File Name: VolatilityEntryAdvisor.efs, VolatilityProfitIndicator.efs, VolatilityTrailingStopP15.efs

Description:

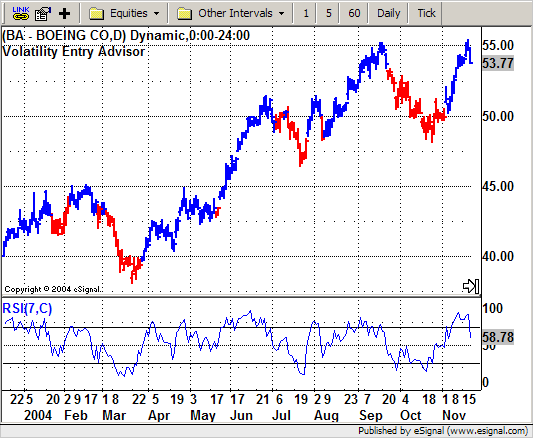

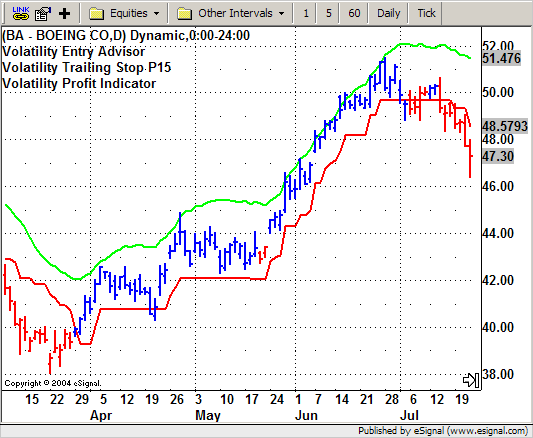

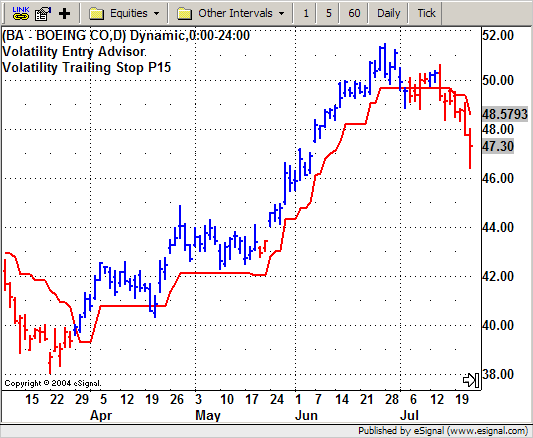

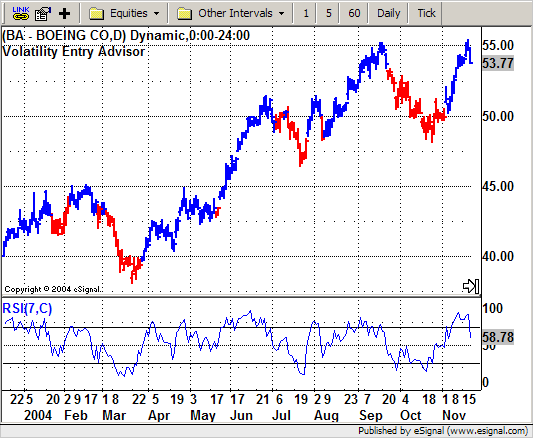

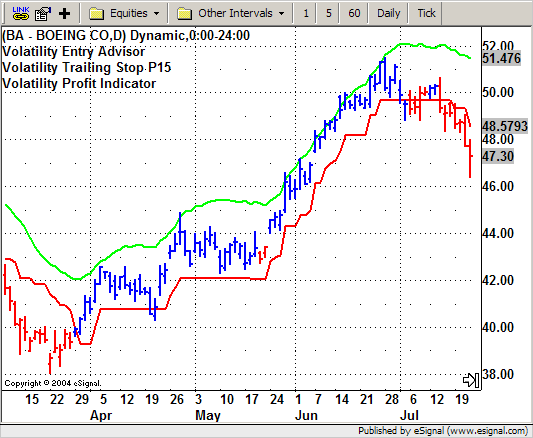

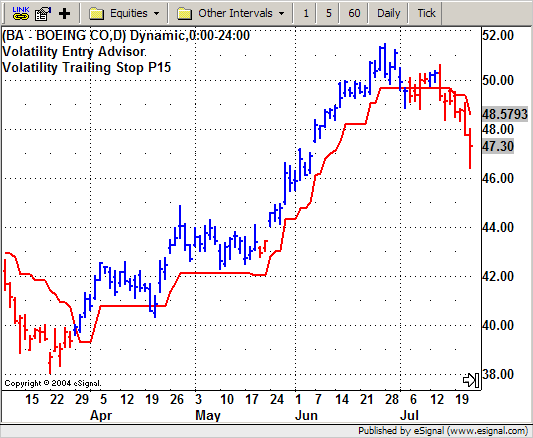

These indicators are based on the February 2005 article, The Truth About Volatility, by Jim Berg.

Formula Parameters:

VolatilityEntryAdvisor.efs

ATR Periods: 10

LL and HH Periods: 20

Thickness: 2

VolatilityProfitIndicator.efs

ATR Periods: 10

MA Periods: 13

Thickness: 2

VolatilityTrailingStopP15.efs

ATR Periods: 10

Thickness: 2

Notes:

The related article is copyrighted material. If you are not a subscriber of Stocks & Commodities, please visit www.traders.com.

Download File:

VolatilityEntryAdvisor.efs

VolatilityProfitIndicator.efs

VolatilityTrailingStopP15.efs

EFS Code:

Description:

These indicators are based on the February 2005 article, The Truth About Volatility, by Jim Berg.

Formula Parameters:

VolatilityEntryAdvisor.efs

ATR Periods: 10

LL and HH Periods: 20

Thickness: 2

VolatilityProfitIndicator.efs

ATR Periods: 10

MA Periods: 13

Thickness: 2

VolatilityTrailingStopP15.efs

ATR Periods: 10

Thickness: 2

Notes:

The related article is copyrighted material. If you are not a subscriber of Stocks & Commodities, please visit www.traders.com.

Download File:

VolatilityEntryAdvisor.efs

VolatilityProfitIndicator.efs

VolatilityTrailingStopP15.efs

