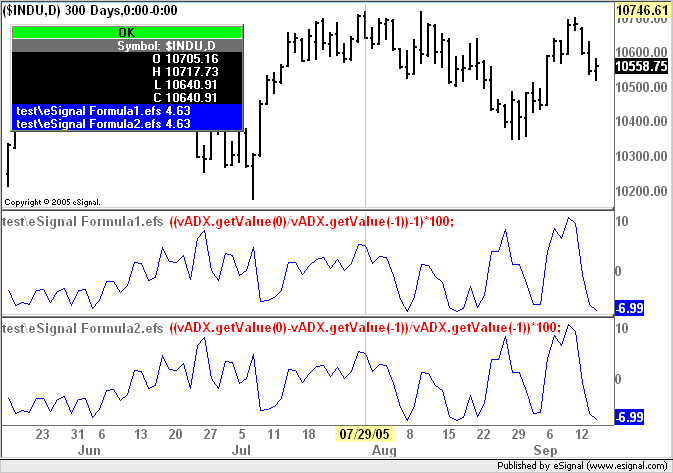

It's been a long since those Mathematics classes, and almost as long since the programming classes. So if anyone can give me some pointers on how to calculate the 1st derivative of an indicator line (basically I just want a way to judge when an ADX study is increasing, so I don't get stuck with a trade being triggered when the trend is over) I'd be most grateful.

I can probably program the rest if I can get some pointers towards how to calculate it

I can probably program the rest if I can get some pointers towards how to calculate it

Comment