File Name: Wilson_RPC.efs

Description:

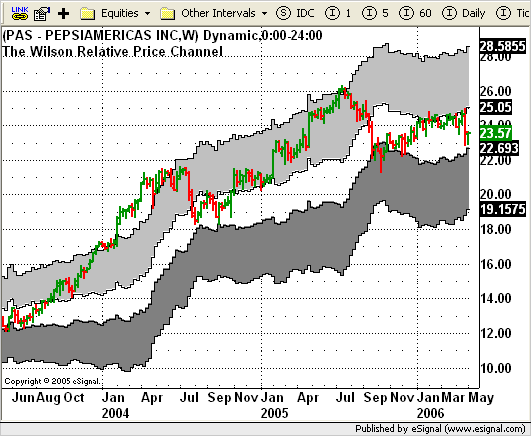

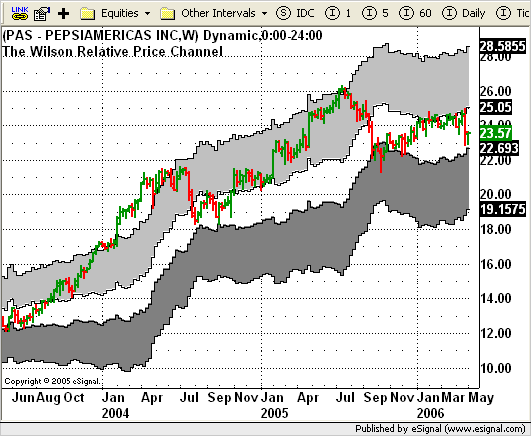

This study is based on the July 2006 article, The Wilson Relative Price Channel, by Leon Wilson

Formula Parameters:

Channel Periods: 34

Smoothing Periods: 1

Over Bought: 70

Over Sold: 30

Upper Neutral Zone: 55

Lower Neutral Zone: 45

Notes:

This formula requires eSignal version 7.9.1 or later. The related article is copyrighted material. If you are not a subscriber of Stocks & Commodities, please visit www.traders.com.

Download File:

Wilson_RPC.efs

EFS Code:

Description:

This study is based on the July 2006 article, The Wilson Relative Price Channel, by Leon Wilson

Formula Parameters:

Channel Periods: 34

Smoothing Periods: 1

Over Bought: 70

Over Sold: 30

Upper Neutral Zone: 55

Lower Neutral Zone: 45

Notes:

This formula requires eSignal version 7.9.1 or later. The related article is copyrighted material. If you are not a subscriber of Stocks & Commodities, please visit www.traders.com.

Download File:

Wilson_RPC.efs

EFS Code:

PHP Code:

/***************************************

Provided By : eSignal (c) Copyright 2006

Description: The Wilson Relative Price Channel

by Leon Wilson

Version 1.0 05/05/2006

Notes:

* July 2006 Issue of Stocks and Commodities Magazine

* Study requires version 7.9.1 or higher.

Formula Parameters: Defaults:

Channel Periods 34

Smoothing Periods 1

Over Bought 70

Over Sold 30

Upper Neutral Zone 55

Lower Neutral Zone 45

***************************************/

function preMain() {

setPriceStudy(true);

setStudyTitle("The Wilson Relative Price Channel ");

setCursorLabelName("Over Bought", 0);

setCursorLabelName("Neutral Upper", 1);

setCursorLabelName("Neutral Lower", 2);

setCursorLabelName("Over Sold", 3);

setShowTitleParameters(false);

setDefaultBarFgColor(Color.black, 0);

setDefaultBarFgColor(Color.black, 1);

setDefaultBarFgColor(Color.black, 2);

setDefaultBarFgColor(Color.black, 3);

setPlotType(PLOTTYPE_SQUAREWAVE, 0);

setPlotType(PLOTTYPE_SQUAREWAVE, 1);

setPlotType(PLOTTYPE_SQUAREWAVE, 2);

setPlotType(PLOTTYPE_SQUAREWAVE, 3);

