File Name: DTI_Trade.efs

Description:

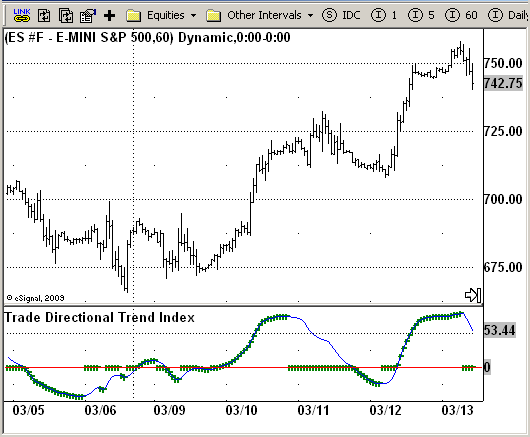

Trade Directional Trend Index (Trade DTI)

Formula Parameters:

r : 14

s : 10

u : 5

Notes:

This is one of the techniques described by William Blau in his book

"Momentum, Direction and Divergence" (1995). His book focuses on three

key aspects of trading: momentum, direction and divergence. Blau, who

was an electrical engineer before becoming a trader, thoroughly examines

the relationship between price and momentum in step-by-step examples.

From this grounding, he then looks at the deficiencies in other oscillators

and introduces some innovative techniques, including a fresh twist on Stochastics.

On directional issues, he analyzes the intricacies of ADX and offers a unique

approach to help define trending and non-trending periods.

Download File:

DTI_Trade.efs

EFS Code:

Description:

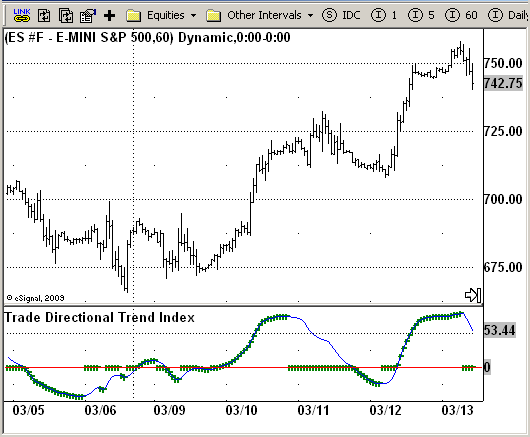

Trade Directional Trend Index (Trade DTI)

Formula Parameters:

r : 14

s : 10

u : 5

Notes:

This is one of the techniques described by William Blau in his book

"Momentum, Direction and Divergence" (1995). His book focuses on three

key aspects of trading: momentum, direction and divergence. Blau, who

was an electrical engineer before becoming a trader, thoroughly examines

the relationship between price and momentum in step-by-step examples.

From this grounding, he then looks at the deficiencies in other oscillators

and introduces some innovative techniques, including a fresh twist on Stochastics.

On directional issues, he analyzes the intricacies of ADX and offers a unique

approach to help define trending and non-trending periods.

Download File:

DTI_Trade.efs

EFS Code:

PHP Code:

/*********************************

Provided By:

eSignal (Copyright c eSignal), a division of Interactive Data

Corporation. 2009. All rights reserved. This sample eSignal

Formula Script (EFS) is for educational purposes only and may be

modified and saved under a new file name. eSignal is not responsible

for the functionality once modified. eSignal reserves the right

to modify and overwrite this EFS file with each new release.

Description:

Trade Directional Trend Index (Trade DTI)

Version: 1.0 03/19/2009

Formula Parameters: Default:

r 14

s 10

u 5

Notes:

This is one of the techniques described by William Blau in his book

"Momentum, Direction and Divergence" (1995). His book focuses on three

key aspects of trading: momentum, direction and divergence. Blau, who

was an electrical engineer before becoming a trader, thoroughly examines

the relationship between price and momentum in step-by-step examples.

From this grounding, he then looks at the deficiencies in other oscillators

and introduces some innovative techniques, including a fresh twist on Stochastics.