EFS Code:

PHP Code:

/*************************

Provided By : eSignal (c) Copyright 2004

Description: Volatility Entry Advisor - by Jim Berg

Version 1.1

Notes:

2/15/2005 - Added setComputeOnClose()

February 2005 Issue - "The Truth About Volatility"

Formula Parameters: Defaults:

ATR Periods 10

LL and HH Periods 20

Thickness 2

*************************/

function preMain() {

setPriceStudy(true);

setStudyTitle("Volatility Entry Advisor ");

setCursorLabelName("Entry", 0);

setCursorLabelName("Exit", 1);

setDefaultBarThickness(2, 0);

setDefaultBarThickness(2, 1);

setDefaultBarFgColor(Color.green, 0);

setDefaultBarFgColor(Color.khaki, 1);

setColorPriceBars(true);

setDefaultPriceBarColor(Color.grey);

setComputeOnClose();

setShowTitleParameters(false);

// Formula Parameters

var fp1 = new FunctionParameter("nATRlen", FunctionParameter.NUMBER);

fp1.setName("ATR Periods");

fp1.setLowerLimit(1);

fp1.setDefault(10);

var fp2 = new FunctionParameter("nDonlen", FunctionParameter.NUMBER);

fp2.setName("LL and HH Periods");

fp2.setLowerLimit(1);

fp2.setDefault(20);

// Study Parameters

var sp1 = new FunctionParameter("nThick", FunctionParameter.NUMBER);

sp1.setName("Thickness");

sp1.setDefault(2);

}

var bEdit = true;

var vATR = null;

var vDonchian = null;

var vColor = Color.grey;

function main(nATRlen, nDonlen, nThick) {

if (bEdit == true) {

vATR = new ATRStudy(nATRlen);

vDonchian = new DonchianStudy(nDonlen, 0);

setDefaultBarThickness(nThick, 0);

setDefaultBarThickness(nThick, 1);

bEdit = false;

