File Name: NonLinearExits.efs

Description:

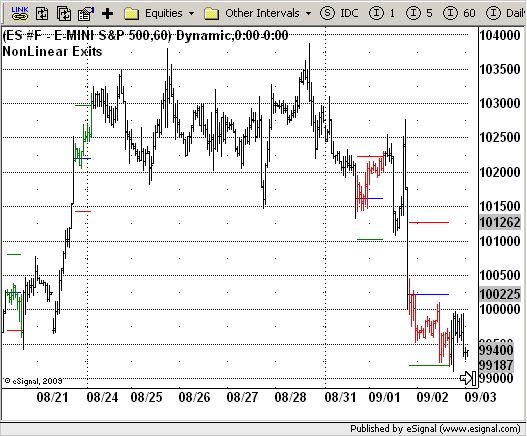

NonLinear Exits

Formula Parameters:

Fraction of ATR for entry : 1

Length of channel for breakout : 20

Length of moving average : 30

Length of ATR, short-term : 10

Length of ATR, long-term : 200

Number of bars from entry to exit : 20

Constants for nonlinear exits a0 : 1

Constants for nonlinear exits a2 : 1

Constants for nonlinear exits a3 : 0.02

Constants for nonlinear exits b0 : 1

Constants for nonlinear exits b2 : 1

Constants for nonlinear exits b3 : 0.02

Notes:

This system illustrates different kinds of nonlinear

exits based on volatility, as given by the average

true range (ATR).

Mike Bryant

Breakout Futures

Download File:

NonLinearExits.efs

EFS Code:

Description:

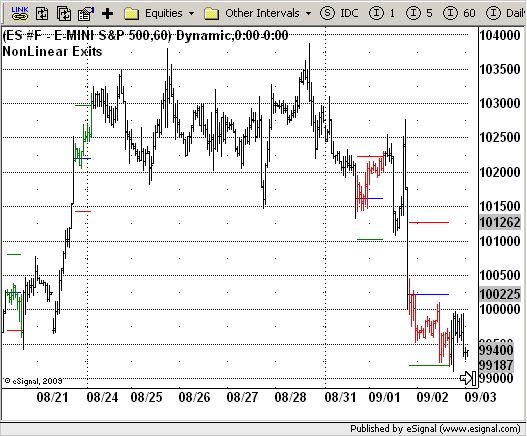

NonLinear Exits

Formula Parameters:

Fraction of ATR for entry : 1

Length of channel for breakout : 20

Length of moving average : 30

Length of ATR, short-term : 10

Length of ATR, long-term : 200

Number of bars from entry to exit : 20

Constants for nonlinear exits a0 : 1

Constants for nonlinear exits a2 : 1

Constants for nonlinear exits a3 : 0.02

Constants for nonlinear exits b0 : 1

Constants for nonlinear exits b2 : 1

Constants for nonlinear exits b3 : 0.02

Notes:

This system illustrates different kinds of nonlinear

exits based on volatility, as given by the average

true range (ATR).

Mike Bryant

Breakout Futures

Download File:

NonLinearExits.efs

EFS Code:

PHP Code:

/*********************************

Provided By:

eSignal (Copyright c eSignal), a division of Interactive Data

Corporation. 2009. All rights reserved. This sample eSignal

Formula Script (EFS) is for educational purposes only and may be

modified and saved under a new file name. eSignal is not responsible

for the functionality once modified. eSignal reserves the right

to modify and overwrite this EFS file with each new release.

Description:

NonLinear Exits

Version: 1.01 11/16/2009

Formula Parameters: Default:

Fraction of ATR for entry 1

Length of channel for breakout 20

Length of moving average 30

Length of ATR, short-term 10

Length of ATR, long-term 200

Number of bars from entry to exit 20

Constants for nonlinear exits a0 1

Constants for nonlinear exits a2 1

Constants for nonlinear exits a3 0.02

Constants for nonlinear exits b0 1

Constants for nonlinear exits b2 1

Constants for nonlinear exits b3 0.02

Notes:

This system illustrates different kinds of nonlinear

exits based on volatility, as given by the average

true range (ATR).