var fp1 = new FunctionParameter("nPeriods", FunctionParameter.NUMBER);

fp1.setName("Channel Periods");

fp1.setLowerLimit(1);

fp1.setUpperLimit(250);

fp1.setDefault(34);

var fp2 = new FunctionParameter("nSmoothing", FunctionParameter.NUMBER);

fp2.setName("Smoothing Periods");

fp2.setLowerLimit(1);

fp2.setUpperLimit(55);

fp2.setDefault(1);

var fp3 = new FunctionParameter("nOB", FunctionParameter.NUMBER);

fp3.setName("Over Bought");

fp3.setLowerLimit(50);

fp3.setUpperLimit(99);

fp3.setDefault(70);

var fp4 = new FunctionParameter("nOS", FunctionParameter.NUMBER);

fp4.setName("Over Sold");

fp4.setLowerLimit(1);

fp4.setUpperLimit(50);

fp4.setDefault(30);

var fp5 = new FunctionParameter("nUpperNZ", FunctionParameter.NUMBER);

fp5.setName("Upper Neutral Zone");

fp5.setLowerLimit(50);

fp5.setUpperLimit(99);

fp5.setDefault(55);

var fp6 = new FunctionParameter("nLowerNZ", FunctionParameter.NUMBER);

fp6.setName("Lower Neutral Zone");

fp6.setLowerLimit(1);

fp6.setUpperLimit(50);

fp6.setDefault(45);

}

var bVersion = null;

var bInit = false;

var xRPC = null;

function main(nPeriods, nSmoothing, nOB, nOS, nUpperNZ, nLowerNZ) {

if (bVersion == null) bVersion = verify();

if (bVersion == false) return;

if (bInit == false) {

xRPC = efsInternal("calcRPC", nPeriods, nSmoothing, nOB, nOS, nUpperNZ, nLowerNZ);

bInit = true;

}

var nRPC_OB = getSeries(xRPC, 0); // Over Bought

var nRPC_UN = getSeries(xRPC, 1); // Upper Neutral

var nRPC_LN = getSeries(xRPC, 2); // Lower Neutral

var nRPC_OS = getSeries(xRPC, 3); // Over Sold

setBarBgColor(Color.lightgrey, 0, nRPC_UN, nRPC_OB);

setBarBgColor(Color.grey, 2, nRPC_LN, nRPC_OS);

return new Array(nRPC_OB, nRPC_UN, nRPC_LN, nRPC_OS);

}

function calcRPC(nPeriods, nSmoothing, nOB, nOS, nUpperNZ, nLowerNZ) {

var nC = close(0);

var OB = ema(nSmoothing, efsInternal("calcCord", nPeriods, nOB), 0);

var UN = ema(nSmoothing, efsInternal("calcCord", nPeriods, nUpperNZ), 0);

var LN = ema(nSmoothing, efsInternal("calcCord", nPeriods, nLowerNZ), 0);

var OS = ema(nSmoothing, efsInternal("calcCord", nPeriods, nOS), 0);

OB = nC - (nC * (OB/100));

UN = nC - (nC * (UN/100));

LN = nC - (nC * (LN/100));

OS = nC - (nC * (OS/100));

return new Array(OB, UN, LN, OS);

}

function calcCord(nPeriods, nCord) {

return (rsi(nPeriods, 0) - nCord);

}

function verify() {

var b = false;

if (getBuildNumber() < 730) {

drawTextAbsolute(5, 35, "This study requires version 7.9.1 or later.",

Color.white, Color.blue, Text.RELATIVETOBOTTOM|Text.RELATIVETOLEFT|Text.BOLD|Text.LEFT,

null, 13, "error");

drawTextAbsolute(5, 20, "Click HERE to upgrade.@URL=http://www.esignal.com/download/default.asp",

Color.white, Color.blue, Text.RELATIVETOBOTTOM|Text.RELATIVETOLEFT|Text.BOLD|Text.LEFT,

null, 13, "upgrade");

return b;

} else {

b = true;

}

return b;

}