File Name: PVI_Peterson.efs

Description:

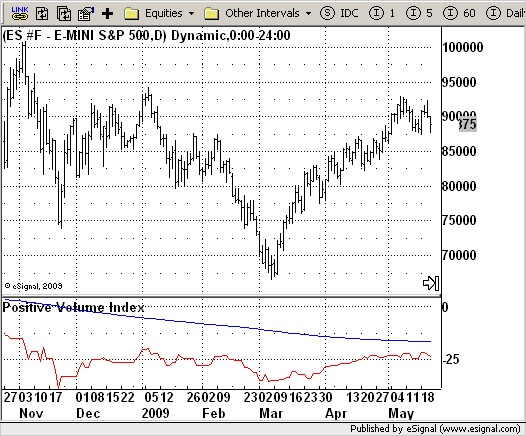

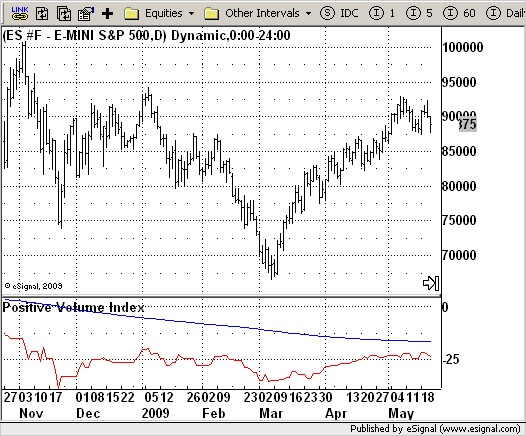

Positive Volume Index

Formula Parameters:

EMA_Len : 255

Notes:

The theory behind the indexes is as follows: On days of increasing volume,

you can expect prices to increase, and on days of decreasing volume, you can

expect prices to decrease. This goes with the idea of the market being in-gear

and out-of-gear. Both PVI and NVI work in similar fashions: Both are a running

cumulative of values, which means you either keep adding or subtracting price

rate of change each day to the previous day`s sum. In the case of PVI, if today`s

volume is less than yesterday`s, don`t add anything; if today`s volume is greater,

then add today`s price rate of change. For NVI, add today`s price rate of change

only if today`s volume is less than yesterday`s.

Download File:

PVI_Peterson.efs

EFS Code:

Description:

Positive Volume Index

Formula Parameters:

EMA_Len : 255

Notes:

The theory behind the indexes is as follows: On days of increasing volume,

you can expect prices to increase, and on days of decreasing volume, you can

expect prices to decrease. This goes with the idea of the market being in-gear

and out-of-gear. Both PVI and NVI work in similar fashions: Both are a running

cumulative of values, which means you either keep adding or subtracting price

rate of change each day to the previous day`s sum. In the case of PVI, if today`s

volume is less than yesterday`s, don`t add anything; if today`s volume is greater,

then add today`s price rate of change. For NVI, add today`s price rate of change

only if today`s volume is less than yesterday`s.

Download File:

PVI_Peterson.efs

EFS Code:

PHP Code:

/*********************************

Provided By:

eSignal (Copyright c eSignal), a division of Interactive Data

Corporation. 2009. All rights reserved. This sample eSignal

Formula Script (EFS) is for educational purposes only and may be

modified and saved under a new file name. eSignal is not responsible

for the functionality once modified. eSignal reserves the right

to modify and overwrite this EFS file with each new release.

Description:

Positive Volume Index

Version: 2.0 05/28/2009

Formula Parameters: Default:

EMA_Len 255

Notes:

The theory behind the indexes is as follows: On days of increasing volume,

you can expect prices to increase, and on days of decreasing volume, you can

expect prices to decrease. This goes with the idea of the market being in-gear

and out-of-gear. Both PVI and NVI work in similar fashions: Both are a running

cumulative of values, which means you either keep adding or subtracting price

rate of change each day to the previous day`s sum. In the case of PVI, if today`s

volume is less than yesterday`s, don`t add anything; if today`s volume is greater,

then add today`s price rate of change. For NVI, add today`s price rate of change

only if today`s volume is less than yesterday`s.

**********************************/

var fpArray = new Array();

var bInit = false;

function preMain(){

setStudyTitle("Positive Volume Index");

setCursorLabelName("PVI",0);

setDefaultBarFgColor(Color.red,0);

setCursorLabelName("EMA",1);

setDefaultBarFgColor(Color.blue,1);

var x = 0;

fpArray[x] = new FunctionParameter("EMA_Len", FunctionParameter.NUMBER);

with(fpArray[x++]) {

setLowerLimit(1);

setDefault(255);

}

}

var xPVI = null;

var xPVI_EMA = null;

function main(EMA_Len) {

var nBarState = getBarState();

var nPVI = 0;

var nEMA = 0;

if (nBarState == BARSTATE_ALLBARS) {

if(EMA_Len == null) EMA_Len = 255;

}

if (bInit == false) {

xPVI = efsInternal("Calc_PVI");

xPVI_EMA = ema(EMA_Len, xPVI);

bInit = true;

}

nPVI = xPVI.getValue(0);

nEMA = xPVI_EMA.getValue(0);

if (nEMA == null) return;

return new Array(nPVI, nEMA);

}

var bSecondInit = false;

var xROC = null;

var xVolume = null;

function Calc_PVI() {

var nRes = 0;

var nRef = ref(-1);

if (bSecondInit == false) {

xROC = roc(1);

xVolume = volume();

bSecondInit = true;

}

if (xROC.getValue(-1) == null) return;

if(xVolume.getValue(0) > xVolume.getValue(-1)) {

nRes = nRef + xROC.getValue(0);

} else {

nRes = nRef;

}

return nRes;

}