File Name: ABillW_AC.efs

Description:

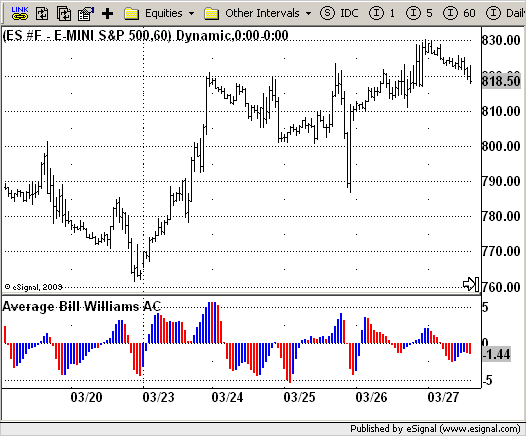

Bill Williams. Awesome Oscillator (AC)

Formula Parameters:

nLengthSlow : 34

nLengthFast : 5

Notes:

This indicator plots the oscillator as a histogram where blue denotes

periods suited for buying and red . for selling. If the current value

of AO (Awesome Oscillator) is above previous, the period is considered

suited for buying and the period is marked blue. If the AO value is not

above previous, the period is considered suited for selling and the

indicator marks it as red.

Download File:

ABillW_AC.efs

EFS Code:

Description:

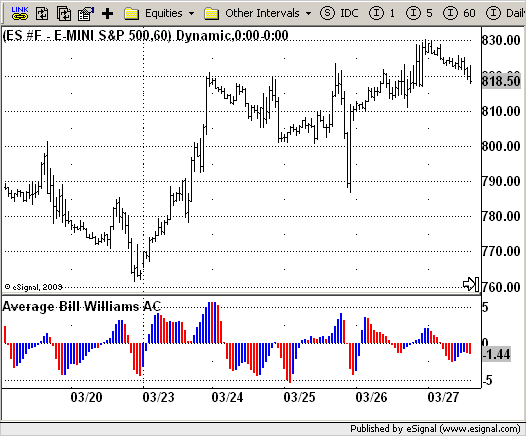

Bill Williams. Awesome Oscillator (AC)

Formula Parameters:

nLengthSlow : 34

nLengthFast : 5

Notes:

This indicator plots the oscillator as a histogram where blue denotes

periods suited for buying and red . for selling. If the current value

of AO (Awesome Oscillator) is above previous, the period is considered

suited for buying and the period is marked blue. If the AO value is not

above previous, the period is considered suited for selling and the

indicator marks it as red.

Download File:

ABillW_AC.efs

EFS Code:

PHP Code:

/*********************************

Provided By:

eSignal (Copyright c eSignal), a division of Interactive Data

Corporation. 2009. All rights reserved. This sample eSignal

Formula Script (EFS) is for educational purposes only and may be

modified and saved under a new file name. eSignal is not responsible

for the functionality once modified. eSignal reserves the right

to modify and overwrite this EFS file with each new release.

Description:

Bill Williams. Awesome Oscillator (AC)

Version: 1.0 03/27/2009

Formula Parameters: Default:

nLengthSlow 34

nLengthFast 5

Notes:

This indicator plots the oscillator as a histogram where blue denotes

periods suited for buying and red . for selling. If the current value

of AO (Awesome Oscillator) is above previous, the period is considered

suited for buying and the period is marked blue. If the AO value is not

above previous, the period is considered suited for selling and the

indicator marks it as red.

**********************************/

var fpArray = new Array();

var bInit = false;

function preMain() {

setStudyTitle("Average Bill Williams AC");

setCursorLabelName("ABillW AC", 0);

setDefaultBarThickness(2,0);

setPlotType(PLOTTYPE_HISTOGRAM);

var x=0;

fpArray[x] = new FunctionParameter("nLengthSlow", FunctionParameter.NUMBER);

with(fpArray[x++]){

setLowerLimit(1);

setDefault(34);

}

fpArray[x] = new FunctionParameter("nLengthFast", FunctionParameter.NUMBER);

with(fpArray[x++]){

setLowerLimit(1);

setDefault(5);

}

}

var xCalc_hl2 = null;

var xAC = null;

function main(nLengthFast, nLengthSlow) {

var nBarState = getBarState();

var nAC = 0;

var nAC1 = 0;

if (nBarState == BARSTATE_ALLBARS) {

if (nLengthSlow == null) nLengthSlow = 34;

if (nLengthFast == null) nLengthFast = 5;

}

if (bInit == false) {

xCalc_hl2 = efsInternal("CalcSMA1_SMA2", nLengthFast, nLengthSlow);

xAC = efsInternal("Calc_AC", nLengthFast, xCalc_hl2, sma(nLengthFast, xCalc_hl2))

bInit = true;

}

nAC = xAC.getValue(0);

nAC1 = xAC.getValue(-1);

if (nAC1 == null) return;

if (nAC > nAC1) setBarFgColor(Color.blue);

else setBarFgColor(Color.red);

return nAC;

}

var bSecondInit = false;

var xSMA1_hl2 = null;

var xSMA2_hl2 = null;

function CalcSMA1_SMA2(nLengthFast, nLengthSlow) {

var nRes = 0;

var SMA1 = 0;

var SMA2 = 0;

if (bSecondInit == false) {

xSMA1_hl2 = sma(nLengthFast, hl2());

xSMA2_hl2 = sma(nLengthSlow, hl2());

bSecondInit = true;

}

SMA1 = xSMA1_hl2.getValue(0);

SMA2 = xSMA2_hl2.getValue(0);

if (SMA1 == null || SMA2 == null) return;

nRes = SMA1 - SMA2;

return nRes;

}

function Calc_AC(nLengthFast, xCalc_hl2, xSMA_hl2) {

var nRes = 0;

if (xSMA_hl2.getValue(0) == null) return;

nRes = xCalc_hl2.getValue(0) - xSMA_hl2.getValue(0);

return nRes;

}