Mike Bryant

Breakout Futures

//www.breakoutfutures.com/Newsletters/Newsletter0608.htm

//www.BreakoutFutures.com

**********************************/

var fpArray = new Array();

var bInit = false;

function preMain() {

setPriceStudy(true);

setShowCursorLabel(true);

setShowTitleParameters(false);

setStudyTitle("NonLinear Exits");

setDefaultPriceBarColor(Color.black);

setCursorLabelName("Open Price", 0);

setDefaultBarFgColor(Color.blue, 0);

setPlotType(PLOTTYPE_FLATLINES, 0);

setDefaultBarThickness(1, 0);

setCursorLabelName("Take Profit Price", 1);

setDefaultBarFgColor(Color.green, 1);

setPlotType(PLOTTYPE_FLATLINES, 1);

setDefaultBarThickness(1, 1);

setCursorLabelName("Stop Loss Price", 2);

setDefaultBarFgColor(Color.red, 2);

setPlotType(PLOTTYPE_FLATLINES, 2);

setDefaultBarThickness(1, 2);

setColorPriceBars(true);

askForInput();

var x=0;

fpArray[x] = new FunctionParameter("EntFr", FunctionParameter.NUMBER);

with(fpArray[x++]){

setName("Fraction of ATR for entry");

setLowerLimit(1);

setDefault(1);

}

fpArray[x] = new FunctionParameter("NChan", FunctionParameter.NUMBER);

with(fpArray[x++]){

setName("Length of channel for breakout");

setLowerLimit(1);

setDefault(20);

}

fpArray[x] = new FunctionParameter("NMA", FunctionParameter.NUMBER);

with(fpArray[x++]){

setName("Length of moving average");

setLowerLimit(1);

setDefault(30);

}

fpArray[x] = new FunctionParameter("NATRst", FunctionParameter.NUMBER);

with(fpArray[x++]){

setName("Length of ATR, short-term");

setLowerLimit(1);

setDefault(10);

}

fpArray[x] = new FunctionParameter("NATRlt", FunctionParameter.NUMBER);

with(fpArray[x++]){

setName("Length of ATR, long-term");

setLowerLimit(1);

setDefault(200);

}

fpArray[x] = new FunctionParameter("NBExit", FunctionParameter.NUMBER);

with(fpArray[x++]){

setName("Number of bars from entry to exit");

setLowerLimit(1);

setDefault(20);

}

fpArray[x] = new FunctionParameter("a0", FunctionParameter.NUMBER);

with(fpArray[x++]){

setName("Constants for nonlinear exits a0");

setLowerLimit(0);

setDefault(1);

}

fpArray[x] = new FunctionParameter("a1", FunctionParameter.NUMBER);

with(fpArray[x++]){

setName("Constants for nonlinear exits a1");

setLowerLimit(0);

setDefault(1);

}

fpArray[x] = new FunctionParameter("a2", FunctionParameter.NUMBER);

with(fpArray[x++]){

setName("Constants for nonlinear exits a2");

setLowerLimit(0);

setDefault(0.02);

}

fpArray[x] = new FunctionParameter("b0", FunctionParameter.NUMBER);

with(fpArray[x++]){

setName("Constants for nonlinear exits b0");

setLowerLimit(0);

setDefault(1);

}

fpArray[x] = new FunctionParameter("b1", FunctionParameter.NUMBER);

with(fpArray[x++]){

setName("Constants for nonlinear exits b1");

setLowerLimit(0);

setDefault(1);

}

fpArray[x] = new FunctionParameter("b2", FunctionParameter.NUMBER);

with(fpArray[x++]){

setName("Constants for nonlinear exits b2");

setLowerLimit(0);

setDefault(0.02);

}

}

var xATRst = null;

var xATRlt = null;

var xMA = null;

var xHH = null;

var xLL = null;

var xClose = null;

var xOpen = null;

var nEntryBar = 0;

var nPriceEntry = 0;

var nPriceProfit = 0;

var nPriceLoss = 0;

var bOut = false;

function main(EntFr, NChan, NMA, NATRst, NATRlt, NBExit, a0, a1, a2, b0, b1, b2) {

var nBarState = getBarState();

var EntLong = false;

var EntShort = false;

var nMA = 0;

var nHH1 = 0;

var nLL1 = 0;

var nClose = 0;

var nOpen = 0;

var ExitSz1 = 0;

var ExitSz2 = 0;

var ATRst = 0;

var ATRlt = 0;

if (nBarState == BARSTATE_ALLBARS) {

if (EntFr == null) EntFr = 1;

if (NChan == null) NChan = 20;

if (NMA == null) NMA = 30;

if (NATRst == null) NATRst = 10;

if (NATRlt == null) NATRlt = 200;

if (NBExit == null) NBExit = 20;

if (a0 == null) a0 = 1;

if (a1 == null) a1 = 1;

if (a2 == null) a2 = 0.02;

if (b0 == null) b0 = 1;

if (b1 == null) b1 = 1;

if (b2 == null) b2 = 0.02;

