File Name: ABillW_ActiveFractal.efs

Description:

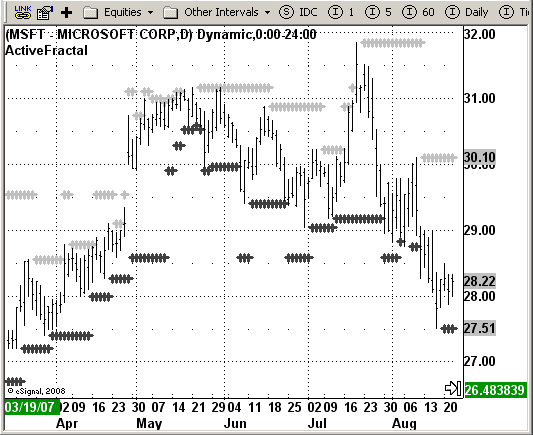

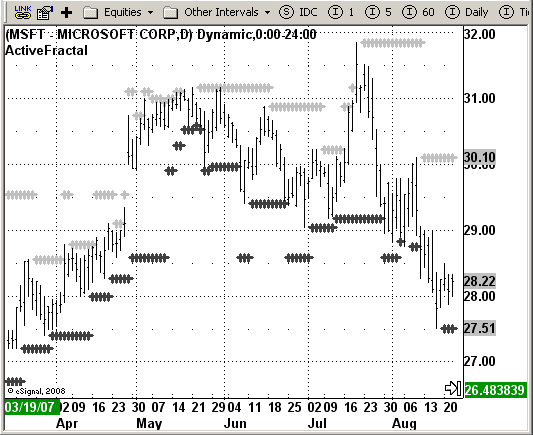

Bill Williams. ActiveFractal

Formula Parameters:

Notes:

According to Bill Williams, one should enter the market after the new

price top (for long positions) or bottom (for short positions) has

been broken through. The identification here is based on defining the

genuine fractal formation; an upward fractal is detected if there is a

row (at least three) increasing values and after the local top has been achieved,

bars (at least two bars) show a constant descent. So the model requires at least

5 bars of which the middle ont is the local top (upward fractal) or the local

bottom (downward fractal)

This indicator highlights periods suited for buying in Light Grey, an periods

suited for selling in Dark Grey.

Download File:

ABillW_ActiveFractal.efs

EFS Code:

Description:

Bill Williams. ActiveFractal

Formula Parameters:

Notes:

According to Bill Williams, one should enter the market after the new

price top (for long positions) or bottom (for short positions) has

been broken through. The identification here is based on defining the

genuine fractal formation; an upward fractal is detected if there is a

row (at least three) increasing values and after the local top has been achieved,

bars (at least two bars) show a constant descent. So the model requires at least

5 bars of which the middle ont is the local top (upward fractal) or the local

bottom (downward fractal)

This indicator highlights periods suited for buying in Light Grey, an periods

suited for selling in Dark Grey.

Download File:

ABillW_ActiveFractal.efs

EFS Code:

PHP Code:

/*********************************

Provided By:

eSignal (Copyright c eSignal), a division of Interactive Data

Corporation. 2008. All rights reserved. This sample eSignal

Formula Script (EFS) is for educational purposes only and may be

modified and saved under a new file name. eSignal is not responsible

for the functionality once modified. eSignal reserves the right

to modify and overwrite this EFS file with each new release.

Description:

Bill Williams. ActiveFractal

Version: 1.0 10/14/2008

Notes:

According to Bill Williams, one should enter the market after the new

price top (for long positions) or bottom (for short positions) has

been broken through. The identification here is based on defining the

genuine fractal formation; an upward fractal is detected if there is a

row (at least three) increasing values and after the local top has been achieved,

bars (at least two bars) show a constant descent. So the model requires at least

5 bars of which the middle ont is the local top (upward fractal) or the local

bottom (downward fractal)

This indicator highlights periods suited for buying in Light Grey, an periods

suited for selling in Dark Grey.

Formula Parameters: Default:

**********************************/

function preMain()

{

setPriceStudy(true);

setStudyTitle("ActiveFractal");

setCursorLabelName("upFract", 0);

setCursorLabelName("dnFract", 1);

setDefaultBarFgColor(Color.darkgrey, 1);

setDefaultBarFgColor(Color.lightgrey, 0);

setPlotType(PLOTTYPE_DOT,0);

setPlotType(PLOTTYPE_DOT,1);

setDefaultBarThickness(3,0);

setDefaultBarThickness(3,1);

}

var bInit = false;

var xma5 = null;

var xma8 = null;

var xma13 = null;

var xHH = null;

var xLL = null;

function main() {

if ( bInit == false ) {

xma5 = sma(5, hl2());

xma8 = sma(8, hl2());

xma13 = sma(13, hl2());

xHH = upperDonchian(2);

xLL = lowerDonchian(2);

bInit = true;

}

if (getCurrentBarCount() < 13) return;

var Value1 = xHH.getValue(0);

var Value2 = xLL.getValue(0);

var Price = 0;

var blBlue = xma13.getValue(-8);

var blRed = xma8.getValue(-5);

var blGreen = xma5.getValue(-3);

var stp_now = false;

var i1 = 1;

var maxFracsBack = 10;

var SwingLow = 0;

var SwingHigh = 0;

var J = 2;

var Found = false;

var Counter = 0;

var X = 0;

var Truth = false;

var dnFrac = 0.0;

var upFrac = 0.0;

for (i1 = 1; (i1 < maxFracsBack) && (SwingLow != -1) && (stp_now == false); i1++)

{

J = 2;

Found = false;

Counter = 0;

for (J = 2;(J < 80)&&(Found == false); J++)

{

Price = low(-J);

X = J + 1;

Truth = true;

for (X = (J + 1); ((X - J) <= 2)&&(Truth); X++)

{

if (Price > low(-X)) Truth = false;

}

X = J - 1;

for (X = (J - 1);((J - X) <= 2)&&(Truth); X--)

{

if (Price >= low(-X)) Truth = false;

}

if (Truth) Counter++;

if (Counter >= i1) Found = true;

}

if (Found) SwingLow = Price;

else SwingLow = -1;

if (((SwingLow > blRed)||(SwingLow > Value2)) == false) stp_now = true;

}

if (stp_now) dnFrac = SwingLow;

else dnFrac = -1;

stp_now = false;

i1 = 1;

for (i1 = 1;(i1 < maxFracsBack)&&(SwingHigh != -1)&&(stp_now == false);i1++)

{

J = 2;

Found = false;

Counter = 0;

for (J = 2;(J < 80)&&(Found == false); J++)

{

Price = high(-J);

X = J + 1;

Truth = true;

for (X = (J + 1); ((X - J) <= 2)&&(Truth); X++)

{

if (Price < high(-X)) Truth = false;

}

X = J - 1;

for (X = (J - 1);((J - X) <= 2)&&(Truth); X--)

{

if (Price <= high(-X)) Truth = false;

}

if (Truth) Counter++;

if (Counter >= i1) Found = true;

}

if (Found) SwingHigh = Price;

else SwingHigh = -1;

if (((SwingHigh < blRed)||(SwingHigh < Value1)) == false) stp_now = true;

}

if (stp_now) upFrac = SwingHigh;

else upFrac = -1;

var Res1 = null;

var Res2 = null;

if ((upFrac != 0)&&(upFrac != -1))

{

Res1 = upFrac;

}

if ((dnFrac != 0)&&(dnFrac != -1))

{

Res2 = dnFrac;

}

return new Array(Res1, Res2);

}