File Name: SwingPrediction.efs

Description:

This formula is based on Fibonacci And Gann Projections by Dennis Peterson, which appeared in the October 2004 issue of Stocks & Commodities.

Formula Parameters:

* Swing # of Bars - 1

This is the minimum number of bars required to define a swing point. This number is for both sides of the swing point (i.e. 5 bars on the left and right of the swing bar).

* Swing Wave Type - % Change in Price

(% Retracement, % Change in Price)

* Swing Wave Percentage - 5

The number 5 will be treated as 5.0%. The number 0.05 will be treated as 0.0005%.

* Swing High Price Source - Close

* Swing Low Price Source - Close

* Line Thickness - 2

* Confirmed Swing Line Color - Blue

* Developing Swing Line Color - Yellow

* Number of Swings for Gann - 1

The number of previous swings points to be included in the Gann projections

* Gann Increment - 0.25

The +/- increment for Gann calculation above and below the base calculation for Gann.

* Number of Gann Increments - 2

The number of Gann increments to be calculated above and below the Gann basis calculation. 2 will draw one above and one low

the basis.

* Fibonacci: DR 1 - 0.382

* Fibonacci: DR 2 - 1.618

* Fibonacci: A1 1 - 0.5

* Fibonacci: A1 2 - 1.732

* Fibonacci: A2 1 - 0.618

* Fibonacci: A2 2 - 2.0

* Fibonacci: C 1 - 0.707

* Fibonacci: C 2 - 2.618

* Fibonacci: DC 1 - 1.0

* Fibonacci: DC 2 - 3.0

Notes:

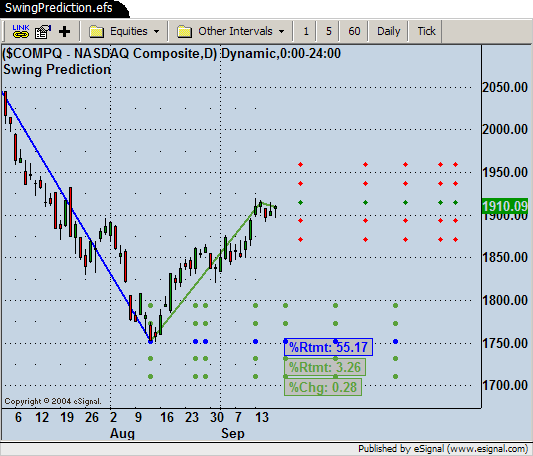

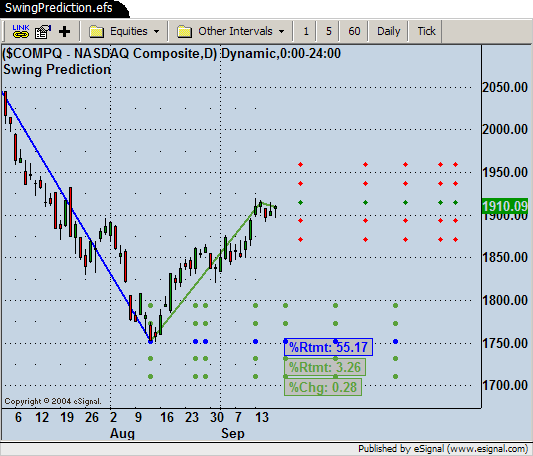

The current version has one added modification since the formula went into publication. Per Dennis Peterson's request, a third label has been added to show a second percent retracement figure. The top %Rtmt label is the percent retracement of the developing swing (green Sept peak) to the second previous confirmed swing (blue June peak). The second %Rtmt label is the percent retracement of the right-most developing swing line (current bar) to the previous confirmed swing (Aug valley). The last %Chg label is the percent change in price of the righ-most developing swing line (current bar) from the developing swing (green Sept peak). The related article is copyrighted material. If you are not a subscriber of Stocks & Commodities, please visit www.traders.com.

Download File:

SwingPrediction.efs

EFS Code:

Description:

This formula is based on Fibonacci And Gann Projections by Dennis Peterson, which appeared in the October 2004 issue of Stocks & Commodities.

Formula Parameters:

* Swing # of Bars - 1

This is the minimum number of bars required to define a swing point. This number is for both sides of the swing point (i.e. 5 bars on the left and right of the swing bar).

* Swing Wave Type - % Change in Price

(% Retracement, % Change in Price)

* Swing Wave Percentage - 5

The number 5 will be treated as 5.0%. The number 0.05 will be treated as 0.0005%.

