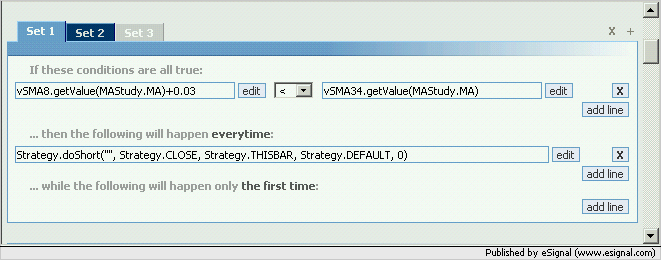

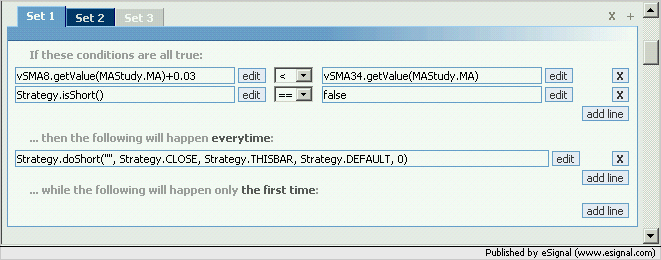

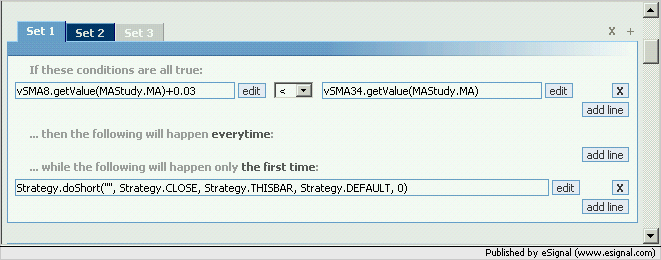

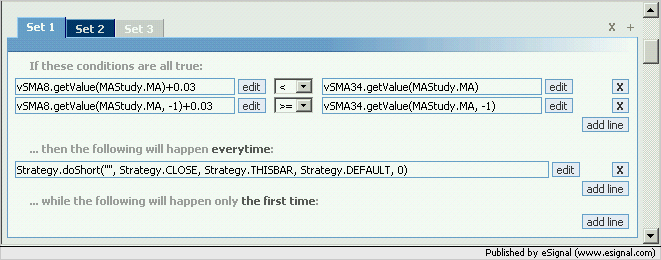

I am looking for moving average crossover strategy plus other indicator condition - such as rsi above 50 etc.

something like that :

if ma85>ema20 go long

exit if stoch <60

opposite by short

I searched but still didnt find.

can someone help me ?

something like that :

if ma85>ema20 go long

exit if stoch <60

opposite by short

I searched but still didnt find.

can someone help me ?

Comment