File Name: ICS.efs

Description:

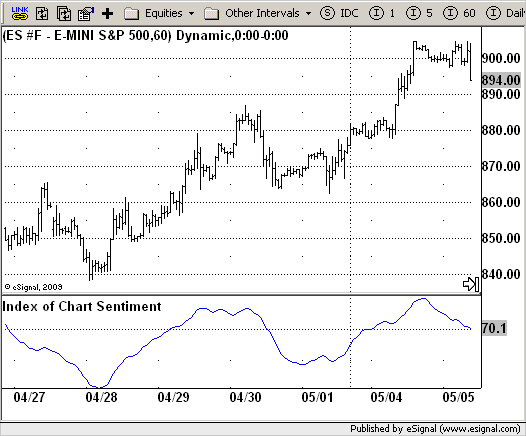

Index of Chart Sentiment (ICS)

Formula Parameters:

BBlength : 55

Deviations : 0.5

Notes:

The main problem of technical indicators is the identifying a trend in its

early stages.

To effectively do this, Mr. Likhovidov created an indicator called the Index

of Chart Sentiment (ICS). The ICS could reach very high levels and this corresponds

to an overbought market; very low values of the index correspond to an oversold market.

When the index moves from lower to higher levels (period of bullish sentiment of the

market) the dominant movement of the chart should be to the upside.

The algorithm for calculating the CandleCode involves a long-period analysis of the

chart. But this analysis does not consist of the usual smoothing and therefore does

not result in any lag.

To fing more information please refer Index Of Chart Sentiment article by Viktor Likhovidov

in recent S&C issue.

Download File:

ICS.efs

EFS Code:

Description:

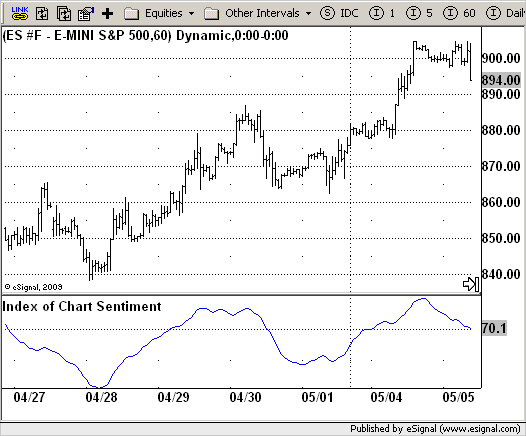

Index of Chart Sentiment (ICS)

Formula Parameters:

BBlength : 55

Deviations : 0.5

Notes:

The main problem of technical indicators is the identifying a trend in its

early stages.

To effectively do this, Mr. Likhovidov created an indicator called the Index

of Chart Sentiment (ICS). The ICS could reach very high levels and this corresponds

to an overbought market; very low values of the index correspond to an oversold market.

When the index moves from lower to higher levels (period of bullish sentiment of the

market) the dominant movement of the chart should be to the upside.

The algorithm for calculating the CandleCode involves a long-period analysis of the

chart. But this analysis does not consist of the usual smoothing and therefore does

not result in any lag.

To fing more information please refer Index Of Chart Sentiment article by Viktor Likhovidov

in recent S&C issue.

Download File:

ICS.efs

EFS Code:

PHP Code:

/*********************************

Provided By:

eSignal (Copyright c eSignal), a division of Interactive Data

Corporation. 2009. All rights reserved. This sample eSignal

Formula Script (EFS) is for educational purposes only and may be

modified and saved under a new file name. eSignal is not responsible

for the functionality once modified. eSignal reserves the right

to modify and overwrite this EFS file with each new release.

Description:

Index of Chart Sentiment (ICS)

Version: 1.0 05/13/2009

Formula Parameters: Default:

BBlength 55

Deviations 0.5

Notes:

The main problem of technical indicators is the identifying a trend in its

early stages.

To effectively do this, Mr. Likhovidov created an indicator called the Index

of Chart Sentiment (ICS). The ICS could reach very high levels and this corresponds

to an overbought market; very low values of the index correspond to an oversold market.

When the index moves from lower to higher levels (period of bullish sentiment of the

market) the dominant movement of the chart should be to the upside.

The algorithm for calculating the CandleCode involves a long-period analysis of the

chart. But this analysis does not consist of the usual smoothing and therefore does

not result in any lag.

To fing more information please refer Index Of Chart Sentiment article by Viktor Likhovidov

in recent S&C issue.