* Swing High Price Source - Close

* Swing Low Price Source - Close

* Line Thickness - 2

* Confirmed Swing Line Color - Blue

* Developing Swing Line Color - Yellow

* Number of Swings for Gann - 1

The number of previous swings points to be included in the Gann projections

* Gann Increment - 0.25

The +/- increment for Gann calculation above and below the base calculation for Gann.

* Number of Gann Increments - 2

The number of Gann increments to be calculated above and below the Gann basis calculation. 2 will draw one above and one low

the basis.

* Fibonacci: DR 1 - 0.382

* Fibonacci: DR 2 - 1.618

* Fibonacci: A1 1 - 0.5

* Fibonacci: A1 2 - 1.732

* Fibonacci: A2 1 - 0.618

* Fibonacci: A2 2 - 2.0

* Fibonacci: C 1 - 0.707

* Fibonacci: C 2 - 2.618

* Fibonacci: DC 1 - 1.0

* Fibonacci: DC 2 - 3.0

Notes:

The current version has one added modification since the formula went into publication. Per Dennis Peterson's request, a third label has been added to show a second percent retracement figure. The top %Rtmt label is the percent retracement of the developing swing (green Sept peak) to the second previous confirmed swing (blue June peak). The second %Rtmt label is the percent retracement of the right-most developing swing line (current bar) to the previous confirmed swing (Aug valley). The last %Chg label is the percent change in price of the righ-most developing swing line (current bar) from the developing swing (green Sept peak). The related article is copyrighted material. If you are not a subscriber of Stocks & Commodities, please visit www.traders.com.

Download File:

SwingPrediction.efs

EFS Code:

PHP Code:

/*****************************************************************

Provided By : eSignal. (c) Copyright 2004

Study: Swing Prediction

Version: 1.0

Formula Parameters: Default:

* Swing: # of Bars 1

This is the minimum number of bars required to define a

swing point. This number is for both sides of the swing

point (i.e. 5 bars on the left and right of the swing bar).

* Swing: Wave Type % Change in Price

(% Retracement, % Change in Price)

* Swing: Wave Percentage 5

The number 5 will be treated as 5.0%. The number 0.05 will

be treated as 0.0005%.

* Swing High Price Source Close

* Swing Low Price Source Close

* Line Thickness 2

* Confirmed Swing Line Color Blue

* Developing Swing Line Color Yellow

* Number of Swings for Gann 1

The number of previous swings points to be included in the

Gann projections

* Gann Increment 0.25

The +/- increment for Gann calculation above and below the base

calculation for Gann.

* Number of Gann Increments 2

The number of Gann increments to be calculated above and below

the Gann basis calculation. 2 will draw one above and one below

the basis.

* Fibonacci: DR 1 0.382

* Fibonacci: DR 2 1.618

* Fibonacci: A1 1 0.5

* Fibonacci: A1 2 1.732

* Fibonacci: A2 1 0.618

* Fibonacci: A2 2 2.0

* Fibonacci: C 1 0.707

* Fibonacci: C 2 2.618

* Fibonacci: DC 1 1.0

* Fibonacci: DC 2 3.0

*****************************************************************/

function preMain() {

setPriceStudy(true);

setStudyTitle("Swing Prediction ");

setShowCursorLabel(false);

setShowTitleParameters(false);

var fp1 = new FunctionParameter("nNum", FunctionParameter.NUMBER);

fp1.setName("Swing: # of Bars");

fp1.setLowerLimit(1);

fp1.setDefault(1);

var fp2a = new FunctionParameter("sWaveType", FunctionParameter.STRING);

fp2a.setName("Swing: Wave Type");

fp2a.addOption("% Retracement");

fp2a.addOption("% Change in Price");

fp2a.setDefault("% Change in Price");

var fp2 = new FunctionParameter("nRet", FunctionParameter.NUMBER);

fp2.setName("Swing: Wave Percentage");

fp2.setLowerLimit(0);

fp2.setDefault(5);

var fp3 = new FunctionParameter("sHighSource", FunctionParameter.STRING);

fp3.setName("Swing High Price Source");

fp3.addOption("Open");

fp3.addOption("High");

fp3.addOption("Low");

fp3.addOption("Close");

fp3.setDefault("Close");

var fp4 = new FunctionParameter("sLowSource", FunctionParameter.STRING);

fp4.setName("Swing Low Price Source");

fp4.addOption("Open");

fp4.addOption("High");

fp4.addOption("Low");

fp4.addOption("Close");

fp4.setDefault("Close");

var fp5 = new FunctionParameter("nThickness", FunctionParameter.NUMBER);