}

var nState = getBarState();

if (nState == BARSTATE_NEWBAR) {

}

var ATR = vATR.getValue(ATRStudy.ATR);

var HHV = vDonchian.getValue(DonchianStudy.UPPER);

var LLV = vDonchian.getValue(DonchianStudy.LOWER);

if (ATR == null || HHV == null || LLV == null) return;

var vEntryLine = LLV+(2*ATR);

var vExitLine = HHV-(2*ATR);

var c = close();

if (c > vEntryLine) {

vColor = Color.blue;

} else if (c < vExitLine) {

vColor = Color.red;

}

setPriceBarColor(vColor);

//return;

return new Array(vEntryLine, vExitLine);

}

/*************************

Provided By : eSignal (c) Copyright 2004

Description: Volatility Profit Indicator - by Jim Berg

Version 1.0

Notes:

February 2005 Issue - "The Truth About Volatility"

Formula Parameters: Defaults:

ATR Periods 10

MA Periods 13

Thickness 2

*************************/

function preMain() {

setPriceStudy(true);

setStudyTitle("Volatility Profit Indicator ");

setCursorLabelName("VProfit", 0);

setDefaultBarThickness(2, 0);

setDefaultBarFgColor(Color.lime, 0);

setShowTitleParameters(false);

// Formula Parameters

var fp1 = new FunctionParameter("nATRlen", FunctionParameter.NUMBER);

fp1.setName("ATR Periods");

fp1.setLowerLimit(1);

fp1.setDefault(10);

var fp2 = new FunctionParameter("nMovlen", FunctionParameter.NUMBER);

fp2.setName("MA Periods");

fp2.setLowerLimit(1);

fp2.setDefault(13);

// Study Parameters

var sp1 = new FunctionParameter("nThick", FunctionParameter.NUMBER);

sp1.setName("Thickness");

sp1.setDefault(2);

}

var bEdit = true;

var vATR = null;

var vMA = null;

function main(nATRlen, nMovlen, nThick) {

if (bEdit == true) {

vATR = new ATRStudy(nATRlen);

vMA = new MAStudy(nMovlen, 0, "High", MAStudy.EXPONENTIAL);

setDefaultBarThickness(nThick, 0);

bEdit = false;

}

var nState = getBarState();

if (nState == BARSTATE_NEWBAR) {

}

var ATR = vATR.getValue(ATRStudy.ATR);

var MA = vMA.getValue(MAStudy.MA);

if (ATR == null || MA == null) return;

var vProfitLine = (MA + (2*ATR));

return vProfitLine;

}

/*************************

Provided By : eSignal (c) Copyright 2004

Description: Volatility Trailing Stop P15 - by Jim Berg

Version 1.0

Notes:

February 2005 Issue - "The Truth About Volatility"

Formula Parameters: Defaults:

ATR Periods 10

Thickness 2

*************************/

function preMain() {

setPriceStudy(true);

setStudyTitle("Volatility Trailing Stop P15 ");

setCursorLabelName("VStop", 0);

setDefaultBarThickness(2, 0);

setDefaultBarFgColor(Color.red, 0);

setShowTitleParameters(false);

// Formula Parameters

var fp1 = new FunctionParameter("nATRlen", FunctionParameter.NUMBER);

fp1.setName("ATR Periods");

fp1.setLowerLimit(1);

fp1.setDefault(10);

// Study Parameters

var sp1 = new FunctionParameter("nThick", FunctionParameter.NUMBER);

sp1.setName("Thickness");

sp1.setDefault(2);

}

var bEdit = true;

var vATR = null;

var aStop = new Array(15);

function main(nATRlen, nThick) {

if (bEdit == true) {

vATR = new ATRStudy(nATRlen);

setDefaultBarThickness(nThick, 0);

bEdit = false;

}

var nState = getBarState();

if (nState == BARSTATE_NEWBAR) {

aStop.pop();

aStop.unshift(0);

}

var ATR = vATR.getValue(ATRStudy.ATR);

if (ATR == null) return;

var c = close();

var vStop = (c - (2*ATR));

aStop[0] = vStop;

var vStop15 = vStop;

for (var i = 0; i < 15; i++) {

vStop15 = Math.max(aStop[i], vStop15);

}

return vStop15;

}