Description:

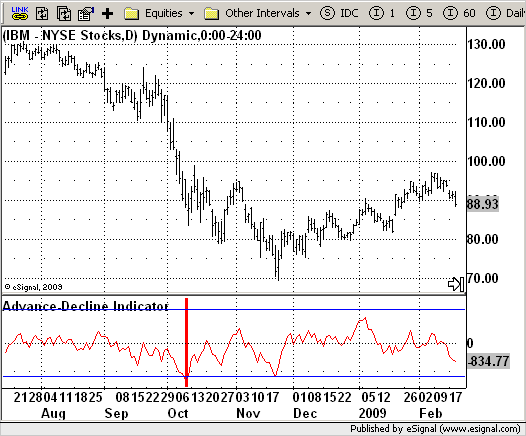

Advance-Decline Indicator

Formula Parameters:

Length : 10

BuyBand : -1500

SellBand : 1500

Symbol : $ADD

Notes:

The Advance-Decline Indicator is a market breadth indicator

based on the smoothed difference between advancing and declining issues.

The indicator shows when the stock market is overbought (and a correction

is due) and when it is oversold (and a rally is due).

The Advance-Decline Indicator is a 10-period exponential moving average of

the difference between the number of advancing and declining issues:

Download File:

AdvDecAvg.efs

EFS Code:

PHP Code:

/*********************************

Provided By:

eSignal (Copyright c eSignal), a division of Interactive Data

Corporation. 2009. All rights reserved. This sample eSignal

Formula Script (EFS) is for educational purposes only and may be

modified and saved under a new file name. eSignal is not responsible

for the functionality once modified. eSignal reserves the right

to modify and overwrite this EFS file with each new release.

Description:

Advance-Decline Indicator

Version: 1.0 04/22/2009

Formula Parameters: Default:

Length 10

BuyBand -1500

SellBand 1500

Symbol $ADD

Notes:

The Advance-Decline Indicator is a market breadth indicator

based on the smoothed difference between advancing and declining issues.

The indicator shows when the stock market is overbought (and a correction

is due) and when it is oversold (and a rally is due).

The Advance-Decline Indicator is a 10-period exponential moving average of

the difference between the number of advancing and declining issues:

**********************************/

var fpArray = new Array();

var bInit = false;

function preMain() {

setStudyTitle("Advance-Decline Indicator");

setCursorLabelName("Advance-Decline", 0);

setDefaultBarFgColor(Color.red, 0);

setPriceStudy(false);

setStudyMax(2000);

setStudyMin(-2000);

var x = 0;

fpArray[x] = new FunctionParameter("Length", FunctionParameter.NUMBER);

with(fpArray[x++]) {

setLowerLimit(1);

setDefault(10);

}

fpArray[x] = new FunctionParameter("BuyBand", FunctionParameter.NUMBER);

with(fpArray[x++]) {

setLowerLimit(-2000);

setDefault(-1500);

}

fpArray[x] = new FunctionParameter("SellBand", FunctionParameter.NUMBER);

with(fpArray[x++]) {

setLowerLimit(-2000);

setDefault(1500);

}

fpArray[x] = new FunctionParameter("Symbol", FunctionParameter.STRING);

with(fpArray[x++]) {

addOption("$ADDQ");

addOption("$ADD");

setDefault("$ADD");

}

}

var xOvbOvs = null;

function main(Length, Symbol, BuyBand, SellBand) {

var nBarState = getBarState();

var nOvbOvs = 0;

if (nBarState == BARSTATE_ALLBARS) {

if (Length == null) Length = 10;

if (BuyBand == null) BuyBand = -1500;

if (SellBand == null) SellBand = 1500;

if (Symbol == null) Symbol = "$ADD";

}

if (bInit == false) {

addBand(BuyBand, PS_SOLID, 1, Color.blue, "Buy");

addBand(SellBand, PS_SOLID, 1, Color.blue, "Sell");

xOvbOvs = ema(Length, sym(Symbol));

bInit = true;

}

nOvbOvs = xOvbOvs.getValue(0);

if (nOvbOvs == null) return;

if (nOvbOvs > SellBand) {

setBarBgColor(Color.green);

}

if (nOvbOvs < BuyBand) {

setBarBgColor(Color.red);

}

return nOvbOvs;

}