}

if (bInit == false) {

xATRst = sma(NATRst, atr(1));

xATRlt = sma(NATRlt, atr(1));

xMA = sma(NMA);

xHH = upperDonchian(NChan);

xLL = lowerDonchian(NChan);

xClose = close();

xHigh = high();

xLow = low();

xOpen = open();

bInit = true;

}

nMA = xMA.getValue(-1);

nHH1 = xHH.getValue(-2);

nLL1 = xLL.getValue(-2);

nClose = xClose.getValue(-1);

ATRst = xATRst.getValue(-1);

ATRlt = xATRlt.getValue(-1);

nOpen = xOpen.getValue(0);

if (getCurrentBarIndex() == 0) return;

if (nHH1 == null || nMA == null || ATRst == null || ATRlt == null) return;

if (nClose > nMA && nClose > (nHH1 + EntFr * ATRst )) {

EntLong = true;

} else {

EntLong = false;

}

if (nClose < nMA && nClose < (nLL1 - EntFr * ATRst )) {

EntShort = true;

} else {

EntShort = false;

}

ExitSz1 = ATRlt * (a0 + a1 * (ATRst / ATRlt) + a2 * Math.pow((ATRst / ATRlt), 2));

ExitSz2 = ATRlt * (b0 + b1 * (ATRst / ATRlt) + b2 * Math.pow((ATRst / ATRlt), 2));

if (EntLong && !Strategy.isLong()) {

Strategy.doLong("Long", Strategy.MARKET, Strategy.THISBAR);

nEntryBar = getCurrentBarCount();

nPriceProfit = nClose + ExitSz2;

nPriceLoss = nClose - ExitSz1;

nPriceEntry = nClose;

setPriceBarColor(Color.green);

} else {

if (EntShort && !Strategy.isShort()) {

Strategy.doShort("Short", Strategy.MARKET, Strategy.THISBAR);

nEntryBar = getCurrentBarCount();

nPriceProfit = nClose - ExitSz2;

nPriceLoss = nClose + ExitSz1;

nPriceEntry = nClose;

setPriceBarColor(Color.red);

} else {

if(Strategy.isLong()) {

setPriceBarColor(Color.green);

if (getCurrentBarCount() - nEntryBar >= NBExit) {

Strategy.doSell("NBar-L", Strategy.CLOSE, Strategy.THISBAR);

} else {

Strategy.doSell("Targ-L", Strategy.LIMIT, Strategy.THISBAR, Strategy.ALL, Math.max(nPriceProfit, nOpen));

Strategy.doSell("MM-L", Strategy.STOP, Strategy.THISBAR, Strategy.ALL, Math.min(nPriceLoss, nOpen));

}

if (!Strategy.isLong()) bOut = true;

} else {

if(Strategy.isShort()) {

setPriceBarColor(Color.red);

if (getCurrentBarCount() - nEntryBar >= NBExit) {

Strategy.doCover("NBar-S", Strategy.CLOSE, Strategy.THISBAR);

} else {

Strategy.doCover("Targ-S", Strategy.LIMIT, Strategy.THISBAR, Strategy.ALL, Math.min(nPriceProfit, nOpen));

Strategy.doCover("MM-S", Strategy.STOP, Strategy.THISBAR, Strategy.ALL, Math.max(nPriceLoss, nOpen));

}

if (!Strategy.isShort()) bOut = true;

}

}

}

}

if (bOut == true) {

nPriceEntry = 0;

nPriceProfit = 0;

nPriceLoss = 0;

bOut = false;

}

if (nPriceEntry != 0) {

return new Array(nPriceEntry, nPriceProfit, nPriceLoss);

} else {

return;

}

}