**********************************/

var fpArray = new Array();

var bInit = false;

function preMain() {

setPriceStudy(false);

setShowTitleParameters( false );

setStudyTitle("Index of Chart Sentiment");

setCursorLabelName("ICS",0);

setDefaultBarFgColor(Color.blue,0);

var x = 0;

fpArray[x] = new FunctionParameter("BBlength", FunctionParameter.NUMBER);

with(fpArray[x++]) {

setLowerLimit(1);

setDefault(55);

}

fpArray[x] = new FunctionParameter("Deviations", FunctionParameter.NUMBER);

with(fpArray[x++]) {

setLowerLimit(0.001);

setDefault(0.5);

}

}

var xICS = null;

function main(BBlength, Deviations) {

var nBarState = getBarState();

var nICS = 0;

if (nBarState == BARSTATE_ALLBARS) {

if(BBlength == null) BBlength = 55

if(Deviations == null) Deviations = 0.5

}

if (bInit == false) {

xICS = ema(24, ema(24, efsInternal("Calc_ICS", BBlength, Deviations)));

bInit = true;

}

nICS = xICS.getValue(0);

if (nICS == null) return;

return nICS;

}

var xOpen = null;

var xClose = null;

var xBody = null;

var xUpperShadow = null;

var xLowerShadow = null;

var xThTop_Body = null;

var xThBot_Body = null;

var xThTop_Ushd = null;

var xThBot_Ushd = null;

var xThTop_Lshd = null;

var xThBot_Lshd = null;

var bSecondInit = false;

function Calc_ICS(BBlength, Deviations) {

var Body = 0;

var UpperShadow = 0;

var LowerShadow = 0;

var ThBot_Body = 0;

var ThTop_Body = 0;

var ThBot_Ushd = 0;

var ThTop_Ushd = 0;

var ThBot_Lshd = 0;

var ThTop_Lshd = 0;

var ColorCode = 0;

var BodyCode = 0;

var UshdCode = 0;

var LshdCode = 0;

var nRes = 0;

if (bSecondInit == false) {

xOpen = open();

xClose = close();

xBody = efsInternal("GetCandleValue", xOpen, xClose);

xUpperShadow = getSeries(xBody, 1);

xLowerShadow = getSeries(xBody, 2);

xThTop_Body = upperBB(BBlength, Deviations, xBody);

xThBot_Body = lowerBB(BBlength, Deviations, xBody);

xThTop_Ushd = upperBB(BBlength, Deviations, xUpperShadow);

xThBot_Ushd = lowerBB(BBlength, Deviations, xUpperShadow);

xThTop_Lshd = upperBB(BBlength, Deviations, xLowerShadow);

xThBot_Lshd = lowerBB(BBlength, Deviations, xLowerShadow);

bSecondInit = true;

}

Body = xBody.getValue(0);

UpperShadow = xUpperShadow.getValue(0);

LowerShadow = xLowerShadow.getValue(0);

ThTop_Body = xThTop_Body.getValue(0);

ThBot_Body = xThBot_Body.getValue(0);

ThTop_Ushd = xThTop_Ushd.getValue(0);

ThBot_Ushd = xThBot_Ushd.getValue(0);

ThTop_Lshd = xThTop_Lshd.getValue(0);

ThBot_Lshd = xThBot_Lshd.getValue(0);

if (ThBot_Lshd == null) return;

if(xClose.getValue(0) >= xOpen.getValue(0)){

ColorCode = 64;

if(xOpen.getValue(0) == xClose.getValue(0))

BodyCode = 0;

else if(Body < ThBot_Body)

BodyCode = 16;

else if(Body < ThTop_Body)

BodyCode = 32;

else

BodyCode = 48;

}

else{

ColorCode = 0;

if(Body < ThBot_Body)

BodyCode = 32;

else if(Body < ThTop_Body)

BodyCode = 16;

else

BodyCode = 0;

}

if(UpperShadow == 0)

UshdCode = 0;

else if(UpperShadow < ThBot_Ushd)

UshdCode = 4;

else if(UpperShadow < ThTop_Ushd)

UshdCode = 8;

else

UshdCode = 12;

if(LowerShadow == 0)

LshdCode = 3;

else if(LowerShadow < ThBot_Lshd)

LshdCode = 2;

else if(LowerShadow < ThTop_Lshd)

LshdCode = 1;

else

LshdCode = 0;

nRes = ColorCode + BodyCode + UshdCode + LshdCode;

return nRes;

}

function GetCandleValue(xOpen, xClose) {

var Body = Math.abs(xOpen.getValue(0) - xClose.getValue(0));

var UpperShadow = high(0) - Math.max(xOpen.getValue(0),xClose.getValue(0));

var LowerShadow = Math.min(xOpen.getValue(0),xClose.getValue(0)) - low(0);

return new Array(Body, UpperShadow, LowerShadow)

}