File Name: VolatilityModifiedFVE.efs

Description:

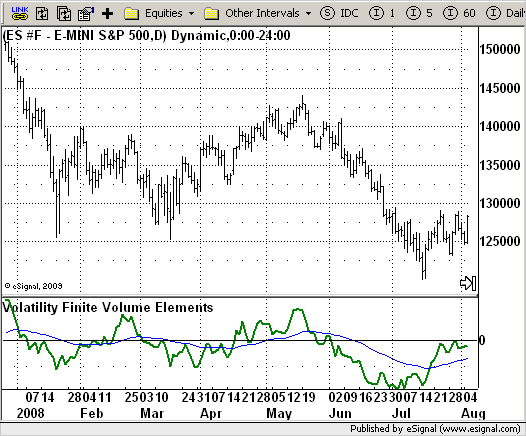

FVE (Volatility Modified)

Formula Parameters:

Samples : 22

Perma : 40

Cintra : 0.1

Cinter : 0.1

Notes:

This is another version of FVE indicator that we have posted earlier

in this forum.

This version has an important enhancement to the previous one that`s

especially useful with intraday minute charts.

Due to the volatility had not been taken into account to avoid the extra

complication in the formula, the previous formula has some drawbacks:

The main drawback is that the constant cutoff coefficient will overestimate

price changes in minute charts and underestimate corresponding changes in

weekly or monthly charts.

And now the indicator uses adaptive cutoff coefficient which will adjust to

all time frames automatically.

Download File:

VolatilityModifiedFVE.efs

EFS Code:

Description:

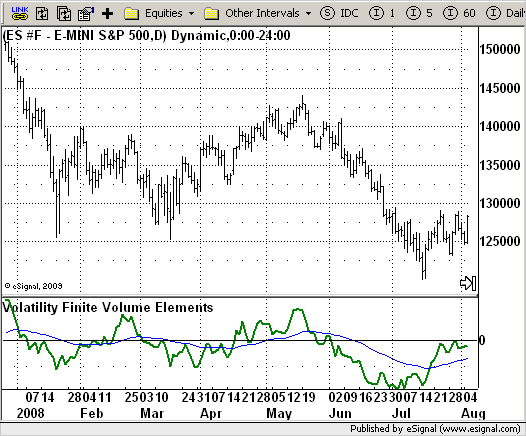

FVE (Volatility Modified)

Formula Parameters:

Samples : 22

Perma : 40

Cintra : 0.1

Cinter : 0.1

Notes:

This is another version of FVE indicator that we have posted earlier

in this forum.

This version has an important enhancement to the previous one that`s

especially useful with intraday minute charts.

Due to the volatility had not been taken into account to avoid the extra

complication in the formula, the previous formula has some drawbacks:

The main drawback is that the constant cutoff coefficient will overestimate

price changes in minute charts and underestimate corresponding changes in

weekly or monthly charts.

And now the indicator uses adaptive cutoff coefficient which will adjust to

all time frames automatically.

Download File:

VolatilityModifiedFVE.efs

EFS Code:

PHP Code:

/*********************************

Provided By:

eSignal (Copyright c eSignal), a division of Interactive Data

Corporation. 2009. All rights reserved. This sample eSignal

Formula Script (EFS) is for educational purposes only and may be

modified and saved under a new file name. eSignal is not responsible

for the functionality once modified. eSignal reserves the right

to modify and overwrite this EFS file with each new release.

Description:

FVE (Volatility Modified)

Version: 1.0 05/26/2009

Formula Parameters: Default:

Samples 22

Perma 40

Cintra 0.1

Cinter 0.1

Notes:

This is another version of FVE indicator that we have posted earlier

in this forum.

This version has an important enhancement to the previous one that`s

especially useful with intraday minute charts.

Due to the volatility had not been taken into account to avoid the extra

complication in the formula, the previous formula has some drawbacks:

The main drawback is that the constant cutoff coefficient will overestimate

price changes in minute charts and underestimate corresponding changes in

weekly or monthly charts.

And now the indicator uses adaptive cutoff coefficient which will adjust to

all time frames automatically.

**********************************/

var fpArray = new Array();

var bInit = false;

function preMain() {

setStudyTitle("Volatility Finite Volume Elements");

setCursorLabelName("FVI",0);

setDefaultBarFgColor(Color.green,0);

setCursorLabelName("FVI EMA",1);

setDefaultBarFgColor(Color.blue,1);

setDefaultBarThickness(2);

addBand(0, PS_SOLID, 1, Color.black);

var x = 0;

fpArray[x] = new FunctionParameter("Samples", FunctionParameter.NUMBER);

with(fpArray[x++]) {

setLowerLimit(1);

setDefault(22);

}

var x = 0;

fpArray[x] = new FunctionParameter("Perma", FunctionParameter.NUMBER);

with(fpArray[x++]) {

setLowerLimit(1);

setDefault(40);