fp5.setName("Line Thickness");

fp5.setLowerLimit(1);

fp5.setDefault(2);

var fp6 = new FunctionParameter("cColor1", FunctionParameter.COLOR);

fp6.setName("Confirmed Swing Line Color");

fp6.setDefault(Color.blue);

var fp7 = new FunctionParameter("cColor2", FunctionParameter.COLOR);

fp7.setName("Developing Swing Line Color");

fp7.setDefault(Color.yellow);

var fp19 = new FunctionParameter("nGann", FunctionParameter.NUMBER);

fp19.setName("Number of Swings for Gann");

fp19.setLowerLimit(1);

fp19.setUpperLimit(6);

fp19.setDefault(1);

var fp19b = new FunctionParameter("nGannInc", FunctionParameter.NUMBER);

fp19b.setName("Gann Increment");

fp19b.setLowerLimit(0);

fp19b.setDefault(0.25);

var fp19c = new FunctionParameter("nGannNum", FunctionParameter.NUMBER);

fp19c.setName("Number of Gann Increments");

fp19c.setLowerLimit(0);

fp19c.setDefault(2);

var fp20 = new FunctionParameter("fib0", FunctionParameter.NUMBER);

fp20.setName("Fibonacci: DR 1");

fp20.setLowerLimit(0);

fp20.setDefault(0.382);

var fp21 = new FunctionParameter("fib1", FunctionParameter.NUMBER);

fp21.setName("Fibonacci: DR 2");

fp21.setLowerLimit(0);

fp21.setDefault(1.618);

var fp22 = new FunctionParameter("fib2", FunctionParameter.NUMBER);

fp22.setName("Fibonacci: A1 1");

fp22.setLowerLimit(0);

fp22.setDefault(0.5);

var fp23 = new FunctionParameter("fib3", FunctionParameter.NUMBER);

fp23.setName("Fibonacci: A1 2");

fp23.setLowerLimit(0);

fp23.setDefault(1.732);

var fp24 = new FunctionParameter("fib4", FunctionParameter.NUMBER);

fp24.setName("Fibonacci: A2 1");

fp24.setLowerLimit(0);

fp24.setDefault(0.618);

var fp25 = new FunctionParameter("fib5", FunctionParameter.NUMBER);

fp25.setName("Fibonacci: A2 2");

fp25.setLowerLimit(0);

fp25.setDefault(2);

var fp26 = new FunctionParameter("fib6", FunctionParameter.NUMBER);

fp26.setName("Fibonacci: C 1");

fp26.setLowerLimit(0);

fp26.setDefault(0.707);

var fp27 = new FunctionParameter("fib7", FunctionParameter.NUMBER);

fp27.setName("Fibonacci: C 2");

fp27.setLowerLimit(0);

fp27.setDefault(2.618);

var fp28 = new FunctionParameter("fib8", FunctionParameter.NUMBER);

fp28.setName("Fibonacci: DC 1");

fp28.setLowerLimit(0);

fp28.setDefault(1.0);

var fp29 = new FunctionParameter("fib9", FunctionParameter.NUMBER);

fp29.setName("Fibonacci: DC 2");

fp29.setLowerLimit(0);

fp29.setDefault(3.0);

}

var bEdit = true; // tracks change of user inputs

var cntr = 0; // image counter for swing lines

var bInit = false; // initialization routine completion

var nNumBars = null; // number of bars for defining swings

var sWaveTypeG = null; // wave type for confirming swings

var nRetpcnt = null; // percent retracement for defining swings

var nThicknessG = null; // line thickness

var cColorCon = null; // confirmed swing color

var cColorDev = null; // developing swing color

var nGannG = 1; // number of swings for Gann calculations

var nGannIncG = null; // increment value for Gann calculations

var nGannNumG = null; // number of increments for Gann calculations

var sHSource = null; // price source for high swings

var sLSource = null; // price source for low swings

var x1a = null; // x-coordinate for point a of developing line 1

var x1b = null; // x-coordinate for point b of developing line 1

var x2a = null; // x-coordinate for point a of developing line 2

var x2b = null; // x-coordinate for point b of developing line 2

var y1a = null; // y-coordinate for point a of developing line 1

var y1b = null; // y-coordinate for point b of developing line 1

var y2a = null; // y-coordinate for point a of developing line 2

var y2b = null; // y-coordinate for point b of developing line 2

var aY2A = new Array(7);// array of current 7 swing prices

var vLastSwing = null; // tracking swing type of last confirmed swing

var nScntr = 0; // bar counter for swing confirmation

var aSwingsIndex = new Array(7); // tracks current swings for DR, C, DC, A1, A2 periods

