File Name: ITL.efs

Description:

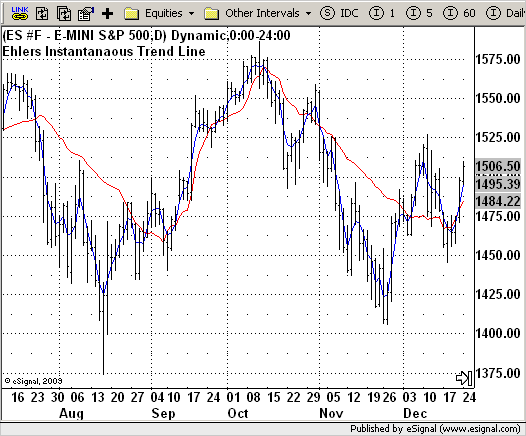

Instantaneous Trend Line (J. Ehler)

Formula Parameters:

Notes:

The early identification of a trend then depends on a valid

measurement of short-term cyclic activity. There are two ways

to do so, either by cycle elimination or by spectrum analysis.

Of the two, cycle elimination is by far the easier.

The identification of the trend is that easy. One can eliminate

the cyclic component when use the average over the cycle length.

One could adjust the average as the cycle length varies and plot

the results day-by-day. The author called the result an "instantaneous

trendline".

You can read more about this approach in Early Trend Identification

by John F. Ehlers article published in 10/1990 Stocks&Commodities magazine.

Download File:

ITL.efs

EFS Code:

Description:

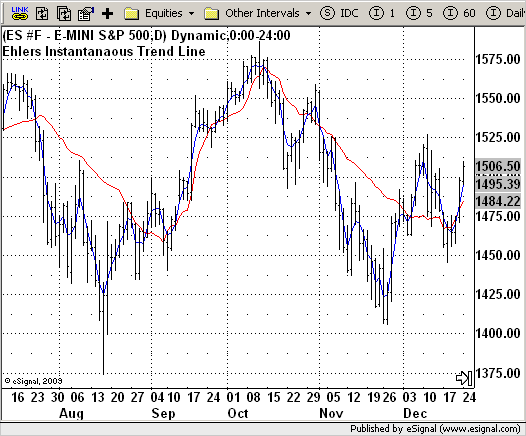

Instantaneous Trend Line (J. Ehler)

Formula Parameters:

Notes:

The early identification of a trend then depends on a valid

measurement of short-term cyclic activity. There are two ways

to do so, either by cycle elimination or by spectrum analysis.

Of the two, cycle elimination is by far the easier.

The identification of the trend is that easy. One can eliminate

the cyclic component when use the average over the cycle length.

One could adjust the average as the cycle length varies and plot

the results day-by-day. The author called the result an "instantaneous

trendline".

You can read more about this approach in Early Trend Identification

by John F. Ehlers article published in 10/1990 Stocks&Commodities magazine.

Download File:

ITL.efs

EFS Code:

PHP Code:

/*********************************

Provided By:

eSignal (Copyright c eSignal), a division of Interactive Data

Corporation. 2009. All rights reserved. This sample eSignal

Formula Script (EFS) is for educational purposes only and may be

modified and saved under a new file name. eSignal is not responsible

for the functionality once modified. eSignal reserves the right

to modify and overwrite this EFS file with each new release.

Description:

Instantaneous Trend Line (J. Ehler)

Version: 1.0 05/18/2009

Formula Parameters: Default:

Notes:

The early identification of a trend then depends on a valid

measurement of short-term cyclic activity. There are two ways

to do so, either by cycle elimination or by spectrum analysis.

Of the two, cycle elimination is by far the easier.

The identification of the trend is that easy. One can eliminate

the cyclic component when use the average over the cycle length.

One could adjust the average as the cycle length varies and plot

the results day-by-day. The author called the result an "instantaneous

trendline".

You can read more about this approach in Early Trend Identification

by John F. Ehlers article published in 10/1990 Stocks&Commodities magazine.