}

var x = 0;

fpArray[x] = new FunctionParameter("Cintra", FunctionParameter.NUMBER);

with(fpArray[x++]) {

setLowerLimit(0.001);

setDefault(0.1);

}

var x = 0;

fpArray[x] = new FunctionParameter("Cinter", FunctionParameter.NUMBER);

with(fpArray[x++]) {

setLowerLimit(0.001);

setDefault(0.1);

}

}

var xModVol = null;

var xModVolEMA = null;

function main(Samples, Perma, Cintra, Cinter){

var nBarState = getBarState();

var nModVol = 0;

var nModVolEMA = 0;

if (nBarState == BARSTATE_ALLBARS) {

if(Samples == null) Samples = 22;

if(Perma == null) Perma = 40;

if(Cintra == null) Cintra = 0.1;

if(Cinter == null) Cinter = 0.1;

}

if (bInit == false) {

xModVol = efsInternal("Calc_ModVolatility", Samples, Perma, Cintra, Cinter);

xModVolEMA = getSeries(xModVol, 1);

bInit = true;

}

nModVol = xModVol.getValue(0);

nModVolEMA = xModVolEMA.getValue(0);

if (nModVolEMA == null) return;

return new Array(nModVol, nModVolEMA);

}

var bSecondInit = false;

var xVolumePlusMinus = null;

var xVolume = null;

var xFVE = null;

var xEMAFVE = null;

function Calc_ModVolatility(Samples, Perma, Cintra, Cinter) {

var nRes = 0;

if (bSecondInit == false) {

xVolume = volume();

xVolumePlusMinus = efsInternal("Calc_VolumePlusMinus", Samples, xVolume, Cintra, Cinter);

xFVE = efsInternal("Calc_FVE", Samples, xVolumePlusMinus, xVolume);

xEMAFVE = ema(Perma, xFVE);

bSecondInit = true;

}

nFVE = xFVE.getValue(0);

nEMA = xEMAFVE.getValue(0);

if (nEMA == null) return;

return new Array(nFVE, nEMA);

}

function Calc_FVE(Samples, xVolumePlusMinus, xVolume) {

var nRes = 0;

var Fvesum = 0;

var VolSum = 0;

var i = 0;

for(i = 0; i < Samples; i++) {

Fvesum += xVolumePlusMinus.getValue(-i);

VolSum += xVolume.getValue(-i);

}

nRes = (Fvesum / VolSum) * 100;

return nRes;

}

var bThridInit = false;

var xClose = null;

var xhlc3 = null;

var xhl2 = null;

var xIntra = null;

var xInter = null;

var xStDevIntra = null;

var xStDevInter = null;

function Calc_VolumePlusMinus(Samples, xVolume, Cintra, Cinter) {

var nRes = 0;

var TP = 0;

var TP1 = 0;

var Intra = 0;

var Vintra = 0;

var Inter = 0;

var Vinter = 0;

var CutOff = 0;

var MF = 0;

if (bThridInit == false) {

xClose = close();

xhlc3 = hlc3();

xhl2 = hl2();

xIntra = efsInternal("Calc_Intra", xhlc3);

xInter = getSeries(xIntra, 1);

xStDevIntra = efsInternal("Calc_StdDev", Samples, sma(Samples, xIntra), xIntra);

xStDevInter = efsInternal("Calc_StdDev", Samples, sma(Samples, xInter), xInter);

bThridInit = true;

}

TP = xhlc3.getValue(0);

TP1 = xhlc3.getValue(-1);

Intra = xIntra.getValue(0);

Vintra = xStDevIntra.getValue(0);

Inter = xInter.getValue(0);

Vinter = xStDevInter.getValue(0);

CutOff = Cintra * Vintra + Cinter * Vinter;

MF = xClose.getValue(0) - xhl2.getValue(0) + TP - TP1;

if(MF > CutOff * xClose.getValue(0))

FveFactor = 1;

else if(MF < -1 * CutOff * xClose.getValue(0))

FveFactor = -1;

else

FveFactor = 0;

nRes = xVolume.getValue(0) * FveFactor;

return nRes;

}

function Calc_Intra(xhlc3) {

var nResIntra = 0;

var nResInter = 0;

if (xhlc3.getValue(-1) == null) return;

nResIntra = Math.log(high(0)) - Math.log(low(0));

nResInter = Math.log(xhlc3.getValue(0)) - Math.log(xhlc3.getValue(-1));

return new Array(nResIntra, nResInter);

}

function Calc_StdDev(nPeriod, xMA, xSeries) {

var StdDev = 0;

var SumSqr = 0;

var counter = 0;

if(xMA.getValue(0) == null) return;

for(counter = 0; counter < nPeriod; counter++)

SumSqr += Math.pow((xSeries.getValue(-counter) - xMA.getValue(0)), 2);

StdDev = Math.sqrt(SumSqr / nPeriod);

return StdDev;

}