionary trading.

Download File:

strMAcrsv.efs

EFS Code:

PHP Code:

/*********************************

Provided By:

eSignal (Copyright c eSignal), a division of Interactive Data

Corporation. 2009. All rights reserved. This sample eSignal

Formula Script (EFS) is for educational purposes only and may be

modified and saved under a new file name. eSignal is not responsible

for the functionality once modified. eSignal reserves the right

to modify and overwrite this EFS file with each new release.

Description:

Moving Average Crossover

Version: 1.0 03/24/2009

Formula Parameters: Default:

Length Fast SMA 20

Length Slow SMA 40

Notes:

The Moving Average Crossover trading strategy is possibly the most popular

trading strategy in the world of trading. First of them were written in the

middle of XX century, when commodities trading strategies became popular.

This strategy is a good example of so-called traditional strategies. Traditional

strategies are always long or short. That means they are never out of the market.

The concept of having a strategy that is always long or short may be scary,

particularly in today?s market where you don?t know what is going to happen as

far as risk on any one market. But a lot of traders believe that the concept is

still valid, especially for those of traders who do their own research or their

own discretionary trading.

**********************************/

var fpArray = new Array();

var bInit = false;

function preMain() {

setPriceStudy(true);

setStudyTitle("Moving Average Crossover");

setColorPriceBars(true);

setDefaultPriceBarColor(Color.black);

setPlotType(PLOTTYPE_LINE,0);

setDefaultBarFgColor(Color.red, 0);

setPlotType(PLOTTYPE_LINE,1);

setDefaultBarFgColor(Color.blue, 1);

var x=0;

fpArray[x] = new FunctionParameter("Length", FunctionParameter.NUMBER);

with(fpArray[x++]){

setName("Length Fast SMA");

setLowerLimit(1);

setDefault(20);

}

var x=0;

fpArray[x] = new FunctionParameter("Length2", FunctionParameter.NUMBER);

with(fpArray[x++]){

setName("Length Slow SMA");

setLowerLimit(1);

setDefault(40);

}

}

var xSMAFast = null;

var xSMASlow = null;

function main(Length, Length2) {

var nBarState = getBarState();

var nSMAFast = 0;

var nSMASlow = 0;

if (nBarState == BARSTATE_ALLBARS) {

if (Length == null) Length = 20;

if (Length2 == null) Length2 = 40;

}

if (bInit == false) {

xSMAFast = sma(Length);

xSMASlow = sma(Length2);

bInit = true;

}

nSMAFast = xSMAFast.getValue(-1);

nSMASlow = xSMASlow.getValue(-1);

if(nSMAFast == null || nSMASlow == null) return;

if (getCurrentBarIndex() == 0) return;

if(nSMAFast >= nSMASlow && !Strategy.isLong())

Strategy.doLong("Crossing Up", Strategy.MARKET, Strategy.THISBAR);

if(nSMAFast < nSMASlow && !Strategy.isShort())

Strategy.doShort("Crossing Down", Strategy.MARKET, Strategy.THISBAR);

if(Strategy.isLong())

setPriceBarColor(Color.lime);

else if(Strategy.isShort())

setPriceBarColor(Color.red);

return new Array(nSMAFast, nSMASlow);

}