**********************************/

var bInit = false;

function preMain() {

setPriceStudy(true);

setStudyTitle("Ehlers Instantanaous Trend Line");

setCursorLabelName("TR",0);

setDefaultBarFgColor(Color.red,0);

setCursorLabelName("ZL",1);

setDefaultBarFgColor(Color.blue,1);

}

var xValue1 = null;

var xInPhase = null;

var xQuadrature = null;

var xPhase = null;

var xDeltaPhase = null;

var xInstPeriod = null;

var xTrendline = null;

function main(){

var Trendline = 0;

var value11 = 0;

if (bInit == false) {

xValue1 = mom(6);

xInPhase = ema(6, xValue1);

xQuadrature = ema(10, efsInternal("Calc_Value3", xValue1));

xPhase = efsInternal("Calc_Phase", xInPhase, xQuadrature);

xDeltaPhase = efsInternal("Calc_DeltaPhase", xPhase);

xInstPeriod = ema(8, efsInternal("Calc_InstPeriod", xDeltaPhase));

xTrendline = efsInternal("Calc_Trendline", xInstPeriod);

xvalue11 = ema(6, efsInternal("Calc_value11"));

bInit = true;

}

Trendline = xTrendline.getValue(0);

value11 = xvalue11.getValue(0);

if (value11 == null || Trendline == null) return;

return new Array(Trendline, value11);

}

function Calc_Value3(xValue1) {

var nRes = 0;

nRes = 0.75 * (xValue1.getValue(0) - xValue1.getValue(-6)) + 0.25 * (xValue1.getValue(-2) - xValue1.getValue(-4));

return nRes;

}

function Calc_Phase(xInPhase, xQuadrature) {

var Phase = 0;

var InPhase = xInPhase.getValue(0);

var Quadrature = xQuadrature.getValue(0)

var InPhase_1 = xInPhase.getValue(-1);

var Quadrature_1 = xQuadrature.getValue(-1)

if(Math.abs(InPhase + InPhase_1) > 0)

Phase = Math.atan(Math.abs( (Quadrature + Quadrature_1) / (InPhase + InPhase_1) ));

if(InPhase < 0 && Quadrature > 0)

Phase = 180 - Phase;

if(InPhase < 0 && Quadrature < 0)

Phase = 180 + Phase;

if(InPhase > 0 && Quadrature < 0)

Phase = 360 - Phase;

return Phase;

}

function Calc_DeltaPhase(xPhase) {

var DeltaPhase = 0;

var Phase = xPhase.getValue(0);

var Phase_1 = xPhase.getValue(-1);

DeltaPhase = Phase_1 - Phase;

if(Phase_1 < 90 && Phase > 270)

DeltaPhase = 360 + Phase_1 - Phase;

if(DeltaPhase < 1)

DeltaPhase = 1;

if(DeltaPhase > 60)

Deltaphase = 60;

return DeltaPhase;

}

function Calc_InstPeriod(xDeltaPhase) {

var InstPeriod = 0;

var InstPeriod_1 = ref(-1);

var value4 = 0;

var i = 0;

if (xDeltaPhase.getValue(-40) == null) return;

for(i = 0; i <= 40; i++){

value4 += xDeltaPhase.getValue(-i);

if(value4 > 360 && InstPeriod == 0)

InstPeriod = i;

}

if(InstPeriod == 0)

InstPeriod = InstPeriod_1;

return InstPeriod;

}

var xClose = null;

function Calc_Trendline(xInstPeriod) {

var value5 = xInstPeriod.getValue(0);

var tmp = 0;

var Period = 0;

var Trendline = 0;

if (xClose == null) xClose = close();

if (value5 == null) return;

if(value5 < 0){

tmp = - value5;

Period = - Math.floor(tmp);

} else

Period = Math.floor(value5);

Trendline = 0;

for(i = Period + 1; i >= 0; i--)

Trendline += xClose.getValue(-i);

if(Period > 0)

Trendline = Trendline / (Period + 2);

return Trendline;

}

var bSecondInit = false;

var xSecMom = null;

function Calc_value11() {

var value11 = 0;

if (bSecondInit == false) {

xSecMom = mom(3);

}

value11 = close(0) + 0.5 * xSecMom.getValue(0);

return value11;

}