var aSwingsPrice = new Array(7); // tracks current swing prices for Gann projections

var aFibs = new Array(10); // Fibonacci numbers for Swing Predictions

var bProjCon = false;

var bProjDev = false;

var tCntr = 0;

function main(nNum, sWaveType, nRet, sHighSource, sLowSource, nThickness, cColor1, cColor2,

nGann, nGannInc, nGannNum, fib0, fib1, fib2, fib3, fib4, fib5, fib6, fib7, fib8, fib9) {

var nState = getBarState();

var nIndex = getCurrentBarIndex();

var h = getValue(sHighSource);

var l = getValue(sLowSource);

var c = close();

var i = 0;

// record keeping

if (nState == BARSTATE_NEWBAR) {

if (cntr > 100) cntr = 0;

if (x1a != null) x1a -= 1;

if (x1b != null) x1b -= 1;

if (x2a != null) x2a -= 1;

if (x2b != null) x2b -= 1;

i = 0;

for (i = 0; i < 7; ++i) {

if (aSwingsIndex[i] != null) aSwingsIndex[i] -= 1;

}

}

//Initialization

if (bEdit == true) {

if (nNumBars == null) nNumBars = nNum;

if (sWaveTypeG == null) sWaveTypeG = sWaveType;

if (nRetpcnt == null) nRetpcnt = nRet/100;

if (nThicknessG == null) nThicknessG = nThickness;

if (cColorCon == null) cColorCon = cColor1;

if (cColorDev == null) cColorDev = cColor2;

if (nGann != null) nGannG = nGann;

if (nGannIncG == null) nGannIncG = nGannInc;

if (nGannNumG == null) nGannNumG = Math.round(nGannNum);

if (sHSource == null) sHSource = sHighSource;

if (sLSource == null) sLSource = sLowSource;

if (x1a == null) x1a = 0;

if (y1a == null) y1a = c;

i = 0;

for (i = 0; i < 10; ++i) {

aFibs[i] = eval("fib"+i);

}

bEdit = false;

}

if (bInit == false) {

bInit = Init(h,l,c);

}

// Swings

if (nState == BARSTATE_NEWBAR) {

nScntr += 1;

// confirmed Swings

if (nScntr > nNumBars) {

confirmSwings();

if (bInit == true) {

doLine("dev1");

doLine("dev2");

}

}

}

checkSwings(h, l);

if (bProjCon == true) {

bProjCon = false;

doProjections("con");

}

if (bProjDev == true) {

bProjDev = false;

doProjections("dev1");

}

if (nIndex >= -1) {

var nWaveRet = (Math.abs(aSwingsPrice[0]-aSwingsPrice[1]) / Math.abs(aSwingsPrice[1]-aSwingsPrice[2]))*100;

var sWaveRetText = " \%Rtmt: " + nWaveRet.toFixed(2) + " ";

var nWaveRet2 = (Math.abs(y2b-aSwingsPrice[0]) / Math.abs(aSwingsPrice[0]-aSwingsPrice[1]))*100;

var sWaveRetText2 = " \%Rtmt: " + nWaveRet2.toFixed(2) + " ";

var nWaveChg = (Math.abs(y2a-y2b) / y1b)*100;

var sWaveChgText = " \%Chg: " + nWaveChg.toFixed(2) + " ";

drawTextRelative(2, 45, sWaveRetText, cColor1, Color.lightgrey,

Text.BOLD|Text.LEFT|Text.VCENTER|Text.FRAME|Text.RELATIVETOBOTTOM,

null, 12, "Ret"); // Developing peak/valley %Ret of previous confirmed peak/valley

drawTextRelative(2, 25, sWaveRetText2, cColor2, Color.lightgrey,

Text.BOLD|Text.LEFT|Text.VCENTER|Text.FRAME|Text.RELATIVETOBOTTOM,

null, 12, "Ret2"); // Current bar %Ret of current developing peak/valley

drawTextRelative(2, 5, sWaveChgText, cColor2, Color.lightgrey,

Text.BOLD|Text.LEFT|Text.VCENTER|Text.FRAME|Text.RELATIVETOBOTTOM,

null, 12, "Chg"); // %Change in price of current bar from current developing peak/valley

}

return;

}

/***********************/

/****** Functions *****/

/***********************/

// The entire formula is too large to display in this forum post.

// To see the code for the support functions, open the formula in

// the EFS editor.