On directional issues, he analyzes the intricacies of ADX and offers a unique

approach to help define trending and non-trending periods.

**********************************/

var fpArray = new Array();

var bInit = false;

function preMain() {

setPriceStudy(false);

setStudyTitle("Trade Directional Trend Index");

setCursorLabelName("DTI Trade", 0);

setCursorLabelName("DTI", 1);

setDefaultBarFgColor(Color.green, 0);

setDefaultBarFgColor(Color.blue, 1);

setPlotType(PLOTTYPE_DOT, 0);

setDefaultBarThickness(2, 0);

addBand(0, PS_SOLID, 1, Color.red);

var x=0;

fpArray[x] = new FunctionParameter("r", FunctionParameter.NUMBER);

with(fpArray[x++]){

setLowerLimit(1);

setDefault(14);

}

fpArray[x] = new FunctionParameter("s", FunctionParameter.NUMBER);

with(fpArray[x++]){

setLowerLimit(1);

setDefault(10);

}

fpArray[x] = new FunctionParameter("u", FunctionParameter.NUMBER);

with(fpArray[x++]){

setLowerLimit(1);

setDefault(5);

}

}

var nDTI_Ref = 0;

var nDTI = 0;

var xHMU = null;

var xLMD = null;

var xPrice = null;

var xPriceAbs = null;

var xuXA = null;

var xuXAAbs = null;

function main(r, s, u) {

var nVal4 = 0;

var nVal5 = 0;

var nDTI_Trade = 0;

var nBarState = getBarState();

if(nBarState == BARSTATE_ALLBARS) {

if (r == null) r = 14;

if (s == null) s = 10;

if (u == null) u = 5;

}

if (nBarState == BARSTATE_NEWBAR) {

nDTI_Ref = nDTI;

}

if ( bInit == false ) {

xHMU = efsInternal("Calc_HMU");

xLMD = efsInternal("Calc_LMD");

xPrice = efsInternal("Calc_Price", xHMU, xLMD);

xPriceAbs = efsInternal("Calc_PriceAbs", xPrice);

xuXA = ema(u, ema(s, ema(r, xPrice)));

xuXAAbs = ema(u, ema(s, ema(r, xPriceAbs)));

bInit = true;

}

if (getCurrentBarCount() < Math.max(Math.max(r, s), u)) return;

var Val1 = 100 * xuXA.getValue(0);

var Val2 = xuXAAbs.getValue(0);

if (Val2 != 0) nDTI = Val1 / Val2;

else nDTI = 0;

if (((nDTI - nDTI_Ref) > 0) && (nDTI > 0)) nVal4 = nDTI;

else Val4 = 0;

if (((nDTI - nDTI_Ref) < 0) && (nDTI < 0)) nVal5 = nDTI;

else Val5 = 0;

nDTI_Trade = nVal4 + nVal5;

if (nDTI_Trade == null) return;

return new Array(nDTI_Trade, nDTI);

}

function Calc_PriceAbs(xPrice) {

var nRes = 0;

nRes = Math.abs(xPrice.getValue(0));

if (nRes == null) nRes = 1;

return nRes;

}

function Calc_Price(xHMU, xLMD) {

var nRes = 0;

nRes = xHMU.getValue(0) - xLMD.getValue(0);

if (nRes == null) nRes = 1;

return nRes;

}

var xHmom = null;

var xHInit = false;

function Calc_HMU() {

var nRes = 0;

var nHmom = 0;

if (xHInit == false) {

xHmom = mom(1,high());

xHInit = true;

}

nHmom = xHmom.getValue(0);

if (nHmom == null) return;

if (nHmom > 0) {

nRes = nHmom;

}

else nRes = 0;

return nRes;

}

var xLmom = null;

var xLInit = false;

function Calc_LMD() {

var nRes = 0;

var nLmom = 0;

if (xLInit == false) {

xLmom = mom(1,low());

xLInit = true;

}

nLmom = xLmom.getValue(0);

if (nLmom == null) return;

if (nLmom < 0) {

nRes = -(nLmom);

}

else nRes = 0;

return nRes;

}